(Learning Objectives 4, 5, 6: Report liabilities on the

Requirements

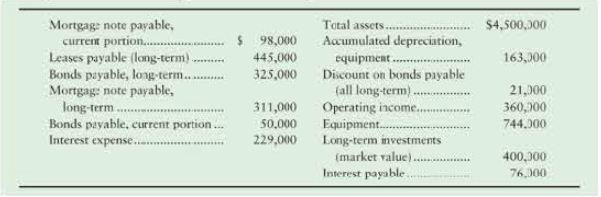

1. Show how each relevant item would be reported on the Brigham Foods classified balance sheet. Include headings and totals for current liabilities and long-term liabilities.

2. Answer the following questions about Brigham Food's financial position at December 31, 2018:

- a. What is the carrying amount of the bonds payable (combine the current and long-tenn amounts)?

- b. Why is the interest-payable amount so much less than the amount or interest expense?

3. How many times did Brigham Foods cover its interest expense during 2018?

4. Assume that all of the existing liabilities are included in the information provided. Calculate the leverage ratio and debt ratio of the company. Use yearend figures in place of averages where needed for the purpose of calculating ratios in this problem. Evaluate the health of the company from a leverage point of view. Assume the company only has common stock issued and outstanding. What other information would be helpful in making your evaluation?

5. Independent of your answer to (4), assume that Footnote 8 of the financial statements includes commitments for long-term operating leases over the next 15 years in the amount of $3,800,000. If the company had to capitalize these leases in 2018, how would it change the leverage ratio and the debt ratio? How would this impact your assessment of the company's health from a leverage point of view?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

MyLab Accounting with Pearson eText -- Access Card -- for Financial Accounting

- On the factory overhead budget for the montharrow_forwardProblem 19-63 (LO 19-5) (Algo) [The following information applies to the questions displayed below.] Tiffany and Carlos decided to liquidate their jointly owned corporation, Royal Oak Furniture (ROF). After liquidating its remaining inventory and paying off its remaining liabilities, ROF had the following tax accounting balance sheet: Cash Building Land FMV $ 399,000 84,000 315,000 Adjusted Tax Basis $ 399,000 27,250 405,000 Total $ 798,000 $ 831,250 Appreciation (Depreciation) 56,750 (90,000) $ (33,250) Under the terms of the agreement, Tiffany will receive the $399,000 cash in exchange for her 50 percent interest in ROF. Tiffany's tax basis in her ROF stock is $59,000. Carlos will receive the building and land in exchange for his 50 percent interest in ROF. His tax basis in the ROF stock is $121,000. Assume for purposes of this problem that the cash available to distribute to the shareholders has been reduced by any tax paid by the corporation on gain recognized as a result of the…arrow_forwardPlease provide problem with accountingarrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning