1.

Compute the issue price of bonds and complete the first three rows of an amortization schedule, if the market interest rate is 6% and the bonds issue at face amount.

1.

Explanation of Solution

Bonds are a kind of interest bearing notes payable, usually issued by companies, universities and governmental organizations. It is a debt instrument used for the purpose of raising fund of the corporations or governmental agencies. If selling price of the bond is equal to its face value, it is called as par on bond. If selling price of the bond is lesser than the face value, it is known as discount on bond. If selling price of the bond is greater than the face value, it is known as premium on bond.

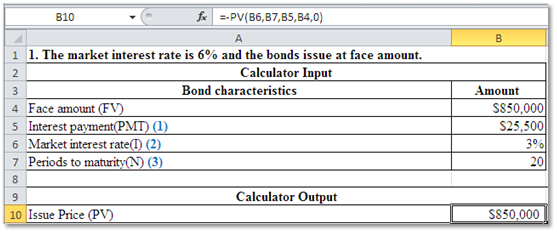

Determine the issue price of bonds.

Figure (1)

Prepare amortization schedule.

| Amortization Schedule | ||||

|

Date (1) |

Cash paid (2) |

Interest expense (3) |

Increase in carrying value (4) |

Carrying value (5) |

| 2018 | ||||

| January 01 | $850,000 | |||

| June 30 | $25,500 | $25,500 | $0 | $850,000 |

| December 31 | $25,500 | $25,500 | $0 | $850,000 |

Table (1)

Working Notes:

Determine the amount of Interest Payment (PMT).

Determine the amount of Market interest rate (I).

Determine the amount of periods to maturity (N).

2.

Compute the issue price of bonds and complete the first three rows of an amortization schedule, if the market interest rate is 7% and the bonds issue at a discount.

2.

Explanation of Solution

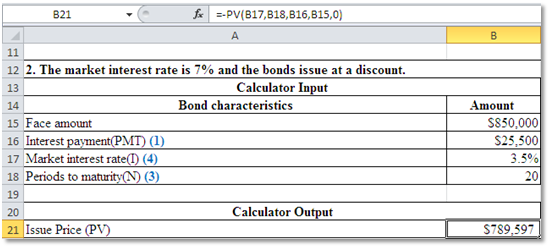

Determine the issue price of bonds.

Figure (2)

Prepare amortization schedule.

| Amortization Schedule | ||||

|

Date (1) |

Cash paid (2) |

Interest expense (3) |

Increase in carrying value (4) |

Carrying value (5) |

| 2018 | ||||

| January 01 | $789,597 | |||

| June 30 | $25,500 | $27,636 | $2,136 | $791,733 |

| December 31 | $25,500 | $27,711 | $2,211 | $793,944 |

Table (2)

Working note:

Determine the amount of Market interest rate (I).

3.

Compute the issue price of bonds and complete the first three rows of an amortization schedule, if the market interest rate is 5% and the bonds issue at a premium.

3.

Explanation of Solution

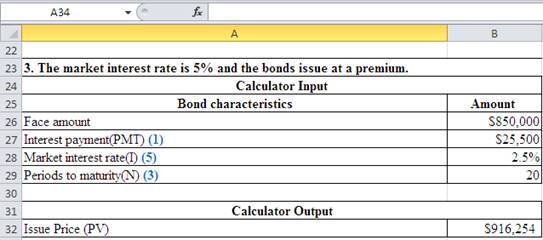

Determine the issue price of bonds.

Figure (3)

Prepare amortization schedule.

| Amortization Schedule | ||||

|

Date (1) |

Cash paid (2) |

Interest expense (3) |

Decrease in carrying value (4) |

Carrying value (5) |

| 2018 | ||||

|

January 01 | $916,254 | |||

| June 30 | $25,500 | $22,906 | $2,594 | $913,660 |

| December 31 | $25,500 | $27,711 | $2,658 | $911,002 |

Table (3)

Working note:

Determine the amount of Market interest rate (I).

Want to see more full solutions like this?

Chapter 9 Solutions

FINANCIAL ACCT(LOOSELEAF)>CUSTOM<-W/COD

- Give me the answer in a clear organized table please. Thank you!arrow_forwardGive me the answer in a clear organized table please. Thank you!arrow_forwardAssess the role of the Conceptual Framework in financial reporting and its influence on accounting theory and practice. Discuss how the qualitative characteristics outlined in the Conceptual Framework enhance financial reporting and contribute to decision-usefulness. Provide examplesarrow_forward

- Current Attempt in Progress Cullumber Corporation has income from continuing operations of $464,000 for the year ended December 31, 2025. It also has the following items (before considering income taxes). 1. An unrealized loss of $128,000 on available-for-sale securities. 2. A gain of $48,000 on the discontinuance of a division (comprised of a $16,000 loss from operations and a $64,000 gain on disposal). Assume all items are subject to income taxes at a 20% tax rate. Prepare a partial income statement, beginning with income from continuing operations. Income from Continuing Operations Discontinued Operations Loss from Operations Gain from Disposal Net Income/(Loss) CULLUMBER CORPORATION Income Statement (Partial) For the Year Ended December 31, 2025 Prepare a statement of comprehensive income. Net Income/(Loss) $ CULLUMBER CORPORATION Statement of Comprehensive Income For the Year Ended December 31, 2025 = Other Comprehensive Income Unrealized Loss of Available-for-Sale Securities ✰…arrow_forwardPlease make a trial balance, adjusted trial balance, Income statement. end balance ,owners equity statement, Balance sheet , Cash flow statement ,Cash end balancearrow_forwardActivity Based Costing - practice problem Fontillas Instrument, Inc. manufactures two products: missile range instruments and space pressure gauges. During April, 50 range instruments and 300 pressure gauges were produced, and overhead costs of $89,500 were estimated. An analysis of estimated overhead costs reveals the following activities. Activities 1. Materials handling 2. Machine setups Cost Drivers Number of requisitions Number of setups Total cost $35,000 27,500 3. Quality inspections Number of inspections 27,000 $89.500 The cost driver volume for each product was as follows: Cost Drivers Instruments Gauge Total Number of requisitions 400 600 1,000 Number of setups 200 300 500 Number of inspections 200 400 600 Insructions (a) Determine the overhead rate for each activity. (b) Assign the manufacturing overhead costs for April to the two products using activity-based costing.arrow_forward

- Bodhi Company has three cost pools and two doggie products (leashes and collars). The activity cost pool of ordering has the cost drive of purchase orders. The activity cost pool of assembly has a cost driver of parts. The activity cost pool of supervising has the cost driver of labor hours. The accumulated data relative to those cost drivers is as follows: Expected Use of Estimated Cost Drivers by Product Cost Drivers Overhead Leashes Collars Purchase orders $260,000 70,000 60,000 Parts 400,000 300,000 500,000 Labor hours 300,000 15,000 10,000 $960,000 Instructions: (a) Compute the activity-based overhead rates. (b) Compute the costs assigned to leashes and collars for each activity cost pool. (c) Compute the total costs assigned to each product.arrow_forwardTorre Corporation incurred the following transactions. 1. Purchased raw materials on account $46,300. 2. Raw Materials of $36,000 were requisitioned to the factory. An analysis of the materials requisition slips indicated that $6,800 was classified as indirect materials. 3. Factory labor costs incurred were $55,900, of which $51,000 pertained to factory wages payable and $4,900 pertained to employer payroll taxes payable. 4. Time tickets indicated that $50,000 was direct labor and $5,900 was indirect labor. 5. Overhead costs incurred on account were $80,500. 6. Manufacturing overhead was applied at the rate of 150% of direct labor cost. 7. Goods costing $88,000 were completed and transferred to finished goods. 8. Finished goods costing $75,000 to manufacture were sold on account for $103,000. Instructions Journalize the transactions.arrow_forwardChapter 15 Assignment of direct materials, direct labor and manufacturing overhead Stine Company uses a job order cost system. During May, a summary of source documents reveals the following. Job Number Materials Requisition Slips Labor Time Tickets 429 430 $2,500 3,500 $1,900 3,000 431 4,400 $10,400 7,600 $12,500 General use 800 1,200 $11,200 $13,700 Stine Company applies manufacturing overhead to jobs at an overhead rate of 60% of direct labor cost. Instructions Prepare summary journal entries to record (i) the requisition slips, (ii) the time tickets, (iii) the assignment of manufacturing overhead to jobs,arrow_forward

- Solve accarrow_forwardSolve fastarrow_forwardAssume that none of the fixed overhead can be avoided. However, if the robots are purchased from Tienh Inc., Crane can use the released productive resources to generate additional income of $375,000. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Direct materials Direct labor Variable overhead 1A Fixed overhead Opportunity cost Purchase price Totals Make A Buy $ SA Net Income Increase (Decrease) $ Based on the above assumptions, indicate whether the offer should be accepted or rejected? The offerarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education