Concept explainers

JOURNALIZING AND POSTING PAYROLL ENTRIES Cascade Company has four employees. All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31.

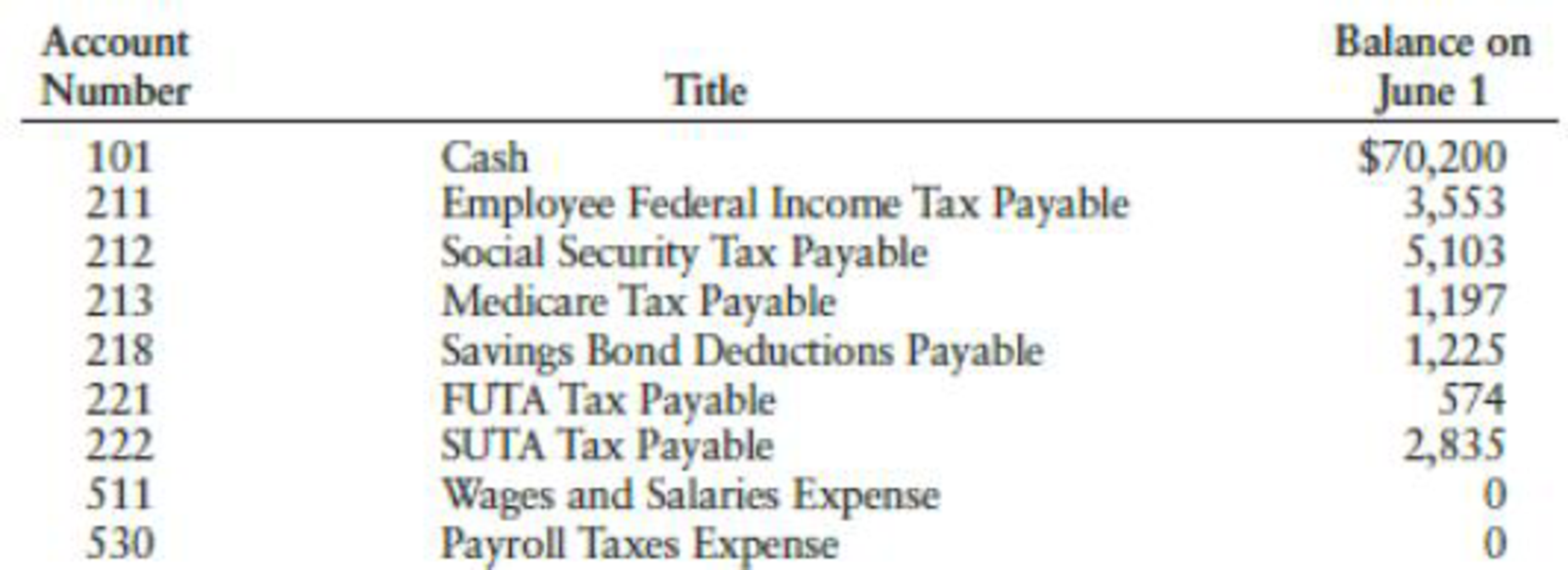

The accounts kept by Cascade include the following:

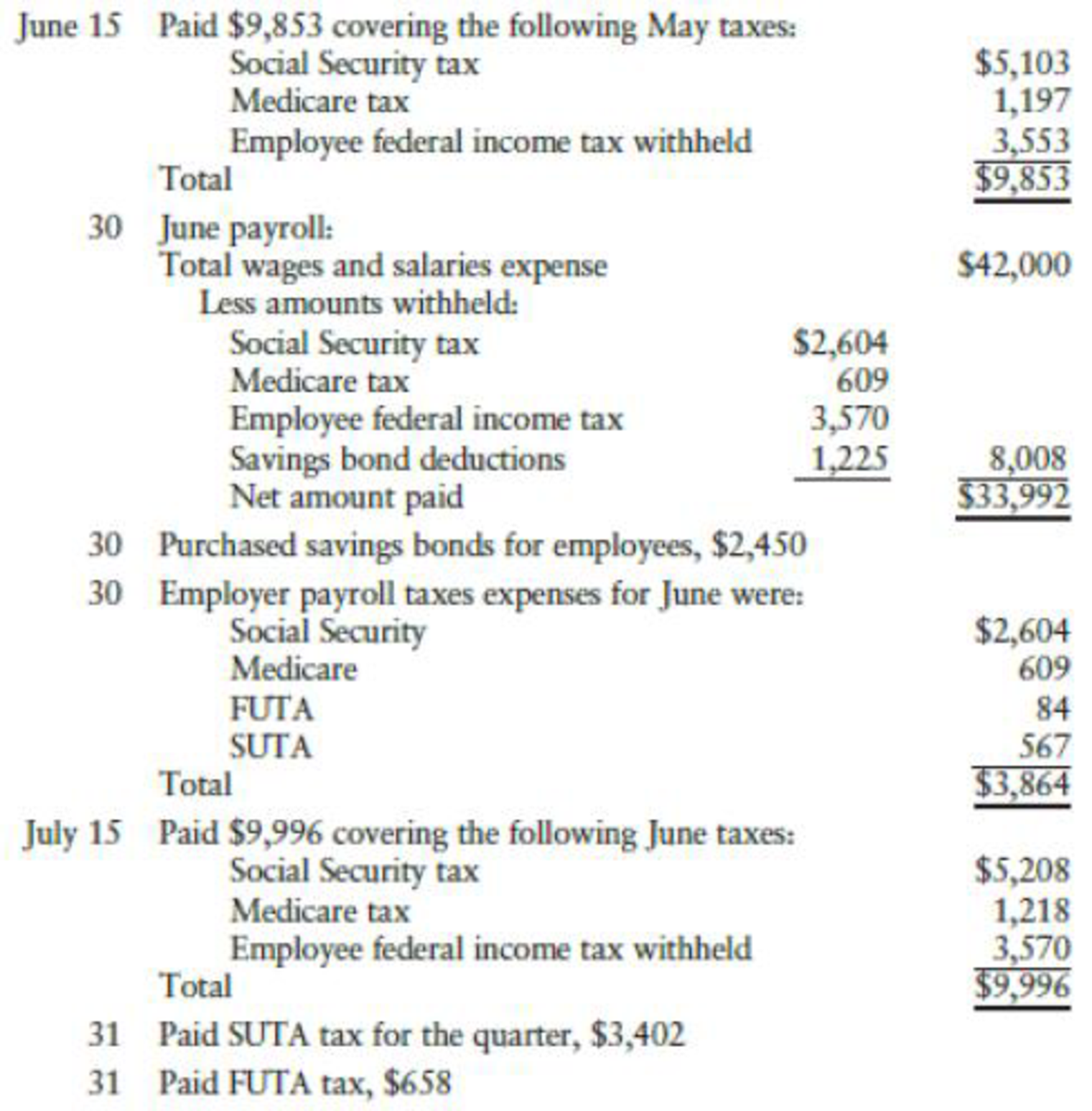

The following transactions relating to payrolls and payroll taxes occurred during June and July:

REQUIRED

- 1. Journalize the preceding transactions using a general journal.

- 2. Open Τ accounts for the payroll expenses and liabilities. Enter the beginning balances and post the transactions recorded in the journal.

1.

Prepare journal entry to record the given transactions.

Explanation of Solution

Payroll tax:

Payroll tax refers to the tax that are equally contributed by employees and employer based on the salary and wages of an employee. Payroll tax includes taxes like federal tax, local income tax, state tax, social security tax and federal and state unemployment tax.

Prepare journal entry to record the payment of payroll tax of May on June 15.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| June 15 | Employee Federal income tax payable | 211 | 3,553 | |

| FICA-Social Security taxes payable | 212 | 5,103 | ||

| FICA-Medicare Taxes payable | 213 | 1,197 | ||

| Cash | 101 | 9,853 | ||

| (To record the deposit of employee federal income tax and Social security and Medicare taxes) |

Table (1)

- Employee federal income tax payable is a liability and it is decreased. Hence, debit employee federal income tax payable by $3,553.

- FICA tax – social and security tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – social and security tax payable by $5,103.

- FICA tax – medical tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – medical tax payable by $1,197.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $9,853.

Prepare journal entry to record the June payroll.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| June 30 | Wages and Salaries expense | 511 | 42,000 | |

| Employee federal income tax payable | 211 | 3,570 | ||

| FICA-Social Security taxes payable | 212 | 2,604 | ||

| FICA-Medicare Taxes payable | 213 | 609 | ||

| Savings bonds deductions payable | 218 | 1,225 | ||

| Cash | 101 | 33,992 | ||

| (To record the payroll for the week ended June 30) |

Table (2)

- Wages and Salaries expense is an expense account and it is increased. Hence, debit wages and salaries expense with $42,000

- Employee Federal income tax payable is a liability and there is an increase in the value of liability. Hence, credit the employee Federal income tax payable by $3,570.

- FICA tax – social and security tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – social and security tax payable by $2,604.

- FICA tax – medical tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – medical tax payable by $609.

- Savings bonds deductions payable is a liability and it is increased. Hence, credit savings bonds deductions payable by $1,225.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $33,992.

Prepare journal entry to record the purchase of bonds for employees.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| June 30 | Savings bonds deductions payable | 218 | 2,450 | |

| Cash | 101 | 2,450 | ||

| (To record the purchase of U.S savings bonds for employees.) |

Table (3)

- Savings bonds deductions payable is a liability and it is decreased. Hence, debit savings bonds deductions payable by $2,450.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $2,450.

Prepare journal entry to record the employer payroll tax expense.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| June 30 | Payroll tax expense | 530 | 3,864 | |

| FICA-Social Security taxes payable | 212 | 2,604 | ||

| FICA-Medicare Taxes payable | 213 | 609 | ||

| FUTA tax payable | 221 | 84 | ||

| SUTA tax payable | 222 | 567 | ||

| (To record the employer payroll taxes expense) |

Table (4)

- Payroll taxes expense is an expense account and it is increased. Hence, debit payroll taxes expense with $3,864.

- FICA tax – social and security tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – social and security tax payable by $2,604.

- FICA tax – medical tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – medical tax payable by $609.

- FUTA tax payable is a liability and it is increased. Hence, credit FUTA tax payable by $84.

- SUTA tax payable is a liability and it is increased. Hence, credit SUTA tax payable by $567.

Prepare journal entry to record the payment of June taxes.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| July 15 | Employee Federal income tax payable | 211 | 3,570 | |

| FICA-Social Security taxes payable | 212 | 5,208 | ||

| FICA-Medicare Taxes payable | 213 | 1,218 | ||

| Cash | 101 | 9,996 | ||

| (To record the deposit of employee federal income tax and Social security and Medicare taxes) |

Table (5)

- Employee federal income tax payable is a liability and it is decreased. Hence, debit employee federal income tax payable by $3,570.

- FICA tax – social and security tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – social and security tax payable by $5,208.

- FICA tax – medical tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – medical tax payable by $1,218.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $9,996.

Prepare journal entry to record the payment of SUTA tax.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| July 31 | SUTA tax payable | 222 | 3,402 | |

| Cash | 101 | 3,402 | ||

| (To record the payment of SUTA tax) |

Table (6)

- SUTA tax payable is a liability and it is decreased. Hence, debit SUTA tax payable by $3,402.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $3,402.

Prepare journal entry to record the payment of FUTA tax.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| July 31 | FUTA tax payable | 221 | 658 | |

| Cash | 101 | 658 | ||

| (To record the payment of FUTA tax) |

Table (7)

- FUTA tax payable is a liability and it is decreased. Hence, debit FUTA tax payable by $658.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $658.

2.

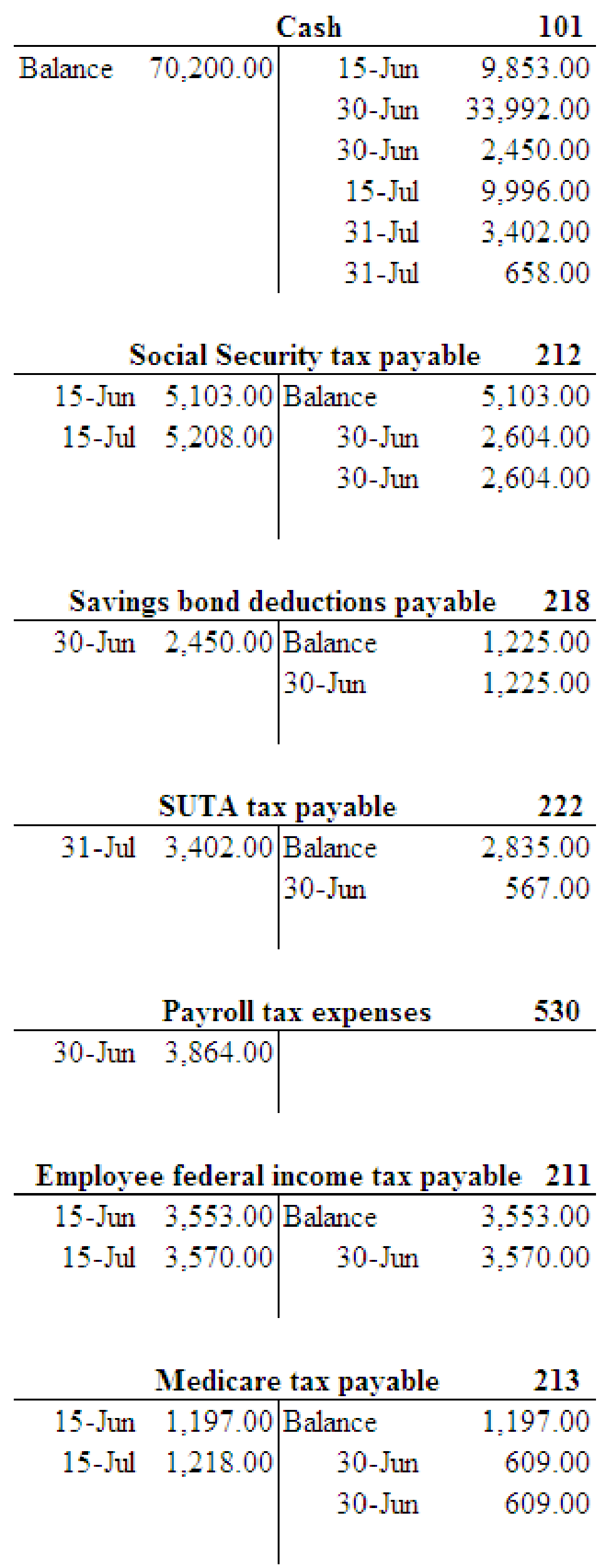

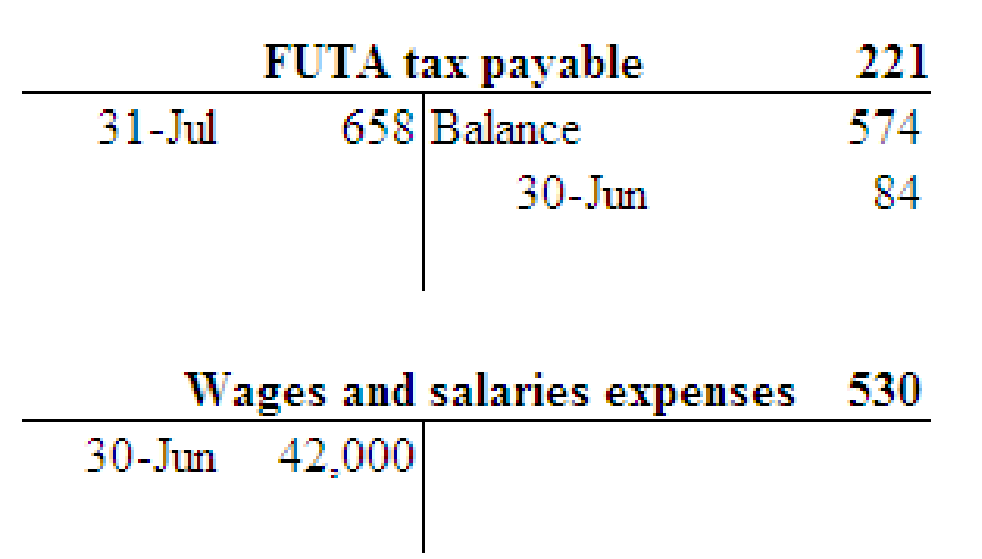

Prepare T-Account for the payroll expenses and liabilities.

Explanation of Solution

Prepare T-Account for the payroll expenses and liabilities.

Want to see more full solutions like this?

Chapter 9 Solutions

Bundle: College Accounting, Chapters 1-9, Loose-Leaf Version, 22nd + LMS Integrated for CengageNOWv2, 2 terms Printed Access Card for Heintz/Parry's College Accounting, Chapters 1-27, 22nd

- California Industries, Inc. borrowed $300,000 at 12% interest on January 1, 2025, for the construction of their new headquarters. Construction began on January 1, 2025, and concluded on December 31, 2025. In addition to the construction loan, California Industries provided the following data: Expenditures: June 1 $500,000 (7 months: 0.58) July 1 $500,000 (6 months:0.50) December 1 $1,000,000 (1 month: 0.08) Other Debt: 10-year, 13% Bond for $4,000,000, dated December 31, 2018* ó-year, 10% Note for $1,600,000, dated December 31, 2022 WHAT IS THEIR AVOIDABLE INTEREST? $24,000 $74,400 $36,000 $30,250arrow_forwardPlease provide solution these financial Accounting Questionarrow_forwardCalifornia Industries, Inc. borrowed $300,000 at 12% interest on January 1, 2025, for the construction of their new headguarters. Construction began on January 1, 2025, and concluded on December 31, 2025. In addition to the construction loan, California Industries provided the following data: Expenditures: June 1 $500,000 (7 months: 0.58) July 1 $500,000 (6 months: 0.50) December 1 $1,000,000 (1 month: 0.08) Other Debt: 10-year, 13% Bond for $4,000,000, dated December 31, 2018 6-year, 10% Note for $1,600,000, dated December 31, 2022 WHAT IS THE WEIGHTED AVERAGE EXPENSES? $540,000 $80,000 $620,000 $250,000arrow_forward

- Non-cash related transactions ARE required to be disclosed on the face of the financials and/or in the footnotes to those statements. Which financial statement shows the non-cash transactions and/or directs financial statement users to see the related footnote for additional details? Income Statement Balance Sheet Statement of Cash Flows Statement of Retained Earningsarrow_forwardGeneral Accountingarrow_forwardI won't to this question answer general Accounting not use aiarrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub