FUNDAMENTAL'S OF COST ACCOUNTING LL

6th Edition

ISBN: 9781260998993

Author: LANEN

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter A, Problem 12E

Present Value of

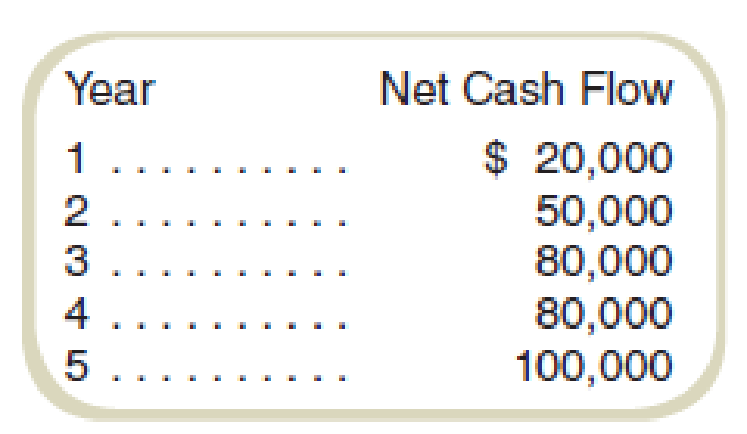

Star City is considering an investment in the community center that is expected to return the following cash flows:

This schedule includes all

Required

- a. What is the

net present value of the project if the appropriate discount rate is 20 percent? - b. What is the net present value of the project if the appropriate discount rate is 12 percent?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Answer this Question

Financial Accounting

Solve these general accounting question

Chapter A Solutions

FUNDAMENTAL'S OF COST ACCOUNTING LL

Ch. A - What are the two most important factors an...Ch. A - Prob. 2RQCh. A - Prob. 3RQCh. A - Prob. 4RQCh. A - Prob. 5RQCh. A - Prob. 6CADQCh. A - What are the four types of cash flows related to a...Ch. A - Is depreciation included in the computation of net...Ch. A - The total tax deduction for depreciation is the...Ch. A - Prob. 10CADQ

Ch. A - In Chapter 14, we discussed performance...Ch. A - Present Value of Cash Flows Star City is...Ch. A - Prob. 13ECh. A - Present Value Analysis in Nonprofit Organizations...Ch. A - Prob. 15ECh. A - What is the net present value of the investment...Ch. A - Prob. 17PCh. A - Sensitivity Analysis in Capital Investment...Ch. A - Compute Net Present Value Dungan Corporation is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I want the correct answer accounting and questionarrow_forward6 When should alternative measurement bases supplement cost? a. Historical cost tells whole story b. Value-relevant factors demand additional perspectives c. Alternatives create confusion d. Single measures work best Answerarrow_forward?!arrow_forward

- Please need answer the financial accounting questionarrow_forwardWhat differentiates process-based validation from outcome testing? (A) Systematic review steps assess control effectiveness (B) Final results alone matter (C) Process review wastes time (D) Outcomes tell complete storyarrow_forwardNewhard Company assigns overhead costs to jobs on the basis of 125% of direct labor costs. The job cost sheet for Job 415 includes $24,500 in direct materials cost and $12,800 in direct labor cost. A total of 2,000 units were produced in Job 415. Required: a. What is the total manufacturing cost assigned to Job 415? b. What is the unit product cost for Job 415?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Profitability index; Author: The Finance Storyteller;https://www.youtube.com/watch?v=Md5ocNqKHq8;License: Standard Youtube License