Managerial Accounting (5th Edition)

5th Edition

ISBN: 9780134128528

Author: Karen W. Braun, Wendy M. Tietz

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 9.65BP

Problems Group B

P9-65B Comprehensive budgeting problem (Learning Objectives 2 & 3)

Conrad Manufacturing is preparing its

| Current assets as of December 31 (prior year): | |

| Cash | $ 4.460 |

| $ 49,000 | |

| Inventory | $ 15,600 |

| Property, plant, and equipment, net | $121,500 |

| Accounts payable | $ 43,000 |

| Capital stock | $127,000 |

| $ 22,800 |

- a. Actual sales in December were $76,000. Selling price per unit is projected to remain stable at $9 per unit throughout the budget period. Sales for the first five months of the upcoming year are budgeted to be as follows:

| January | $80,100 |

| February | $89,100 |

| March | $82,800 |

| April | $85,500 |

| May | $77,400 |

- b. Sales are 30% cash and 70% credit. All credit sales are collected in the month following the sale.

- c. Conrad Manufacturing has a policy stating that each month’s ending inventory of finished goods should be 10% of the following month’s sales (in units).

- d. Of each month’s direct materials purchases, 20% are paid for in the month of purchase, while the remainder is paid for in the month following purchase. Two pounds of direct material is needed per unit at $1.50 per pound. Ending inventory of direct materials should be 20% of next month’s production needs.

- e. Most of the labor at the manufacturing facility is indirect, but there is some direct labor incurred. The direct labor hours per unit is 0.03. The direct labor rate per hour is $13 per hour. All direct labor is paid for in the month in which the work is performed. The direct labor total cost for each of the upcoming three months is as follows:

| January | $3,510 |

| February | $3,834 |

| March | $3,600 |

- f. Monthly manufacturing

overhead costs are $6,500 for factory rent, $2,900 for other fixed manufacturing expenses, and $1.40 per unit for variable manufacturing overhead. Nodepreciation is included in these figures. All expenses are paid in the month in which they are incurred. - g. Computer equipment for the administrative offices will be purchased in the upcoming quarter. In January, the company will purchase equipment for $5,800 (cash), while February’s cash expenditure will be $11,600 and March’s cash expenditure will be $15,800.

- h. Operating expenses are budgeted to be $1.20 per unit sold plus fixed operating expenses of $1,400 per month. All operating expenses are paid in the month in which they are incurred. No depreciation is included in these figures.

- i. Depreciation on the building and equipment for the general and administrative offices is budgeted to be $4,900 for the entire quarter, which includes depreciation on new acquisitions.

- j. Conrad Manufacturing has a policy that the ending cash balance in each month must be at least $4,400. The company has a line of credit with a local bank. It can borrow in increments of $1,000 at the beginning of each month, up to a total outstanding loan balance of $160,000. The interest rate on these loans is 1% per month simple interest (not compounded). The company would pay down on the line of credit balance in increments of $1,000 if it has excess funds at the end of the quarter. The company would also pay the accumulated interest at the end of the quarter on the funds borrowed during the quarter.

- k. The company’s income tax rate is projected to be 30% of operating income less interest expense. The company pays $10,800 cash at the end of February in estimated taxes.

Requirements

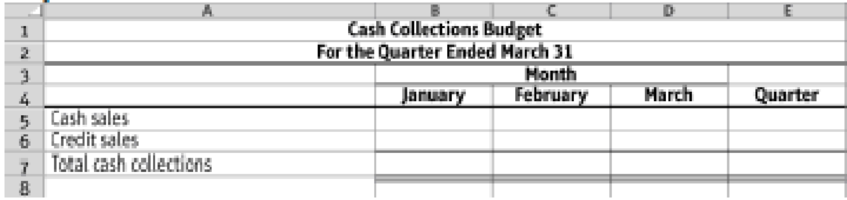

- 1. Prepare a schedule of cash collections for January, February, and March, and for the quarter in total.

9.5-60 Full Alternative Text

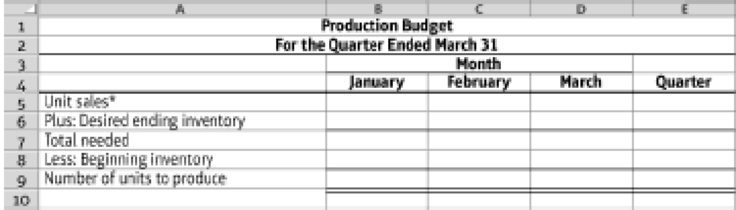

- 2. Prepare a production budget.

9.5-61 Full Alternative Text

*Hint: Unit sales = Sales in dollars/Selling price per unit

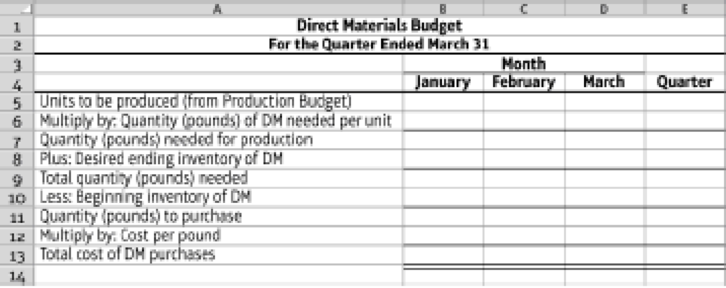

- 3. Prepare a direct materials budget.

9.5-62 Full Alternative Text

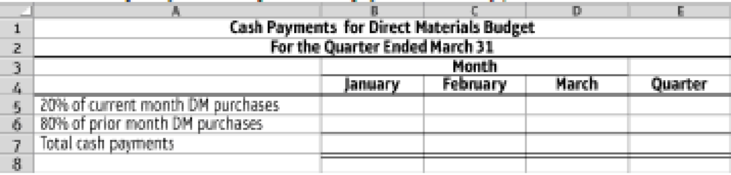

- 4. Prepare a cash payments budget for the direct material purchases from Requirement 3, using the following format. (Use the accounts payable balance at December 31 of prior year for the prior month payment in January.)

9.5-63 Full Alternative Text

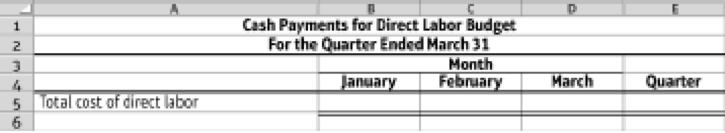

- 5. Prepare a cash payments budget for direct labor, using the following format:

9.5-64 Full Alternative Text

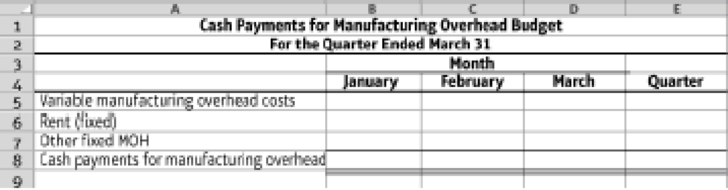

- 6. Prepare a cash payments budget for manufacturing overhead costs.

9.5-65 Full Alternative Text

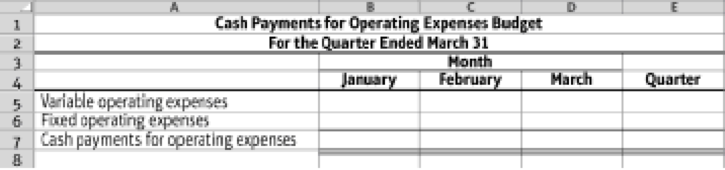

- 7. Prepare a cash payments budget for operating expenses.

9.5-66 Full Alternative Text

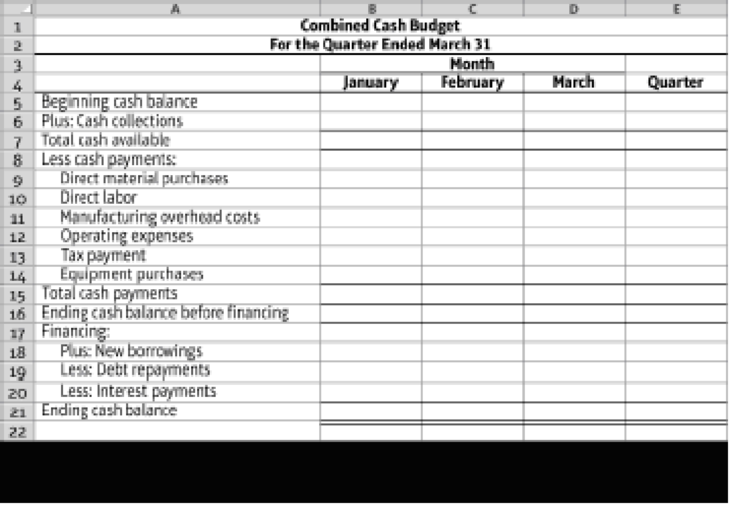

- 8. Prepare a combined

cash budget .

9.5-67 Full Alternative Text

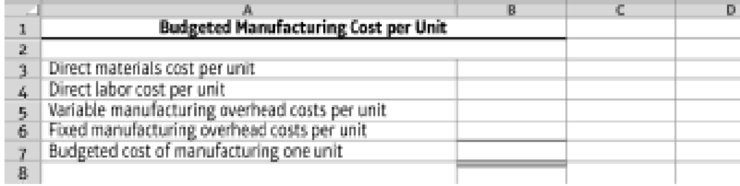

- 9. Calculate the budgeted

manufacturing cost per unit (assume that fixed manufacturing overhead is budgeted to be $0.70 per unit for the year).

9.5-68 Full Alternative Text

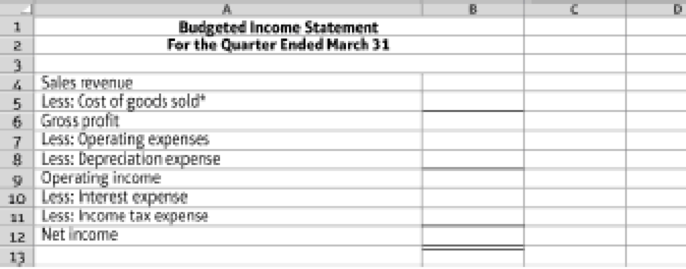

- 10. Prepare a

budgeted income statement for the quarter ending March 31.

9.5-69 Full Alternative Text

*Hint: Cost of goods sold = Budgeted cost of manufacturing one unit x Number of units sold

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

How much cash is received for accrued interest on May 1 by the bond issuer on these financial accounting question?

Provide solution this financial accounting question

What was the balance in interest payable on the 2021 balance sheet for this financial accounting question?

Chapter 9 Solutions

Managerial Accounting (5th Edition)

Ch. 9 - (Learning Objective 1) Which term describes the...Ch. 9 - (Learning Objective 1) Benefits of budgeting...Ch. 9 - Prob. 3QCCh. 9 - Prob. 4QCCh. 9 - Prob. 5QCCh. 9 - Prob. 6QCCh. 9 - Prob. 7QCCh. 9 - Prob. 8QCCh. 9 - Prob. 9QCCh. 9 - Prob. 10QC

Ch. 9 - Short Exercises S9-1 Order of preparation and...Ch. 9 - Explain why companies use zero-based budgeting...Ch. 9 - Understanding key terms and definitions (Learning...Ch. 9 - Sales Budget (Learning Objective 2) Jefferson...Ch. 9 - Production budget (Learning Objective 2) Nichols...Ch. 9 - Direct materials budget (Learning Objective 2)...Ch. 9 - Prob. 9.7SECh. 9 - Prob. 9.8SECh. 9 - Prob. 9.9SECh. 9 - Prob. 9.10SECh. 9 - Prob. 9.11SECh. 9 - Cash payments budget (Learning Objective 3) Finley...Ch. 9 - Cash budget (Learning Objective 3) SaveCo...Ch. 9 - Prob. 9.14SECh. 9 - Prob. 9.15SECh. 9 - Identify ethical standards violated (Learning...Ch. 9 - Prob. 9.17AECh. 9 - Sales budget for a retail organization (Learning...Ch. 9 - Prob. 9.19AECh. 9 - Production budget (Learning Objective 2) Hoffman...Ch. 9 - Direct materials budget (Learning Objective 2)...Ch. 9 - Production and direct materials budgets (Learning...Ch. 9 - Direct labor budget (Learning Objective 2)...Ch. 9 - Manufacturing overhead budget (Learning Objective...Ch. 9 - Operating expenses budget and an income statement...Ch. 9 - Budgeted income statement (Learning Objective 2)...Ch. 9 - Prob. 9.27AECh. 9 - Cash collections budget (Learning Objective 3)...Ch. 9 - Cash payments budget (Learning Objective 3) The...Ch. 9 - Prob. 9.30AECh. 9 - Prob. 9.31AECh. 9 - Budgeted balance sheet (Learning Objective 3) Use...Ch. 9 - Prob. 9.33AECh. 9 - Prob. 9.34AECh. 9 - Cost of goods sold, inventory, and purchases...Ch. 9 - Cost of goods sold, inventory, and purchases...Ch. 9 - Prob. 9.37BECh. 9 - Prob. 9.38BECh. 9 - Prob. 9.39BECh. 9 - Prob. 9.40BECh. 9 - Direct materials budget (Learning Objective 2) Moe...Ch. 9 - Prob. 9.42BECh. 9 - Prob. 9.43BECh. 9 - Manufacturing overhead budget (Learning Objective...Ch. 9 - Prob. 9.45BECh. 9 - Prob. 9.46BECh. 9 - Prob. 9.47BECh. 9 - Prob. 9.48BECh. 9 - Prob. 9.49BECh. 9 - Combined cash budget (Learning Objective 3)...Ch. 9 - Sales and cash collections budgets (Learning...Ch. 9 - Prob. 9.52BECh. 9 - Prob. 9.53BECh. 9 - Prob. 9.54BECh. 9 - Prob. 9.55BECh. 9 - Prob. 9.56BECh. 9 - Comprehensive budgeting problem (Learning...Ch. 9 - Cash budgets under two alternatives (Learning...Ch. 9 - Comprehensive summary problem (Learning Objectives...Ch. 9 - Prob. 9.60APCh. 9 - Cash budgets (Learning Objective 3) Elis...Ch. 9 - Prob. 9.62APCh. 9 - Cost of goods sold, inventory, and purchases...Ch. 9 - Prob. 9.64APCh. 9 - Problems Group B P9-65B Comprehensive budgeting...Ch. 9 - Cash budgets under two alternatives (Learning...Ch. 9 - Comprehensive summary problem (Learning Objectives...Ch. 9 - Prob. 9.68BPCh. 9 - Cash budgets (Learning Objective 3) Ivans...Ch. 9 - Combined cash budget and a budgeted balance sheet...Ch. 9 - Prob. 9.71BPCh. 9 - Prepare comprehensive budgets for a retailer...Ch. 9 - Prob. 9.73SCCh. 9 - Discussion Questions 1. The sales budget is the...Ch. 9 - Budgeting for a Single Product In this activity,...Ch. 9 - Ethics and budgetary slack (Learning Objectives 1,...Ch. 9 - Prob. 9.77ACT

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute the total cost of work in process for the year on these general accounting questionarrow_forwardDetermine the cost per equivalent unit of conversion on these general accounting questionarrow_forwardCarla Vista Corporation had a projected benefit obligation of $2,890,000 and plan assets of $3,097,000 at January 1, 2025. Carla Vista also had a net actuarial loss of $437,680 in accumulated OCI at January 1, 2025. The average remaining service period of Carla Vista's employees is 7.9 years. Compute Carla Vista's minimum amortization of the actuarial loss. Minimum amortization of the actuarial lossarrow_forward

- Chapter 15 Homework i 10 0.83 points Saved Help Save & Exit Submit Check my work QS 15-8 (Algo) Computing predetermined overhead rates LO P3 A company estimates the following manufacturing costs at the beginning of the period: direct labor, $520,000; direct materials, $216,000; and factory overhead, $141,000. Required: eBook 1. Compute its predetermined overhead rate as a percent of direct labor. 2. Compute its predetermined overhead rate as a percent of direct materials. Ask Complete this question by entering your answers in the tabs below. Print Required 1 Required 2 References Mc Graw Hill Compute its predetermined overhead rate as a percent of direct labor. Overhead Rate Numerator: 1 Denominator: = Overhead Rate = Overhead Rate = 0arrow_forwardhello teacher please solve questions general accountingarrow_forwardCampbell Soup Company reported pension expense of $94 million and contributed $81.5 million to the pension fund. Prepare Campbell's journal entry to record pension expense and funding, assuming campbell has no OCI amounts.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY