Bundle: Accounting, Loose-Leaf Version, 26th + LMS Integrated for CengageNOW, 2 terms Printed Access Card

26th Edition

ISBN: 9781305715967

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 9.19EX

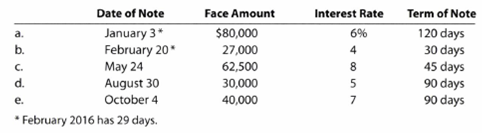

Determine due date and interest on notes

Determine the due date and the amount of interest due at maturity on the following notes dated in 2016:

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Can you help me with accounting questions

16 Financial Accounting

No AI ANSWER

Chapter 9 Solutions

Bundle: Accounting, Loose-Leaf Version, 26th + LMS Integrated for CengageNOW, 2 terms Printed Access Card

Ch. 9 - What are the three classifications of receivables?Ch. 9 - Dans Hardware is a small hardware store in the...Ch. 9 - What kind of an account (asset, liability, etc.)...Ch. 9 - After the accounts are adjusted and closed at the...Ch. 9 - A firm has consistently adjusted its allowance...Ch. 9 - Which of the two methods of estimating...Ch. 9 - Neptune Company issued a note receivable to...Ch. 9 - If a note provides for payment of principal of...Ch. 9 - The maker of a 240,000, 6%, 90-day note receivable...Ch. 9 - The note receivable dishonored in Discussion...

Ch. 9 - Prob. 9.1APECh. 9 - Direct write-off method Journalize the following...Ch. 9 - Allowance method Journalize the following...Ch. 9 - Allowance method Journalize the following...Ch. 9 - Percent of sales method At the end of the current...Ch. 9 - Percent of sales method At the end of the current...Ch. 9 - Analysis of receivables method At the end of the...Ch. 9 - Analysis of receivables method At the end of the...Ch. 9 - Note receivable Guzman Company received a 60-day,...Ch. 9 - Note receivable Prefix Supply Company received a...Ch. 9 - Prob. 9.6APECh. 9 - Prob. 9.6BPECh. 9 - Prob. 9.1EXCh. 9 - Nature of uncollectible accounts MGM Resorts...Ch. 9 - Entries for uncollectible accounts, using direct...Ch. 9 - Entries for uncollectible receivables, using...Ch. 9 - Entries to write off accounts receivable Creative...Ch. 9 - Providing for doubtful accounts At the end of the...Ch. 9 - Number of days past due Toot Auto Supply...Ch. 9 - Aging of receivables schedule The accounts...Ch. 9 - Estimating allowance for doubtful accounts Waddell...Ch. 9 - Adjustment for uncollectible accounts Using data...Ch. 9 - Estimating doubtful accounts Selbys Bike Co. is a...Ch. 9 - Entry for uncollectible accounts Using the data in...Ch. 9 - Entries for bad debt expense under the direct...Ch. 9 - Entries for bad debt expense under the direct...Ch. 9 - Effect of doubtful accounts on net income During...Ch. 9 - Effect of doubtful accounts on net income Using...Ch. 9 - Entries for bad debt expense under the direct...Ch. 9 - Entries for bad debt expense under the direct...Ch. 9 - Determine due date and interest on notes Determine...Ch. 9 - Entries for notes receivable Master Designs...Ch. 9 - Entries for notes receivable The series of seven...Ch. 9 - Entries for notes receivable, including year-end...Ch. 9 - Entries for receipt and dishonor of note...Ch. 9 - Entries for receipt and dishonor of notes...Ch. 9 - Prob. 9.25EXCh. 9 - Accounts receivable turnover and days sales in...Ch. 9 - Prob. 9.27EXCh. 9 - Prob. 9.28EXCh. 9 - Prob. 9.29EXCh. 9 - Entries related to uncollectible accounts The...Ch. 9 - Aging of receivables; estimating allowance for...Ch. 9 - Compare two methods of accounting for...Ch. 9 - Details of notes receivable and related entries...Ch. 9 - Notes receivable entries The following data relate...Ch. 9 - Sales and notes receivable transactions The...Ch. 9 - Entries related to uncollectible accounts The...Ch. 9 - Aging of receivables; estimating allowance for...Ch. 9 - Compare two methods of accounting for...Ch. 9 - Details of notes receivable and related entries...Ch. 9 - Notes receivable entries The following data relate...Ch. 9 - Sales and notes receivable transactions The...Ch. 9 - Prob. 9.1CPCh. 9 - Estimate uncollectible accounts For several years,...Ch. 9 - Prob. 9.3CPCh. 9 - Prob. 9.4CPCh. 9 - Accounts receivable turnover and days sales in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Comprehensive income would be?arrow_forwardGloble Ltd. incurs a $18 per pound cost to produce Product A, which it then sells for $28 per pound. The company can further process Product A to produce Product B. Product B would sell for $34 per pound and would require an additional cost of $12 per pound to be produced. The differential revenue of producing Product B is _. answerarrow_forwardAns ? Financial accountingarrow_forward

- Please give me answer general accounting questionarrow_forwardGloble Ltd. incurs a $18 per pound cost to produce Product A, which it then sells for $28 per pound. The company can further process Product A to produce Product B. Product B would sell for $34 per pound and would require an additional cost of $12 per pound to be produced. The differential revenue of producing Product B is _.arrow_forwardGeneral Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

7.2 Ch 7: Notes Payable and Interest, Revenue recognition explained; Author: Accounting Prof - making it easy, The finance storyteller;https://www.youtube.com/watch?v=wMC3wCdPnRg;License: Standard YouTube License, CC-BY