Horngren's Accounting

11th Edition

ISBN: 9780133851151

Author: MILLER-NOBLES, Tracie L., Mattison, Brenda., Matsumura, Ella Mae, Horngren, Charles T.

Publisher: Pearson,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem S9.8SE

Applying the allowance method (aging-of-receivables) to account for uncollectibles

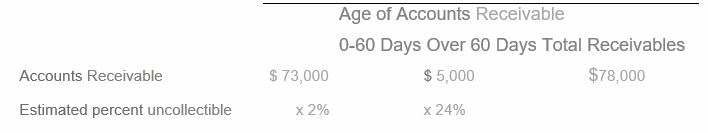

World Class Work Shoes had the following balance at December 31, 2016, before the

year-end adjustments:

The aging of accounts receivable yields the following data:

Requirements

- Journalize World Class’s entry to record

bad debts expense for 2016 using the aging-of-receivables method. - Prepare a T-account to compute the ending balance of Allowance for Bad Debts.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Sunshine and Rainbows Resort had the following balances at December 31, 2025, before the year-end adjustments:

View the balances.

The aging of accounts receivable yields the following data:

View the accounts receivable aging schedule.

Requirements

1. Journalize Sunshine and Rainbows Resort's entry to record bad debts expense for 2025 using the aging-of-receivables method.

2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts.

Requirement 1. Journalize Sunshine and Rainbows Resort's entry to record bad debts expense for 2025 using the aging-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the journal

entry table.)

Dec.

Date

31

Accounts and Explanation

Debit

Credit

Balances

-

☑

Accounts Receivable Aging Schedule

Age of Accounts Receivable

0-60 Days

Over 60 Days

Total Receivables

Accounts Receivable

75,000

$

3,000

$

78,000

Estimated percent uncollectible

× 4%

* 24%

-

☑

Accounts Receivable

Allowance for Bad…

Spring Garden Flowers had the following balances at December 31, 2024, before the year-end adjustments:

E (Click the icon to view the balances.)

The aging of accounts receivable yields the following data:

E (Click the icon to view the accounts receivable aging schedule.)

Requirements

Journalize Spring's entry to record bad debts expense for 2024 using the aging-of-receivables method.

1.

2.

Prepare a T-account to compute the ending balance of Allowance for Bad Debts.

Requirement 1. Journalize Spring's entry to record bad debts expense for 2024 using the aging-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

Date

Accounts

Debit

Credit

Dec.

31

Data Table

Accounts Receivable

Allowance for Bad Debts

66,000

1,615

Requirement 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts.

Allowance for Bad Debts

Print

Done

Data Table

Age of Accounts Receivable

0-60 Days

Over 60 Days

Total…

At December 31, 2018, the Accounts Receivable balance of Solar Energy Manufacturing is $205,000. The Allowance for Bad Debts account has a $8,050 debit balance. Solar Energy Manufacturing prepares the following aging schedule for its accounts receivable:

Journalize the year-end adjusting entry for bad debts on the basis of the aging schedule. Show the T-account for the Allowance for Bad Debts at December 31, 2018.

Begin by determining the target balance of Allowance for Bad Debts by using the age of each account.

Age of Accounts

1-30

31-60

61-90

Over 90

Total

Days

Days

Days

Days

Balance

Accounts Receivable

$70,000

$85,000

$45,000

$5,000

Estimated percent uncollectible

0.5

%

5.0

%

7.0

%

46.0

%

Estimated total uncollectible

Journalize the year-end adjusting entry for bad debts on the basis of the aging schedule. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

Date

Accounts and…

Chapter 9 Solutions

Horngren's Accounting

Ch. 9 - 1. With good internal controls, the person who...Ch. 9 - Prob. 2QCCh. 9 - Which of the following is a limitation of the...Ch. 9 - 3. The entry to record a write-off of an...Ch. 9 - Brickman Company uses the allowance method to...Ch. 9 - Brickman’s ending balance of accounts Receivable...Ch. 9 - At December 31 year-end, Crain Company has an...Ch. 9 - Using the data in the preceding question, what...Ch. 9 - At year-end, Schultz Company has cash of $11,600,...Ch. 9 - Using the data in the preceding question, assume...

Ch. 9 - What is the difference between accounts receivable...Ch. 9 - List some common examples of other receivables,...Ch. 9 - Prob. 3RQCh. 9 - When dealing with receivables, give an example of...Ch. 9 - What type of account must the sum of all...Ch. 9 - Prob. 6RQCh. 9 - What occurs when a business factors its...Ch. 9 - What occurs when a business pledges its...Ch. 9 - What is the expense account associated with the...Ch. 9 - When is bad debts expense recorded when using the...Ch. 9 - What are some limitations of using the direct...Ch. 9 - Prob. 12RQCh. 9 - Prob. 13RQCh. 9 - When using the allowance method, what account is...Ch. 9 - Prob. 15RQCh. 9 - Prob. 16RQCh. 9 - How do the percent-of-receivables and...Ch. 9 - What is the difference between the...Ch. 9 - In accounting for bad debts, how do the income...Ch. 9 - What is the formula to compute interest on a note...Ch. 9 - Prob. 21RQCh. 9 - Prob. 22RQCh. 9 - Prob. 23RQCh. 9 - Prob. 24RQCh. 9 - Prob. S9.1SECh. 9 - Prob. S9.2SECh. 9 - Applying the direct write-off method to account...Ch. 9 - Collecting a receivable previously written...Ch. 9 - Applying die allowance method to account for...Ch. 9 - Applying the allowance method (percent-of-sales)...Ch. 9 - Applying the allowance method...Ch. 9 - Applying the allowance method...Ch. 9 - Computing interest amounts on notes receivable A...Ch. 9 - Accounting for a note receivable On June 6,...Ch. 9 - Accruing interest revenue and recording collection...Ch. 9 - Recording a dishonored note receivable Midway...Ch. 9 - Using the acid-test ratio, accounts receivable...Ch. 9 - Defining common receivables terms Learning...Ch. 9 - E9-15 Identifying and correcting internal control...Ch. 9 - Journalizing transactions using the direct...Ch. 9 - Prob. E9.17ECh. 9 - Prob. E9.18ECh. 9 - Accounting for uncollectible accounts using the...Ch. 9 - Prob. E9.20ECh. 9 - Prob. E9.21ECh. 9 - Journalizing note receivable transactions...Ch. 9 - Journalizing note receivable transactions The...Ch. 9 - Journalizing note receivable transactions Like New...Ch. 9 - Evaluating ratio data Chippewa Carpets reported...Ch. 9 - Prob. E9.26ECh. 9 - Accounting for uncollectible accounts using the...Ch. 9 - Accounting for uncollectible accounts using the...Ch. 9 - Accounting for uncollectible accounts using the...Ch. 9 - Prob. P9.30APGACh. 9 - Accounting for notes receivable and accruing...Ch. 9 - Accounting for notes receivable, dishonored notes,...Ch. 9 - Prob. P9.33APGACh. 9 - Prob. P9.34BPGBCh. 9 - Prob. P9.35BPGBCh. 9 - Prob. P9.36BPGBCh. 9 - Prob. P9.37BPGBCh. 9 - Prob. P9.38BPGBCh. 9 - Prob. P9.39BPGBCh. 9 - Prob. P9.40BPGBCh. 9 - Prob. P9.41CPCh. 9 - Accounting for uncollectible accounts using the...Ch. 9 - Decision Case 9-1 Weddings on Demand sells on...Ch. 9 - Decision Case 9-2 Pauline’s Pottery has always...Ch. 9 - Prob. 9.1FCCh. 9 - > Financial Statement Case 9-1 Use Starbucks...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hardys Landscape Services total revenue on account for 2018 amounted to 273,205. The company, which uses the allowance method, estimates bad debts at percent of total revenue on account. Required Journalize the following selected entries: 2012 Dec. 12Record services performed on account for E. E. Morton, 245. 31Record the adjusting entry for Bad Debts Expense. 31Record the closing entry for Bad Debts Expense. 2013 Feb. 18Write off the account of E. E. Morton as uncollectible, 245. Check Figure Adjusting entry amount, 1,366.03arrow_forwardUsing data in Exercise 9-9, assume that the allowance for doubtful accounts for Waddell Industries has a credit balance of 6,350 before adjustment on August 31. Journalize the adjusting entry for uncollectible accounts as of August 31. Waddell Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8. The accounts receivable clerk for Waddell Industries prepared the following partially completed aging of receivables schedule as of the end of business on August 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: a. Determine the number of days past due for each of the preceding accounts as of August 31. b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forwardAllowance Method of Accounting for Bad Debts—Comparison of the Two Approaches Kandel Company had the following data available for 2016 (before making any adjustments): Required Prepare the journal entry to recognize bad debts under the following assumptions: (a) bad debts expense is expected to be 2% of net credit sales for the year and (b) Kandel expects it will not be able to collect 6% of the balance in accounts receivable at year-end. Assume instead that the balance in the allowance account is a $2,600 debit. How will this affect your answers to part (1)?arrow_forward

- Using the data in Exercise 9-11, assume that the allowance for doubtful accounts for Selbys Bike Co. had a debit balance of 7,200 as of December 31, 2016. Journalize the adjusting entry for uncollectible accounts as of December 31, 2016. Journalize the adjusting entry for uncollectible accounts as of December 31, 2016. Selbys Bike Co. is a wholesaler of motorcycle supplies. An aging of the companys accounts receivable on December 31, 2016, and a historical analysis of the percentage of uncollectible accounts in each age category are as follows: Estimate what the proper balance of the allowance for doubtful accounts should be as of December 31, 2016.arrow_forwardRogan Companys total sales on account for the year amounted to 327,000. The company, which uses the allowance method, estimated bad debts at 1 percent of its credit sales. Required Journalize the following selected entries: 2017 Dec.31 Record the adjusting entry. 2018 Mar. 2Write off the account of A. M. Billson as uncollectible, 584. June 6Write off the account of W. H. Gilders as uncollectible, 492. Check Figure Adjusting entry amount, 3,270arrow_forwardOlena Mirrors records bad debt using the allowance, income statement method. They recorded $343,160 in accounts receivable for the year and $577,930 in credit sales. The uncollectible percentage is 4.4%. On May 10, Olena Mirrors identifies one uncollectible account from Elsa Sweeney in the amount of $2,870. On August 12, Elsa Sweeney unexpectedly pays $1,441 toward her account. Record journal entries for the following. A. Year-end adjusting entry for 2017 bad debt B. May 10, 2018 identification entry C. Entry for payment on August 12, 2018arrow_forward

- Worldwide Marble Importers had the following balances at December 31, 2024, before the year-end adjustments: (Click the icon to view the balances.) The aging of accounts receivable yields the following data: (Click the icon to view the accounts receivable aging schedule.) Requirements 1. Journalize Worldwide's entry to record bad debts expense for 2024 using the aging-of-receivables method. 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts. Requirement 1. Journalize Worldwide's entry to record bad debts expense for 2024 using the aging-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts Dec. 31 Data table Accounts Receivable Estimated percent uncollectible $ 0-60 Days 71,000 x 4% Print Age of Accounts Receivable Over 60 Days 4,000 x 25% $ Done Debit $ Credit C Total Receivables 75,000 Data table Accounts Receivable 75,000 Print Allowance for Bad Debts 1,978 Done Xarrow_forwardWorldwide Marble Importers had the following balances at December 31, 2024, before the year-end adjustments: (Click the icon to view the balances.) The aging of accounts receivable yields the following data: (Click the icon to view the accounts receivable aging schedule.) Requirements 1. Journalize Worldwide's entry to record bad debts expense for 2024 using the aging-of-receivables method. 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts. Requirement 1. Journalize Worldwide's entry to record bad debts expense for 2024 using the aging-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts Dec. 31 Requirement 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts. Allowance for Bad Debts Data table Accounts Receivable Estimated percent uncollectible $ 0-60 Days 74,000 x 2% Print Debit Age of Accounts Receivable Over 60 Days 6,000 x 25% $ Done $…arrow_forwardSprague Company uses the aging method to adjust the allowance for uncollectibleaccounts at the end of the period. At December 31, 2018, the balance of accounts receivable is$250,000 and the allowance for uncollectible accounts has a credit balance of $4,000 (beforeadjustment). An analysis of accounts receivable produced the following age groups:Current ...................................... $150,00060 days past due......................... 90,000Over 60 days past due................ 10,000$250,000Based on past experience, Sprague estimates that the percentage of accounts that will prove tobe uncollectible within the three age groups is 2% of the current balance, 8% of the 60 dayspast due balance, and 18% of the over 60 days past due balance. Based on these facts, theadjusting entry for uncollectible accounts should be made in the amount ofa. $8,000.b. $12,000.c. $17,000.d. $16,000.arrow_forward

- Prior to recording the following. E. Perry Electronics, Incorporated, had a credit balance of $2.600 in its Allowance for Doubtful Accounts 1. On August 31, 2017, a customer balance for $540 from a prior year was determined to be uncollectable and was written off 2. On December 15, 2017, the customer balance for $540 written off on August 31, 2017, was collected in full Required: Using the following categories, indicate the accounts affected and the amounts (Enter any decreases to accounts with a minus sign.) Transaction 2a (Reversal of write-off) 2b (Collection from customer) Assets Liabilities Shareholders Equity Chearrow_forwardplease fill all requirementsarrow_forwardAt December 31, 2018, the Leni Inc. account balances before the year-end adjusting entries are the following, Accounts receivable- P50000 Allowance for uncollectible accounts P4500 According to aging of accounts receivable, P6250 of the December 31 receivables are expected to be uncollectible. How much is the net realizable value of accounts receivable after adjustment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License