Concept explainers

Candyland uses

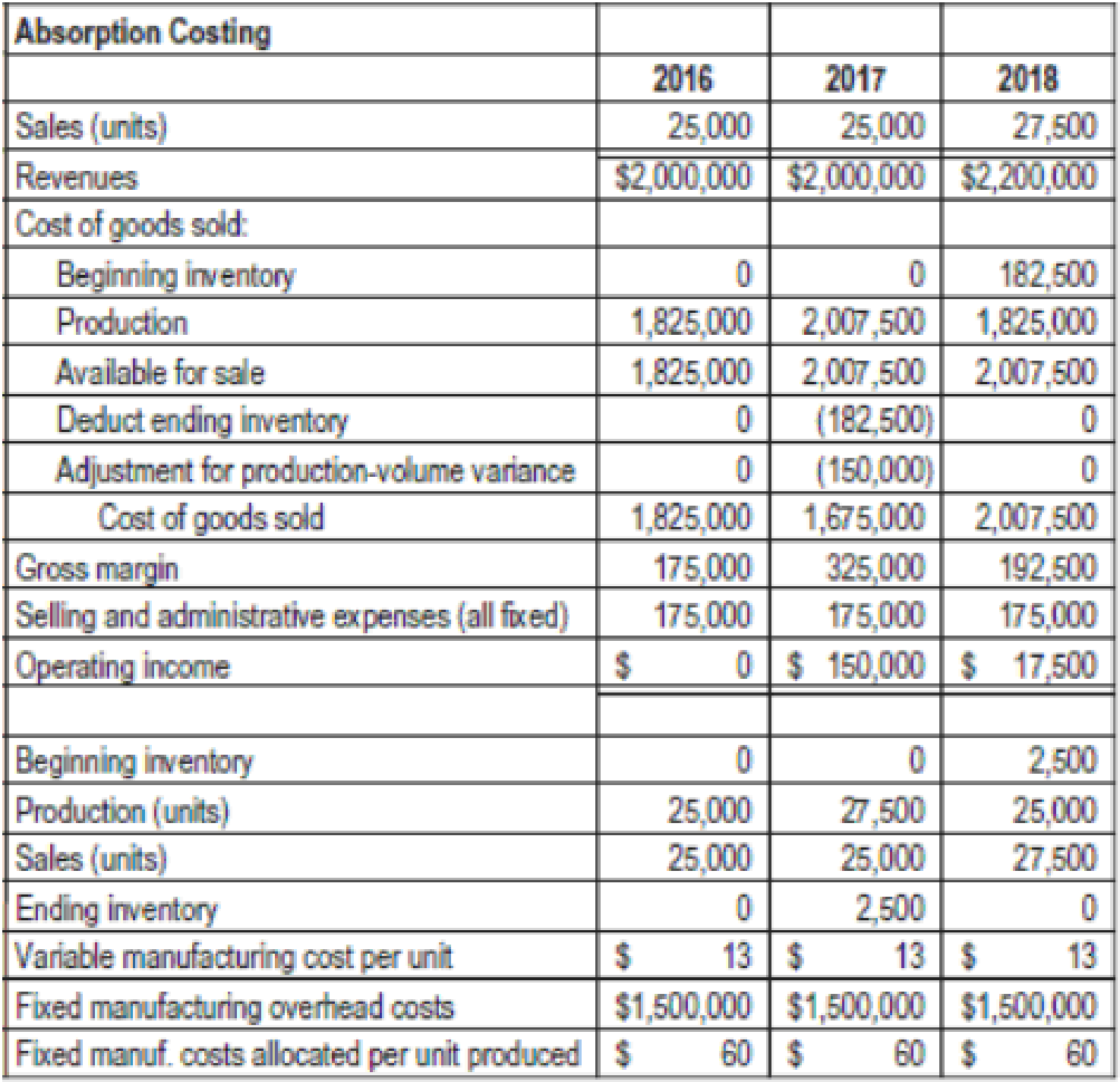

- 1. What denominator level is Candyland using to allocate fixed

manufacturing costs to the candy? How is Candyland disposing of any favorable or unfavorable production-volume variance at the end of the year? Explain your answer briefly. - 2. How did Candyland’s accountants arrive at the breakeven volume of 25,000 units?

- 3. Prepare a variable costing-based income statement for each year. Explain the variation in variable costing operating income for each year based on contribution margin per unit and sales volume.

- 4. Reconcile the operating incomes under variable costing and absorption costing for each year, and use this information to explain to Jack McCay the positive operating income in 2017 and the drop in operating income in 2018.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

- Determine the term being defined or described by the following statement: Evaluation of how income will change based on an alternative course of action. a. Differential analysis b. Opportunity cost c. Product cost distortion d. Sunk cost e. Theory of constraintsarrow_forwardAccount Que.arrow_forwardWhat is Jordan ROE? General accountingarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning