REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

16th Edition

ISBN: 9780134789705

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 9.35P

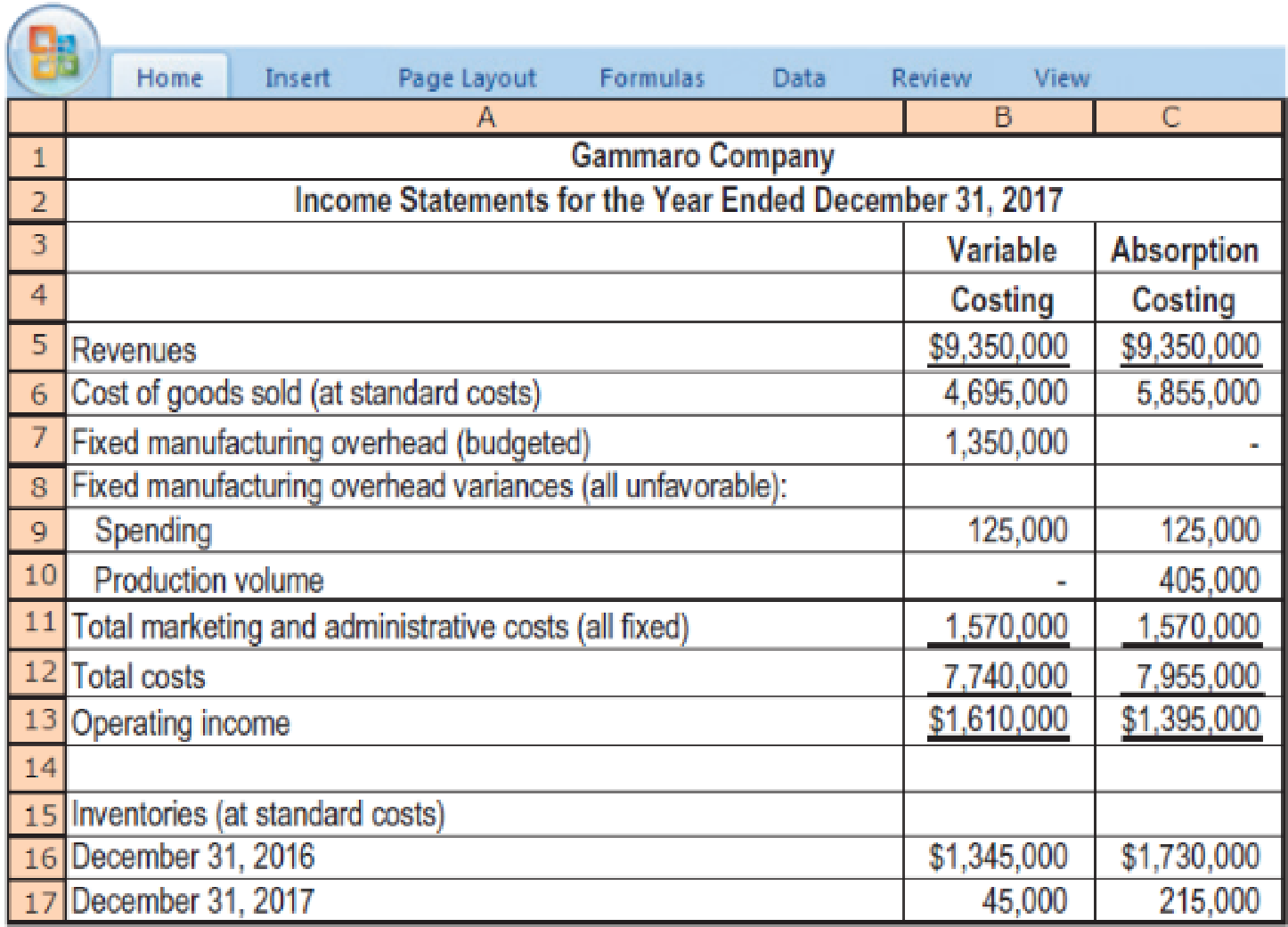

Comparison of variable costing and absorption costing. Gammaro Company uses

- 1. At what percentage of denominator level was the plant operating during 2017?

- 2. How much fixed manufacturing

overhead was included in the 2016 and the 2017 ending inventory under absorption costing? - 3. Reconcile and explain the difference in 2017 operating incomes under variable and absorption costing.

- 4. Tim Sweeney is concerned: He notes that despite an increase in sales over 2016, 2017 operating income has actually declined under absorption costing. Explain how this occurred.

Expert Solution & Answer

Learn your wayIncludes step-by-step video

schedule05:56

Students have asked these similar questions

I need help with this problem and accounting

Provide correct solution and accounting

Compute the company's degree of opereting leverage?

Chapter 9 Solutions

REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

Ch. 9 - Differences in operating income between variable...Ch. 9 - Why is the term direct costing a misnomer?Ch. 9 - Do companies in either the service sector or the...Ch. 9 - Explain the main conceptual issue under variable...Ch. 9 - Companies that make no variable-cost/fixed-cost...Ch. 9 - The main trouble with variable costing is that it...Ch. 9 - Give an example of how, under absorption costing,...Ch. 9 - What are the factors that affect the breakeven...Ch. 9 - Critics of absorption costing have increasingly...Ch. 9 - What are two ways of reducing the negative aspects...

Ch. 9 - Prob. 9.11QCh. 9 - Describe the downward demand spiral and its...Ch. 9 - Will the financial statements of a company always...Ch. 9 - Prob. 9.14QCh. 9 - The difference between practical capacity and...Ch. 9 - In comparing the absorption and variable cost...Ch. 9 - Queen Sales, Inc. has just completed its first...Ch. 9 - King Tooling has produced and sold the following...Ch. 9 - The following information relates to Drexler Inc.s...Ch. 9 - Prob. 9.20MCQCh. 9 - Variable and absorption costing, explaining...Ch. 9 - Throughput costing (continuation of 9-21). The...Ch. 9 - Variable and absorption costing, explaining...Ch. 9 - Throughput costing (continuation of 9-23). The...Ch. 9 - Variable versus absorption costing. The Tomlinson...Ch. 9 - Absorption and variable costing. (CMA) Miami,...Ch. 9 - Absorption versus variable costing. Horace Company...Ch. 9 - Candyland uses standard costing to produce a...Ch. 9 - Capacity management, denominator-level capacity...Ch. 9 - Denominator-level problem. Thunder Bolt Inc., is a...Ch. 9 - Variable and absorption costing and breakeven...Ch. 9 - Variable costing versus absorption costing. The...Ch. 9 - Throughput Costing (continuation of 9-32) 1....Ch. 9 - Variable costing and absorption costing, the Z-Var...Ch. 9 - Comparison of variable costing and absorption...Ch. 9 - Effects of differing production levels on...Ch. 9 - Alternative denominator-level capacity concepts,...Ch. 9 - Motivational considerations in denominator-level...Ch. 9 - Denominator-level choices, changes in inventory...Ch. 9 - Variable and absorption costing and breakeven...Ch. 9 - Downward demand spiral. Market.com is about to...Ch. 9 - Absorption costing and production-volume...Ch. 9 - Operating income effects of denominator-level...Ch. 9 - Variable and absorption costing, actual costing....Ch. 9 - Prob. 9.45PCh. 9 - Cost allocation, responsibility accounting, ethics...Ch. 9 - Absorption, variable, and throughput costing....Ch. 9 - Costing methods and variances, comprehensive. Rob...

Additional Business Textbook Solutions

Find more solutions based on key concepts

E8-16 Understanding internal control, components, procedures, and laws

Learning Objectives 1, 2, 3

Match ...

Horngren's Accounting (12th Edition)

The flowchart for the process at the local car wash. Introduction: Flowchart: A flowchart is a visualrepresenta...

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Incremental IRR and its shortcomings. Introduction: IRR helps to make capital budget decisions. IRR relies on t...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

23. What factors affect a company’s gross profit rate—that is, what can cause the gross profit rate to increase...

Financial Accounting: Tools for Business Decision Making, 8th Edition

1-13. Identify a product, either a good or a service, that will take advantage of this opportunity. Although yo...

Business Essentials (12th Edition) (What's New in Intro to Business)

What is an action plan? Why are action plans such an important part of market planning? Why is it so important ...

MARKETING:REAL PEOPLE,REAL CHOICES

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which feature distinguishes nominal accounts from real accounts in closing entries? Options: (i) Temporary nature requiring closure (ii) Balance sheet presentation (iii) Permanent balances carried forward (iv) Contra account status financial Accounting problemarrow_forwardProvide correct solution accountingarrow_forwardWhat is its degree of opereting leverage? General accountingarrow_forward

- General accountingarrow_forwardWhich feature distinguishes nominal accounts from real accounts in closing entries? Options: (i) Temporary nature requiring closure (ii) Balance sheet presentation (iii) Permanent balances carried forward (iv) Contra account statusarrow_forwardNeed help this questionarrow_forward

- Organization/Industry Rank Employer Survey Student Survey Career Service Director Survey Average Pay Deloitte & Touche/accounting 1 1 8 1 55 Ernst & Young/accounting 2 6 3 6 50 PricewaterhouseCoopers/accounting 3 22 5 2 50 KPMG/accounting 4 17 11 5 50 U.S. State Department/government 5 12 2 24 60 Goldman Sachs/investment banking 6 3 13 16 60 Teach for America/non-profit; government 7 24 6 7 35 Target/retail 8 19 18 3 45 JPMorgan/investment banking 9 13 12 17 60 IBM/technology 10 11 17 13 60 Accenture/consulting 11 5 38 15 60 General Mills/consumer products 12 3 33 28 60 Abbott Laboratories/health 13 2 44 36 55 Walt Disney/hospitality 14 60 1 8 40 Enterprise Rent-A-Car/transportation 15 28 51 4 35 General Electric/manufacturing 16 19 16 9 55 Phillip Morris/consumer products 17 8 50 19 55 Microsoft/technology 18 28 9 34 75 Prudential/insurance 19 9 55 37 50 Intel/technology 20 14 23 63 60 Aflac/insurance 21 9 55 62 50 Verizon…arrow_forwardProvide correct solution accountingarrow_forwardWhat is the gross marginarrow_forward

- The accrued expense is ? General accountingarrow_forwardCalculate the total contribution margin also in percentage and per unit general accountingarrow_forwardD-Mart reported a net income of $19,500 for the previous year. At the beginning of the year, the company had $300,000 in assets. By the end of the year, assets had increased by $100,000. Calculate the return on assets.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY