Concept explainers

JOURNALIZING AND POSTING PAYROLL ENTRIES Oxford Company has five employees, All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31.

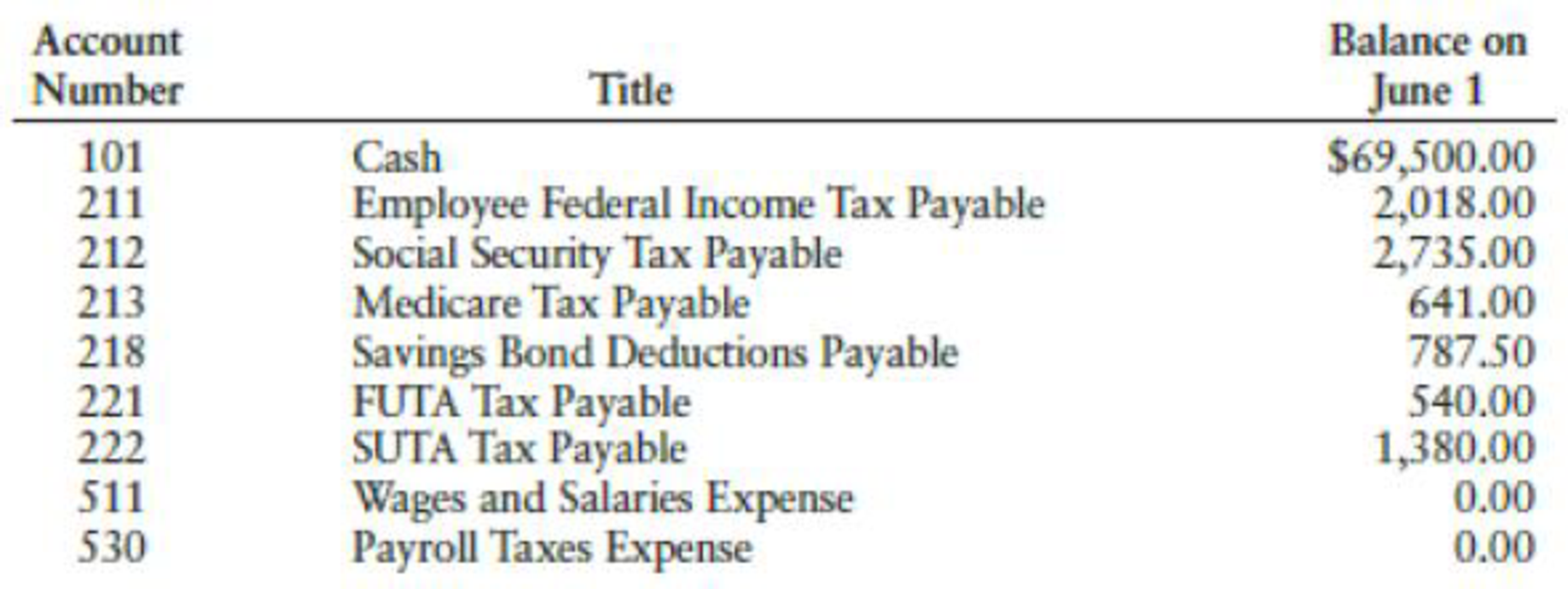

The accounts kept by Oxford Company include the following:

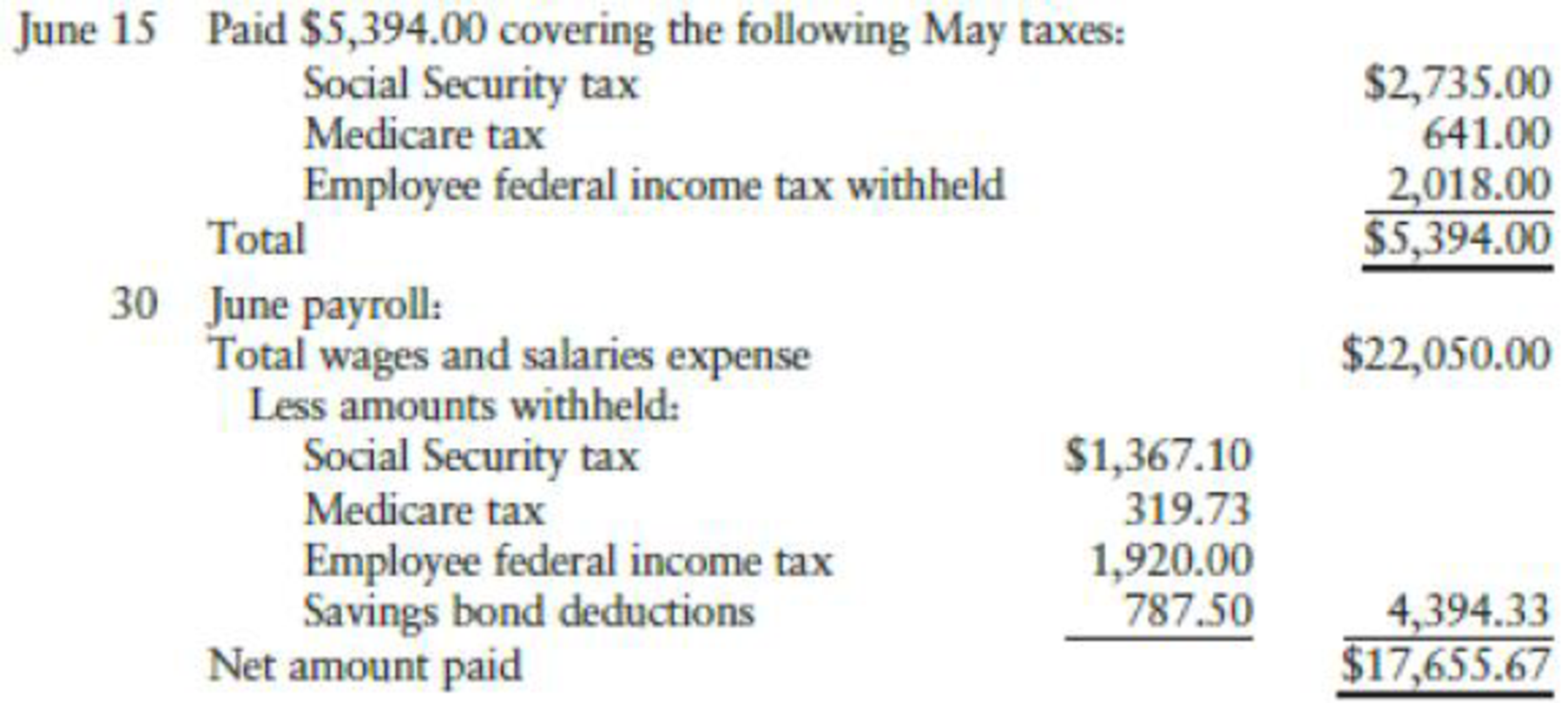

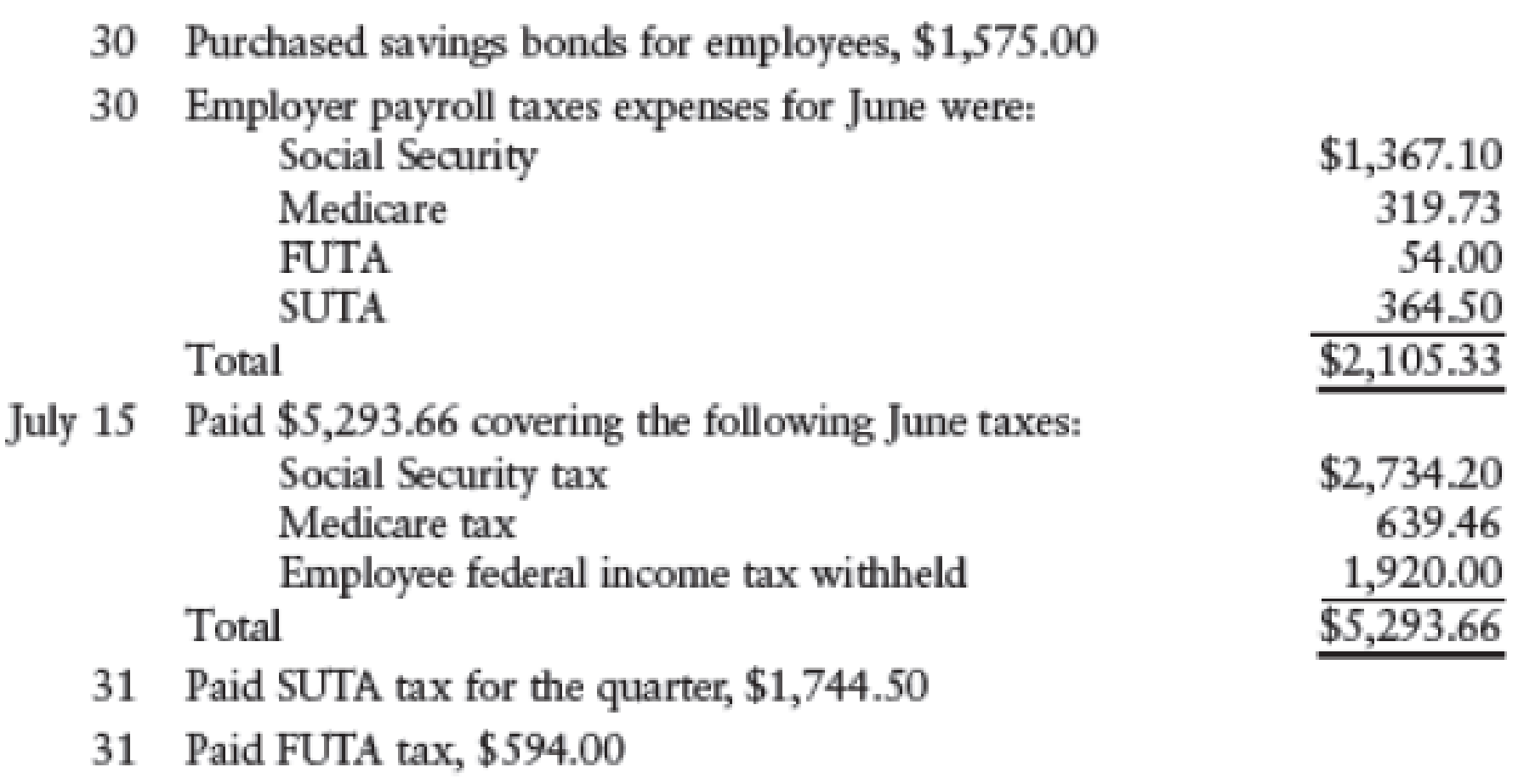

The following transactions relating to payrolls and payroll taxes occurred during June and July:

REQURED

- 1. Journalize the preceding transactions using a general journal.

- 2. Open Τ accounts for the payroll expenses and liabilities. Enter the beginning balances and post the transactions recorded in the journal.

1.

Prepare journal entry to record the given transactions.

Explanation of Solution

Payroll tax:

Payroll tax refers to the tax that are equally contributed by employees and employer based on the salary and wages of an employee. Payroll tax includes taxes like federal tax, local income tax, state tax, social security tax and federal and state unemployment tax.

Prepare journal entry to record the payment of payroll tax of May on June 15.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| June 15 | Employee Federal income tax payable | 211 | 2,018.00 | |

| FICA-Social Security taxes payable | 212 | 2,735.00 | ||

| FICA-Medicare Taxes payable | 213 | 641.00 | ||

| Cash | 101 | 5,394.00 | ||

| (To record the deposit of employee federal income tax and Social security and Medicare taxes) |

Table (1)

- Employee federal income tax payable is a liability and it is decreased. Hence, debit employee federal income tax payable by $2,018.00.

- FICA tax – social and security tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – social and security tax payable by $2,735.00.

- FICA tax – medical tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – medical tax payable by $641.00.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $5,394.00.

Prepare journal entry to record the June payroll.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| June 30 | Wages and Salaries expense | 511 | 22,050.00 | |

| Employee federal income tax payable | 211 | 1,920.00 | ||

| FICA-Social Security taxes payable | 212 | 1,367.10 | ||

| FICA-Medicare Taxes payable | 213 | 319.73 | ||

| Savings bonds deductions payable | 218 | 787.50 | ||

| Cash | 101 | 17,655.67 | ||

| (To record the payroll for the week ended June 30) |

Table (2)

- Wages and Salaries expense is an expense account and it is increased. Hence, debit wages and salaries expense with $22,050.00.

- Employee Federal income tax payable is a liability and there is an increase in the value of liability. Hence, credit the employee Federal income tax payable by $1,920.00.

- FICA tax – social and security tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – social and security tax payable by $1,367.10.

- FICA tax – medical tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – medical tax payable by $319.73.

- Savings bonds deductions payable is a liability and it is increased. Hence, credit savings bonds deductions payable by $787.50.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $17,655.67.

Prepare journal entry to record the purchase of bonds for employees.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| June 30 | Savings bonds deductions payable | 218 | 1,575.00 | |

| Cash | 101 | 1,575.00 | ||

| (To record the purchase of U.S savings bonds for employees.) |

Table (3)

- Savings bonds deductions payable is a liability and it is decreased. Hence, debit savings bonds deductions payable by $1,575.00.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $1,575.00.

Prepare journal entry to record the employer payroll tax expense.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| June 30 | Payroll tax expense | 530 | 2,105.33 | |

| FICA-Social Security taxes payable | 212 | 1,367.10 | ||

| FICA-Medicare Taxes payable | 213 | 319.73 | ||

| FUTA tax payable | 221 | 54.00 | ||

| SUTA tax payable | 222 | 364.50 | ||

| (To record the employer payroll taxes expense) |

Table (4)

- Payroll taxes expense is an expense account and it is increased. Hence, debit payroll taxes expense with $2,105.33.

- FICA tax – social and security tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – social and security tax payable by $1,367.10.

- FICA tax – medical tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – medical tax payable by $319.73.

- FUTA tax payable is a liability and it is increased. Hence, credit FUTA tax payable by $54.00.

- SUTA tax payable is a liability and it is increased. Hence, credit SUTA tax payable by $364.50.

Prepare journal entry to record the payment of June taxes.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| July 15 | Employee Federal income tax payable | 211 | 1,920.00 | |

| FICA-Social Security taxes payable | 212 | 2,734.20 | ||

| FICA-Medicare Taxes payable | 213 | 639.46 | ||

| Cash | 101 | 5,293.66 | ||

| (To record the deposit of employee federal income tax and Social security and Medicare taxes) |

Table (5)

- Employee federal income tax payable is a liability and it is decreased. Hence, debit employee federal income tax payable by $1,920.00.

- FICA tax – social and security tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – social and security tax payable by $2,734.20.

- FICA tax – medical tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – medical tax payable by $639.46.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $5,293.66.

Prepare journal entry to record the payment of SUTA tax.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| July 31 | SUTA tax payable | 222 | 1,744.50 | |

| Cash | 101 | 1,744.50 | ||

| (To record the payment of SUTA tax) |

Table (6)

- SUTA tax payable is a liability and it is decreased. Hence, debit SUTA tax payable by $1,744.50.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $1,744.50.

Prepare journal entry to record the payment of FUTA tax.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| July 31 | FUTA tax payable | 221 | 594 | |

| Cash | 101 | 594 | ||

| (To record the payment of FUTA tax) |

Table (7)

- FUTA tax payable is a liability and it is decreased. Hence, debit FUTA tax payable by $594.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $594.

2.

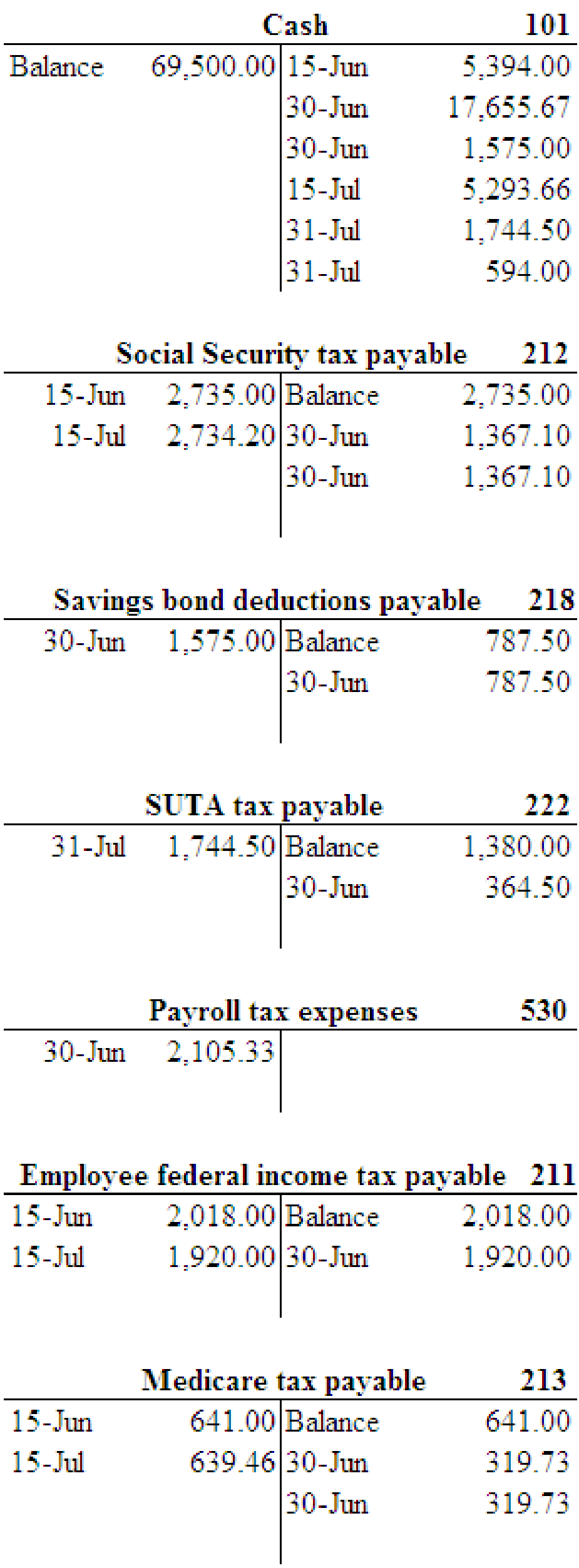

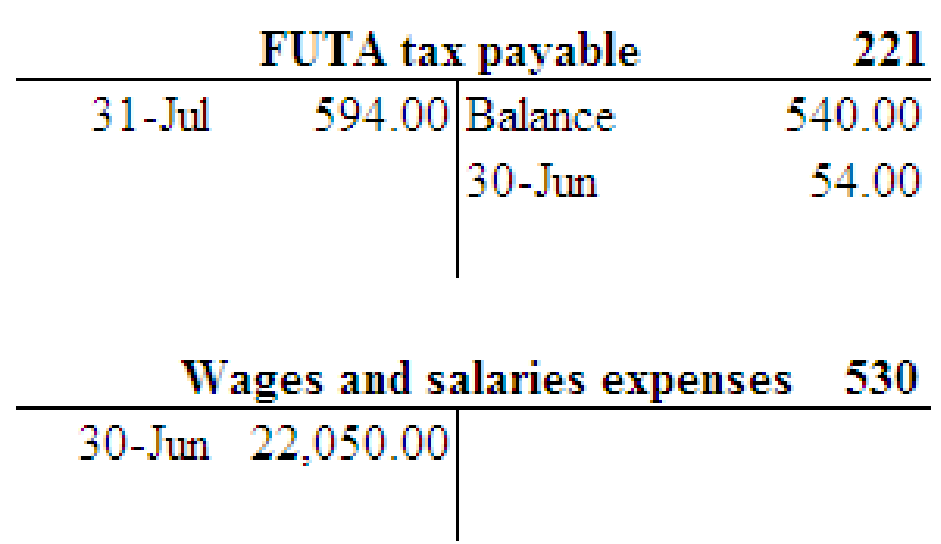

Prepare T-Account for the payroll expenses and liabilities.

Explanation of Solution

Prepare T-Account for the payroll expenses and liabilities.

Want to see more full solutions like this?

Chapter 9 Solutions

Bundle: College Accounting, Chapters 1-15, Loose-Leaf Version, 22nd + LMS Integrated for CengageNOWv2, 1 term Printed Access Card

- What Is the correct answer A B ?? General Accounting questionarrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardAccounting questionarrow_forward

- Determine the cost of the patent.arrow_forwardAccounting questionarrow_forwardMs. Sharon Washton was born 26 years ago in Bahn, Germany. She is the daughter of a Canadian High Commissioner serving in that country. However, Ms. Washton is now working in Prague, Czech Republic. The only income that she earns in the year is from her Prague marketing job, $55,000 annually, and is subject to income tax in Czech Republic. She has never visited Canada. Determine the residency status of Sharon Washtonarrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning