Concept explainers

Adjustment for uncollectible accounts

Using data in Exercise 9-9, assume that the allowance for doubtful accounts for Waddell Industries has a credit balance of $6,350 before adjustment on August 31. Journalize the

Reference:

EX 9-9 Estimating allowance for doubtful accounts OBJ. 4

Waddell Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8.

| Age Class | Percent Uncollectible |

| Not past due | 3% |

| 1-30 days past due | 4 |

| 31-60 days past due | 15 |

| 61-90 days past due | 35 |

| Over 90 days past due | 80 |

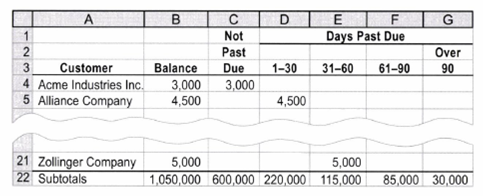

EX 9-8 Aging of receivables schedule OBJ. 4

The

The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals:

| Customer | Balance | Due Date |

| Builders Industries | $44,500 | May 1 |

| Elkhorn Company | 21,000 | June 20 |

| Granite Creek Inc. | 7,500 | July 13 |

| Lockwood Company | 14,000 | September 9 |

| Teton Company | 13,000 | August 7 |

a. Determine the number of days past due for each of the preceding accounts as of August 31.

b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.

Trending nowThis is a popular solution!

Chapter 9 Solutions

Custom Bundle: Accounting, Loose-leaf Version, 26th + Working Papers, Chapters 1-17, 26th Edition

- Answer? ? Financial accounting questionarrow_forwardJob H85 was ordered by a customer on September 25. During the month of September, Jaycee Corporation requisitioned $3,300 of direct materials and used $4,700 of direct labor. The job was not finished by the end of the month but needed an additional $3,200 of direct materials and additional direct labor of $7,400 to finish the job in October. The company applies overhead at the end of each month at a rate of 100% of the direct labor cost incurred. What is the total cost of the job when it is completed in October?arrow_forwardWhat is the correct option? ? General Accounting questionarrow_forward

- Genral accountarrow_forwardI want to correct answer accounting questionsarrow_forwardDifferential Chemical produced 18,000 gallons of Preon and 39,000 gallons of Paron. Joint costs incurred in producing the two products totaled $8,500. At the split-off point, Preon has a market value of $11 per gallon and Paron $3.5 per gallon. Compute the portion of the joint costs to be allocated to Preon if the value basis is used. Accurate Answerarrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage