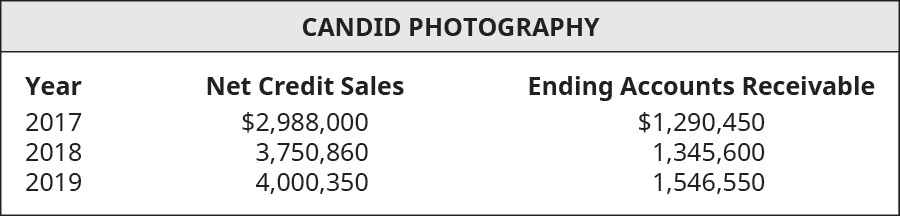

Problem 1MC: Which of the following is not a criterion to recognize revenue under GAAP? A. The earnings process... Problem 2MC: Which of the following best represents the matching principle criteria? A. Expenses are reported in... Problem 3MC: If a customer pays with a credit card and the service has been provided, which of the following... Problem 4MC: A car dealership sells a car to a customer for $35,000. The customer makes a 10% down payment, and... Problem 5MC: Tines Commerce computes bad debt based on the allowance method. They determine their current years... Problem 6MC: Doer Company reports year-end credit sales in the amount of $390,000 and accounts receivable of... Problem 7MC: Balloons Plus computes bad debt based on the allowance method. They determine their current years... Problem 8MC: Conner Pride reports year-end credit sales in the amount of $567,000 and accounts receivable of... Problem 9MC: Which method delays recognition of bad debt until the specific customer accounts receivable is... Problem 10MC: Which of the following estimation methods considers the amount of time past due when computing bad... Problem 11MC: Which of the following best represents a positive product of a lower number of days sales in... Problem 12MC: South Rims has an accounts receivable balance at the end of 2018 of $357,470. The net credit sales... Problem 13MC: What information can best be elicited from a receivable ratio? A. company performance with current... Problem 14MC: Ancient Grains Unlimited has an accounts receivable turnover ratio of 3.34 times. The net credit... Problem 15MC: Which of the following is not a way to manage earnings? A. Change the method for bad debt... Problem 16MC: Which of the following is true about earnings management? A. It works within the constraints of... Problem 17MC: Which statement is most directly affected by a change to net income? A. balance sheet B. income... Problem 18MC: Michelle Company reports $345,000 in credit sales and $267,500 in accounts receivable at the end of... Problem 19MC: Which of the following is true of a maturity date? A. It must be calculated in days, not in months... Problem 20MC: Mark Industries issues a note in the amount of $45,000 on August 1, 2018 in exchange for the sale of... Problem 21MC: A customer takes out a loan of $130,000 on January 1, with a maturity date of 36 months, and an... Problem 22MC: A company collects an honored note with a maturity date of 24 months from establishment, a 10%... Problem 23MC: Orion Rentals is unable to collect on a note worth $25,000 and has accumulated interest of $250. It... Problem 1Q: What is the matching principle? Problem 2Q: A beverage wholesale outlet sells beverages by the case. On April 13, a customer purchased 18 cases... Problem 3Q: On January 1, a flower shop contracts with customers to provide flowers for their wedding on June 2.... Problem 4Q: American Signs allows customers to pay with their Jones credit card and cash. Jones charges American... Problem 5Q: Which account type is used to record bad debt estimation and is a contra account to Accounts... Problem 6Q: Earrings Depot records bad debt using the allowance, balance sheet method. They recorded $97,440 in... Problem 7Q: Racing Adventures records bad debt using the allowance, income statement method. They recorded... Problem 8Q: Aron Larson is a customer of Bank Enterprises. Mr. Larson took out a loan in the amount of $120,000... Problem 9Q: The following accounts receivable information pertains to Growth Markets LLC. What is the total... Problem 10Q: What are bad debts? Problem 11Q: What are some possible negative signals when the product of the accounts receivable turnover ratio... Problem 12Q: Berry Farms has an accounts receivable balance at the end of 2018 of $425,650. The net credit sales... Problem 13Q: What are the two most common receivables ratios, and what do these ratios tell a stakeholder about... Problem 14Q: What is the difference between earnings management and earnings manipulation? Problem 15Q: What is an earnings management benefit from showing a reduced figure for bad debt expense? Problem 16Q: Angelos Outlet used to report bad debt using the balance sheet method and is now switching to the... Problem 17Q: What is an earnings management benefit from showing an increased figure for bad debt expense? Problem 18Q: What are the two methods of revenue recognition for long-term construction projects? Problem 19Q: What is the installment method? Problem 20Q: What is a possible ramification of deferred revenue reporting? Problem 21Q: What is the completed contract method? Problem 22Q: What is the percentage of completion method? Problem 23Q: British Imports is unable to collect on a note worth $215,000 that has accumulated interest of $465.... Problem 24Q: Chemical Enterprises issues a note in the amount of $156,000 to a customer on January 1, 2018. Terms... Problem 25Q: What is the principal of a note? Problem 26Q: A customer was unable to pay the accounts receivable on time in the amount of $34,000. The customer... Problem 27Q: What are three differences between accounts receivable and notes receivable? Problem 1EA: Prepare journal entries for the following transactions from Restaurant Depot. Problem 2EA: Prepare journal entries for the following transactions from Cars Plus. Problem 3EA: Consider the following transaction: On March 6, Fun Cards sells 540 card decks with a sales price of... Problem 4EA: Window World extended credit to customer Nile Jenkins in the amount of $130,900 for his purchase of... Problem 5EA: Millennium Associates records bad debt using the allowance, income statement method. They recorded... Problem 6EA: Millennium Associates records bad debt using the allowance, balance sheet method. They recorded... Problem 7EA: The following accounts receivable information pertains to Marshall Inc. Determine the estimated... Problem 8EA: Using the following select financial statement information from Black Water Industries, compute the... Problem 9EA: Using the following select financial statement information from Black Water Industries, compute the... Problem 10EA: Millennial Manufacturing has net credit sales for 2018 in the amount of $1,433,630, beginning... Problem 11EA: Mirror Mart uses the balance sheet aging method to account for uncollectible debt on receivables.... Problem 12EA: Aerospace Electronics reports $567,000 in credit sales for 2018 and $632,500 in 2019. They have a... Problem 13EA: Dortmund Stockyard reports $896,000 in credit sales for 2018 and $802,670 in 2019. It has a $675,000... Problem 14EA: Arvan Patel is a customer of Banks Hardware Store. For Mr. Patels latest purchase on January 1,... Problem 15EA: Resin Milling issued a $390,500 note on January 1, 2018 to a customer in exchange for merchandise.... Problem 16EA: Mystic Magic issued a $120,250 note on January 1, 2018 to a customer, Amy Arnold, in exchange for... Problem 1EB: Prepare journal entries for the following transactions from Movie Mart. Problem 2EB: Prepare journal entries for the following transactions from Angled Pictures. Problem 3EB: Consider the following transaction: On February 15, Darling Dolls sells 110 dolls with a sales price... Problem 4EB: Laminate Express extended credit to customer Amal Sunderland in the amount of $244,650 for his... Problem 5EB: Olena Mirrors records bad debt using the allowance, income statement method. They recorded $343,160... Problem 6EB: Olena Mirrors records bad debt using the allowance, balance sheet method. They recorded $343,160 in... Problem 7EB: The following accounts receivable information pertains to Envelope Experts. Determine the estimated... Problem 8EB: Using the following select financial statement information from Mover Supply Depot, compute the... Problem 9EB: Using the following select financial statement information from Mover Supply Depot, compute the... Problem 10EB: Starlight Enterprises has net credit sales for 2019 in the amount of $2,600,325, beginning accounts... Problem 11EB: Outpost Designs uses the balance sheet aging method to account for uncollectible debt on... Problem 12EB: Clovis Enterprises reports $845,500 in credit sales for 2018 and $933,000 in 2019. It has a $758,000... Problem 13EB: Fortune Accounting reports $1,455,000 in credit sales for 2018 and $1,678,430 in 2019. It has an... Problem 14EB: Anderson Air is a customer of Handler Cleaning Operations. For Anderson Airs latest purchase on... Problem 15EB: Rain T-Shirts issued a $440,600 note on January 1, 2018 to a customer, Larry Potts, in exchange for... Problem 16EB: Element Surfboards issued a $210,800 note on January 1, 2018 to a customer, Leona Marland, in... Problem 1PA: Prepare journal entries for the following transactions from Barrels Warehouse. Problem 2PA: Prepare journal entries for the following transactions of Dulce Delights. Problem 3PA: Prepare journal entries for the following transactions from Forest Furniture. Problem 4PA: Jars Plus recorded $861,430 in credit sales for the year and $488,000 in accounts receivable. The... Problem 5PA: The following accounts receivable information pertains to Luxury Cruises. A. Determine the estimated... Problem 6PA: Funnel Direct recorded $1,345,780 in credit sales for the year and $695,455 in accounts receivable.... Problem 7PA: Review the select information for Bean Superstore and Legumes Plus (industry competitors), and then... Problem 8PA: The following select financial statement information from Candid Photography. Compute the accounts... Problem 9PA: Noren Company uses the balance sheet aging method to account for uncollectible debt on receivables.... Problem 10PA: Elegant Universal uses the balance sheet aging method to account for uncollectible debt on... Problem 11PA: Record journal entries for the following transactions of Telesco Enterprises. Problem 12PA: Record journal entries for the following transactions of Wind Solutions. Problem 13PA: Record journal entries for the following transactions of Commissary Productions. Problem 14PA: Record journal entries for the following transactions of Piano Wholesalers. Problem 15PA: Organics Plus is considering which bad debt estimation method works best for its company. It is... Problem 1PB: Prepare journal entries for the following transactions from Lumber Wholesale. Problem 2PB: Prepare journal entries for the following transactions of Maritime Memories. Problem 3PB: Prepare journal entries for the following transactions from School Mart. Problem 4PB: Bristax Corporation recorded $1,385,660 in credit sales for the year, and $732,410 in accounts... Problem 5PB: The following accounts receivable information pertains to Select Distributors. A. Determine the... Problem 6PB: Ink Records recorded $2,333,898 in credit sales for the year and $1,466,990 in accounts receivable.... Problem 7PB: Review the select information for Liquor Plaza and Beer Buddies (industry competitors) and complete... Problem 8PB: The following select financial statement information from Vortex Computing. Compute the accounts... Problem 9PB: Elegant Linens uses the balance sheet aging method to account for uncollectible debt on receivables.... Problem 10PB: Goods for Less uses the balance sheet aging method to account for uncollectible debt on receivables.... Problem 11PB: Record journal entries for the following transactions of Noreen Turbines. Problem 12PB: Record journal entries for the following transactions of Mesa Construction. Problem 13PB: Record journal entries for the following transactions of Graphics Signs. Problem 14PB: Record journal entries for the following transactions of Trout Masters. Problem 15PB: Shimmer Products is considering which bad debt estimation method works best for its company. It is... Problem 1TP: Review the new revenue recognition guidance issued by the Financial Accounting Standards Board... Problem 4TP: You are considering two possible companies for investment purposes. The following data is available... Problem 5TP: You own a construction company and have recently received a contract with the local school district... Problem 6TP: When a customer is delinquent on paying a notes receivable, your company has the option to continue... format_list_bulleted

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning