COST ACCOUNTING

16th Edition

ISBN: 9781323169261

Author: Horngren

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 9.23E

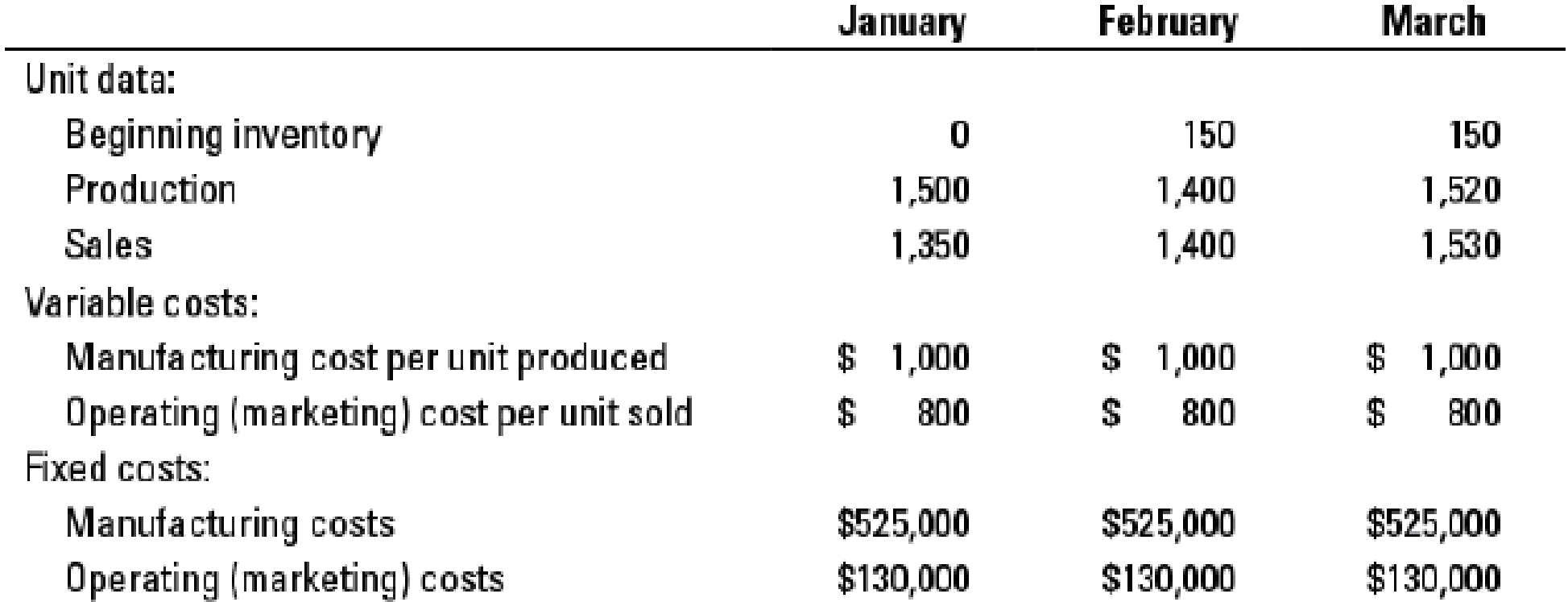

Variable and absorption costing, explaining operating-income differences. EntertainMe Corporation manufactures and sells 50-inch television sets and uses

The selling price per unit is $3,300. The budgeted level of production used to calculate the budgeted fixed

- 1. Prepare income statements for EntertainMe in January, February, and March 2017 under (a) variable costing and (b) absorption costing.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please give me true answer this financial accounting question

Can you please give me correct solution this general accounting question?

Michael McDowell Co. establishes a $108 million liability at the end of 2025 for the estimated site-cleanup costs at two of its manufacturing facilities. All related closing costs will be paid and deducted on the tax return in 2026. Also, at the end of 2025, the company has $54 million of temporary differences due to excess depreciation for tax purposes, $7.56 million of which will reverse in 2026.

The enacted tax rate for all years is 20%, and the company pays taxes of $34.56 million on $172.80 million of taxable income in 2025. McDowell expects to have taxable income in 2026.

Assuming that the only deferred tax account at the beginning of 2025 was a deferred tax liability of $5,400,000, draft the income tax expense portion of the income statement for 2025, beginning with the line "Income before income taxes." (Hint: You must first compute (1) the amount of temporary difference underlying the beginning $5,400,000 deferred tax liability, then (2) the amount of temporary differences…

Chapter 9 Solutions

COST ACCOUNTING

Ch. 9 - Differences in operating income between variable...Ch. 9 - Why is the term direct costing a misnomer?Ch. 9 - Do companies in either the service sector or the...Ch. 9 - Explain the main conceptual issue under variable...Ch. 9 - Companies that make no variable-cost/fixed-cost...Ch. 9 - The main trouble with variable costing is that it...Ch. 9 - Give an example of how, under absorption costing,...Ch. 9 - What are the factors that affect the breakeven...Ch. 9 - Critics of absorption costing have increasingly...Ch. 9 - What are two ways of reducing the negative aspects...

Ch. 9 - Prob. 9.11QCh. 9 - Describe the downward demand spiral and its...Ch. 9 - Will the financial statements of a company always...Ch. 9 - Prob. 9.14QCh. 9 - The difference between practical capacity and...Ch. 9 - In comparing the absorption and variable cost...Ch. 9 - Queen Sales, Inc. has just completed its first...Ch. 9 - King Tooling has produced and sold the following...Ch. 9 - The following information relates to Drexler Inc.s...Ch. 9 - Prob. 9.20MCQCh. 9 - Variable and absorption costing, explaining...Ch. 9 - Throughput costing (continuation of 9-21). The...Ch. 9 - Variable and absorption costing, explaining...Ch. 9 - Throughput costing (continuation of 9-23). The...Ch. 9 - Variable versus absorption costing. The Tomlinson...Ch. 9 - Absorption and variable costing. (CMA) Miami,...Ch. 9 - Absorption versus variable costing. Horace Company...Ch. 9 - Candyland uses standard costing to produce a...Ch. 9 - Capacity management, denominator-level capacity...Ch. 9 - Denominator-level problem. Thunder Bolt Inc., is a...Ch. 9 - Variable and absorption costing and breakeven...Ch. 9 - Variable costing versus absorption costing. The...Ch. 9 - Throughput Costing (continuation of 9-32) 1....Ch. 9 - Variable costing and absorption costing, the Z-Var...Ch. 9 - Comparison of variable costing and absorption...Ch. 9 - Effects of differing production levels on...Ch. 9 - Alternative denominator-level capacity concepts,...Ch. 9 - Motivational considerations in denominator-level...Ch. 9 - Denominator-level choices, changes in inventory...Ch. 9 - Variable and absorption costing and breakeven...Ch. 9 - Downward demand spiral. Market.com is about to...Ch. 9 - Absorption costing and production-volume...Ch. 9 - Operating income effects of denominator-level...Ch. 9 - Variable and absorption costing, actual costing....Ch. 9 - Prob. 9.45PCh. 9 - Cost allocation, responsibility accounting, ethics...Ch. 9 - Absorption, variable, and throughput costing....Ch. 9 - Costing methods and variances, comprehensive. Rob...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please answer the following requirements a and b on these general accounting questionarrow_forwardGeneral Accountingarrow_forwardHarper, Incorporated, acquires 40 percent of the outstanding voting stock of Kinman Company on January 1, 2023, for $210,000 in cash. The book value of Kinman's net assets on that date was $400,000, although one of the company's buildings, with a $60,000 carrying amount, was actually worth $100,000. This building had a 10-year remaining life. Kinman owned a royalty agreement with a 20-year remaining life that was undervalued by $85,000. Kinman sold Inventory with an original cost of $60,000 to Harper during 2023 at a price of $90,000. Harper still held $15,000 (transfer price) of this amount in Inventory as of December 31, 2023. These goods are to be sold to outside parties during 2024. Kinman reported a $40,000 net loss and a $20,000 other comprehensive loss for 2023. The company still manages to declare and pay a $10,000 cash dividend during the year. During 2024, Kinman reported a $40,000 net income and declared and paid a cash dividend of $12,000. It made additional inventory sales…arrow_forward

- Solve this general accounting question not use aiarrow_forwardPlease provide solution this general accounting questionarrow_forwardMichael McDowell Co. establishes a $108 million liability at the end of 2025 for the estimated site-cleanup costs at two of its manufacturing facilities. All related closing costs will be paid and deducted on the tax return in 2026. Also, at the end of 2025, the company has $54 million of temporary differences due to excess depreciation for tax purposes, $7.56 million of which will reverse in 2026. The enacted tax rate for all years is 20%, and the company pays taxes of $34.56 million on $172.80 million of taxable income in 2025. McDowell expects to have taxable income in 2026. Assuming that the only deferred tax account at the beginning of 2025 was a deferred tax liability of $5,400,000, draft the income tax expense portion of the income statement for 2025, beginning with the line "Income before income taxes." (Hint: You must first compute (1) the amount of temporary difference underlying the beginning $5,400,000 deferred tax liability, then (2) the amount of temporary differences…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY