Concept explainers

Cho Sportswear: Aged Schedule of Accounts Receivable

| Past Due | ||||||

| Customer | Current | 1-30 Days | 31-60 Days | 61-90 Days | Over 90 Days | Totals |

| Ryoko Design Assosciates | $100,000 | $23,800 | $ 123,800 | |||

| Marcy Fashions, Inc | 657,000 | 198,000 | $76,000 | 931,000 | ||

| Conory Clothing | $456,000 | $789,412 | 1,245,412 | |||

| Lee Womensware | 237,200 | 10,230 | 54,570 | 349,200 | 651,200 | |

| Bauer Brands, Ltd. | 100,230 | 76,770 | 41,588 | 19,000 | 237,588 | |

| Totals | $1,094,430 | $308,800 | $130,570 | $846,788 | $808,412 | $3,189,000 |

The company estimated an allowance for uncollectible accounts based on the following estimates

| Aging Category | Allowance Provided |

| Current | 5% |

| 1 -30 days past due | 9 |

| 31-60 days past due | 20 |

| 61-90 days past due | 55* |

| Over 90 days past due | 80* |

After a specific review of the company’s accounts receivable, Cho’s credit manager decided to provide a full allowance against all Bauer Brands’ balances that are more than 60 days past due. The percentage allowance is applied to the 61-90 days and over 90 days past due aging categories only after deducting the balances due from Bauer Brands.

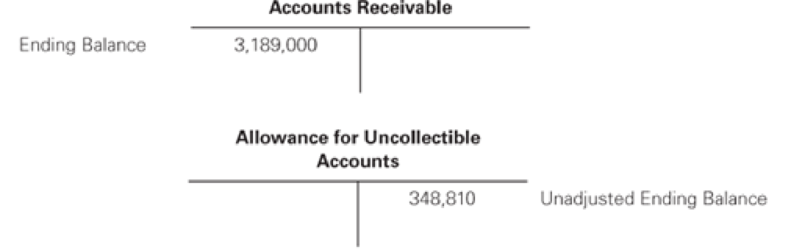

Cho reported net credit sales of $45,000,000 for the current year. We present the company’s of accounts receivable and the allowance for uncollectible accounts:

Required

- a. Compute the balance required in the allowance for uncollectible accounts at the end of the year.

- b. Prepare the journal entry to record the bad debt provision for the current year.

- c. Independent of your answer to part (b) prepare the journal entry to record the bad debt provision for the current year assuming that the allowance for uncollectible accounts had a $331,000 debit balance.

- d. In the following year, Cho’s credit management decided to write off all accounts that were over 90 days past due. Prepare the journal entry.

- e. After the write-offs recorded in part (d), assume that Conroy Clothing pays the entire balance due. Prepare the journal entries required to record the subsequent recovery of the Conroy Clothing receivables.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Intermediate Accounting Plus Mylab Accounting With Pearson Etext -- Access Card Package (2nd Edition)

- Warner Manufacturing incurs $16 in variable costs and $7 in allocated fixed costs to produce a product that sells for $35 per unit. A buyer in Canada offers to purchase 1,800 units at $20 each. Warner Manufacturing has excess capacity and can handle the additional production. What effect will acceptance of the offer have on net income?arrow_forwardCalculate the price charged to the customer for Jobarrow_forwardWhat is the company's plantwide overhead rate? Accountingarrow_forward

- Hendrix Corporation had annual sales of $75 million, which occurred evenly throughout the 365 days of the year. Its accounts receivable balance averaged $3 million. How long, on average, does it take the firm to collect on its sales? Answerarrow_forwardKichi company had the following informationarrow_forwardWhat is the flexible budget net income?arrow_forward

- Hendrix Corporation had annual sales of $75 million, which occurred evenly throughout the 365 days of the year. Its accounts receivable balance averaged $3 million. How long, on average, does it take the firm to collect on its sales?arrow_forwardWhat was the dollar amount of under allocated or overallocated manufacturing overhead ?arrow_forward5 POINTSarrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College