Horngren's Cost Accounting, Student Value Edition (16th Edition)

16th Edition

ISBN: 9780134476032

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 9.41P

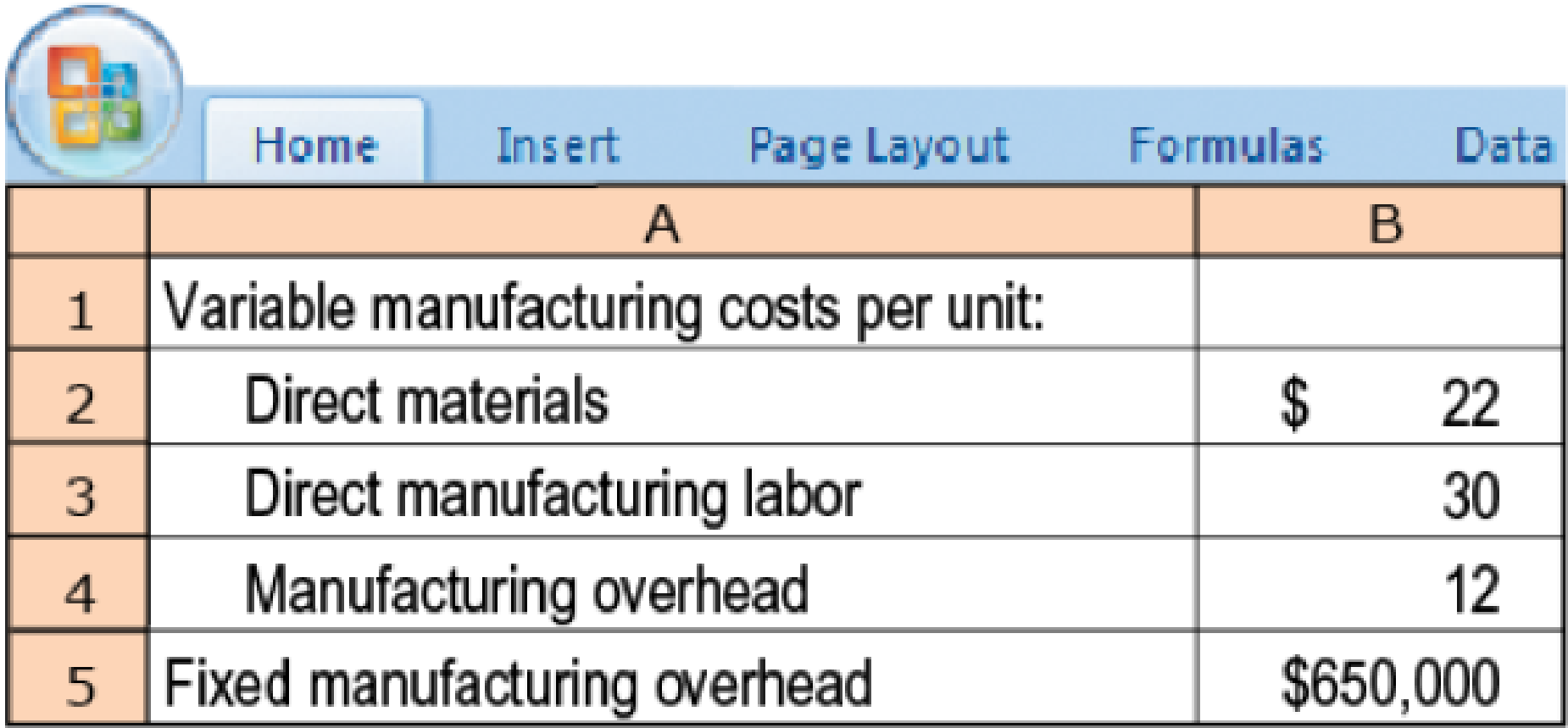

Downward demand spiral. Market.com is about to enter the highly competitive personal electronics market with a new type of tablet. In anticipation of future growth, the company has leased a large manufacturing facility and has purchased several expensive pieces of equipment. In 2017, the company’s first year Market.com budgets for production and sales of 50,000 units, compared with its practical capacity of 78,000. The company’s cost data are as follows:

- 1. Assume that Market.com uses absorption costing and uses budgeted units produced as the denominator for calculating its fixed manufacturing

overhead rate. Selling price is set at 140% ofmanufacturing cost . Compute Market.com’s selling price.

Required

- 2. Market.com enters the market with the selling price computed previously. However, despite growth in the overall market, sales are not as robust as the company had expected, and a competitor has priced its product at $102.00. Mr. Samuel Buttons, the company’s president, insists that the competitor must be pricing its product at a loss and that the competitor will be unable to sustain that. In response, Market.com makes no price adjustments but budgets production and sales for 2018 at 43,800 tablets. Variable and fixed costs are not expected to change. Compute Market.com’s new selling price. Comment on how Market.com’s choice of budgeted production affected its selling price and competitive position.

- 3. Recompute the selling price using practical capacity as the denominator level of activity. How would this choice have affected Market.com’s position in the marketplace? Generally, how would this choice affect the production-volume variance?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Bartlett's Pears has a profit margin of 8.20 percent on sales of $24,300,000. If the firm has a debt of $10,400,000 and total assets of $21,000,000, what is the firm's ROA?

Expert need your help

NO AI ANSWER

Chapter 9 Solutions

Horngren's Cost Accounting, Student Value Edition (16th Edition)

Ch. 9 - Differences in operating income between variable...Ch. 9 - Why is the term direct costing a misnomer?Ch. 9 - Do companies in either the service sector or the...Ch. 9 - Explain the main conceptual issue under variable...Ch. 9 - Companies that make no variable-cost/fixed-cost...Ch. 9 - The main trouble with variable costing is that it...Ch. 9 - Give an example of how, under absorption costing,...Ch. 9 - What are the factors that affect the breakeven...Ch. 9 - Critics of absorption costing have increasingly...Ch. 9 - What are two ways of reducing the negative aspects...

Ch. 9 - Prob. 9.11QCh. 9 - Describe the downward demand spiral and its...Ch. 9 - Will the financial statements of a company always...Ch. 9 - Prob. 9.14QCh. 9 - The difference between practical capacity and...Ch. 9 - In comparing the absorption and variable cost...Ch. 9 - Queen Sales, Inc. has just completed its first...Ch. 9 - King Tooling has produced and sold the following...Ch. 9 - The following information relates to Drexler Inc.s...Ch. 9 - Prob. 9.20MCQCh. 9 - Variable and absorption costing, explaining...Ch. 9 - Throughput costing (continuation of 9-21). The...Ch. 9 - Variable and absorption costing, explaining...Ch. 9 - Throughput costing (continuation of 9-23). The...Ch. 9 - Variable versus absorption costing. The Tomlinson...Ch. 9 - Absorption and variable costing. (CMA) Miami,...Ch. 9 - Absorption versus variable costing. Horace Company...Ch. 9 - Candyland uses standard costing to produce a...Ch. 9 - Capacity management, denominator-level capacity...Ch. 9 - Denominator-level problem. Thunder Bolt Inc., is a...Ch. 9 - Variable and absorption costing and breakeven...Ch. 9 - Variable costing versus absorption costing. The...Ch. 9 - Throughput Costing (continuation of 9-32) 1....Ch. 9 - Variable costing and absorption costing, the Z-Var...Ch. 9 - Comparison of variable costing and absorption...Ch. 9 - Effects of differing production levels on...Ch. 9 - Alternative denominator-level capacity concepts,...Ch. 9 - Motivational considerations in denominator-level...Ch. 9 - Denominator-level choices, changes in inventory...Ch. 9 - Variable and absorption costing and breakeven...Ch. 9 - Downward demand spiral. Market.com is about to...Ch. 9 - Absorption costing and production-volume...Ch. 9 - Operating income effects of denominator-level...Ch. 9 - Variable and absorption costing, actual costing....Ch. 9 - Prob. 9.45PCh. 9 - Cost allocation, responsibility accounting, ethics...Ch. 9 - Absorption, variable, and throughput costing....Ch. 9 - Costing methods and variances, comprehensive. Rob...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial Accounting: Shiva Corporation's break-even point in sales is $840,000, and its variable expenses are 65% of sales. If the company lost $33,000 last year, sales must have amounted to: a) $746,000 b) $860,000 c) $800,000 d) $620,000arrow_forwardPlease solve this question general accountingarrow_forwardSub: accountingarrow_forward

- A company has sales of $150 million, cost of goods sold of $100 million, and a before-tax profit of 8%. If purchasing was able to reduce the cost of goods sold by $5 million, how much additional sales would be required to achieve the same impact on profit?arrow_forwardAnswer? ? Financial accounting questionarrow_forwardThe gross margin for July?arrow_forward

- The time value of money concept is most relevant toarrow_forwardMia Vision Clinic is considering an investment that required an outlay of $505,000 and promises a net cash inflow one year from now of $660,000. Assume the cost of capital is 13 percent. Break the $550,000 future cash inflow into three components: 1. The cost of capital. 2. The profit earned on the investment.arrow_forwardGENERAL ACCOUNTINGarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

GE McKinsey Matrix for SBU Strategies; Author: Wolters World;https://www.youtube.com/watch?v=FffD1Ze76JQ;License: Standard Youtube License