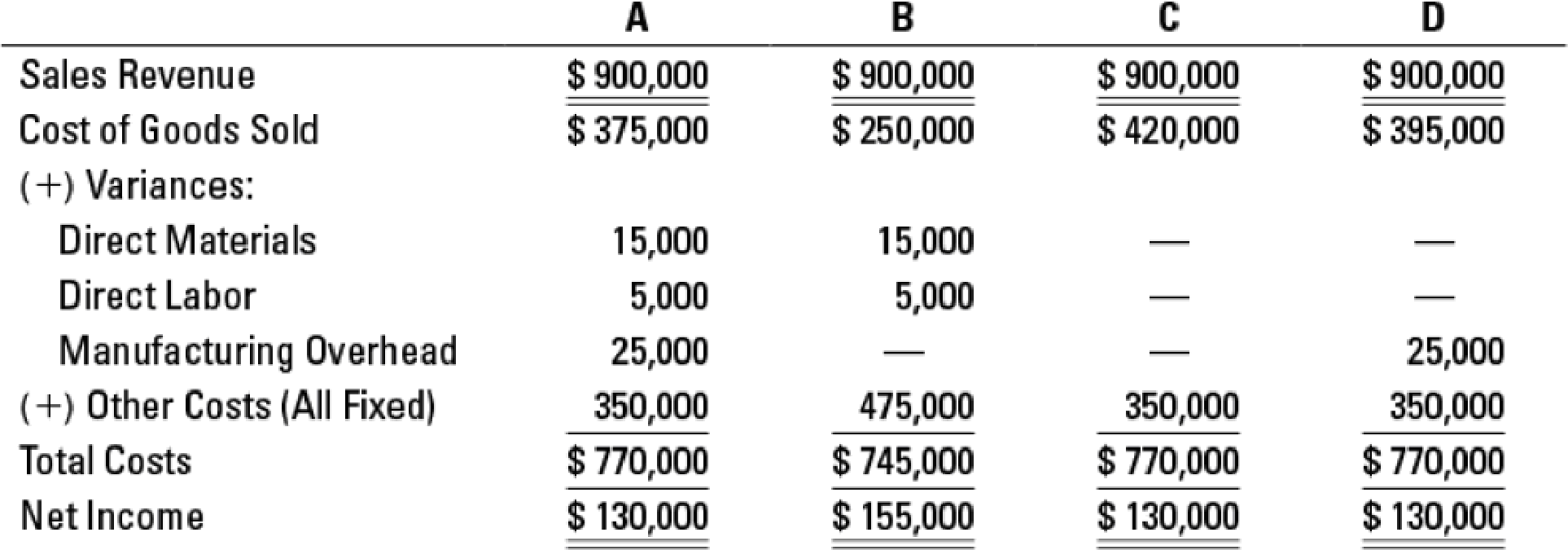

Costing methods and variances, comprehensive. Rob Kapito, the controller of Blackstar Paint Supply Company, has been exploring a variety of internal accounting systems. Rob hopes to get the input of Blackstar’s board of directors in choosing one. To prepare for his presentation to the board, Rob applies four different cost accounting methods to the firm’s operating data for 2017. The four methods are actual absorption costing, normal absorption costing, standard absorption costing, and standard variable costing. With the help of a junior accountant, Rob prepares the following alternative income statements:

Where applicable, Rob allocates both fixed and variable manufacturing

- 1. Match each method below with the appropriate income statement (A, B, C, or D):

Required

| Actual Absorption costing | _____ |

| Normal Absorption costing | _____ |

| Standard Absorption costing | _____ |

| Standard Variable costing | _____ |

- 2. During 2017, how did Blackstar’s level of finished-goods inventory change? In other words, is it possible to know whether Blackstar’s finished-goods inventory increased, decreased, or stayed constant during the year?

- 3. From the four income statements, can you determine how the actual volume of production during the year compared to the denominator (expected) volume level?

- 4. Did Blackstar have a favorable or unfavorable variable overhead spending variance during 2017?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

COST ACCOUNTING

- Milani, Incorporated, acquired 10 percent of Seida Corporation on January 1, 2023, for $190,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2024, Milani purchased an additional 30 percent of Seida for $600,000 which resulted in significant influence over Seida. On that date, the fair value of Seida's common stock was $2,000,000 in total. Seida's January 1, 2024, book value equaled $1,850,000, although land was undervalued by $120,000. Any additional excess fair value over Seida's book value was attributable to a trademark with an eight-year remaining life. During 2024, Seida reported income of $300,000 and declared and paid dividends of $110,000. Required: Prepare the 2024 journal entries for Milani related to its investment in Seida. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheetarrow_forwardThe leo company hadarrow_forwardMCQ 4arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub