Forecasted Statements and Ratios

Upton Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, ships them to its chain of retail stores, and has a staff to advise customers and help them set up their new computers.

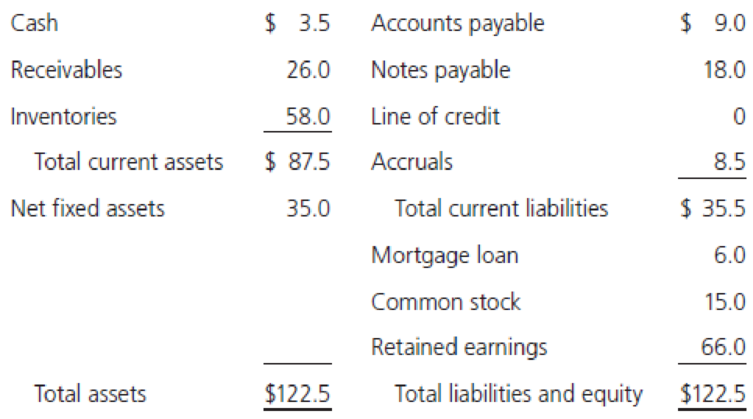

Upton’s

Sales for 2018 were $350 million, and net income for the year was $10.5 million, so the firm’s profit margin was 3.0%. Upton paid dividends of $4.2 million to common stockholders, so its payout ratio was 40%. Its tax rate was 40%, and it operated at full capacity. Assume that all assets/sales ratios, (spontaneous liabilities)/sales ratios, the profit margin, and the payout ratio remain constant in 2019.

- a. If sales are projected to increase by $70 million, or 20%, during 2019, use the AFN equation to determine Upton’s projected external capital requirements.

- b. Using the AFN equation, determine Upton’s self-supporting growth rate. That is, what is the maximum growth rate the firm can achieve without having to employ nonspontaneous external funds?

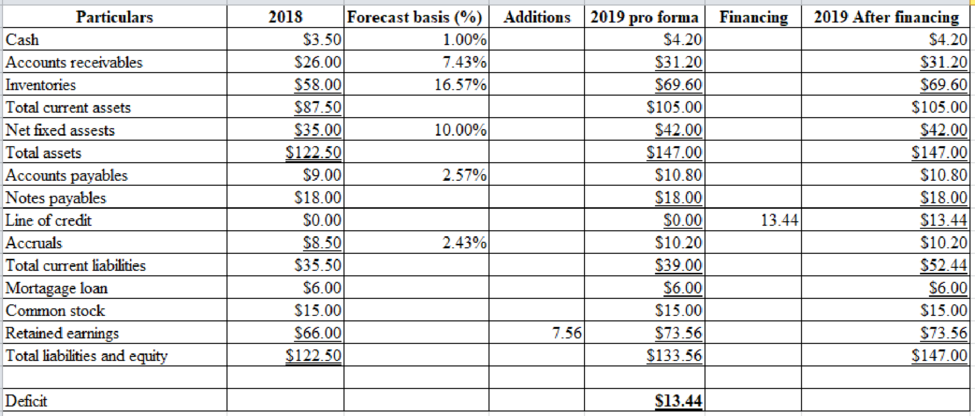

- c. Use the forecasted financial statement method to

forecast Upton’s balance sheet for December 31, 2019. Assume that all additional external capital is raised as a line of credit at the end of the year and is reflected (because the debt is added at the end of the year, there will be no additional interest expense due to the new debt). Assume Upton’s profit margin and dividend payout ratio will be the same in 2019 as they were in 2018. What is the amount of the line of credit reported on the 2019 forecasted balance sheets? (Hint: You don’t need toforecast the income statements because the line of credit is taken out on the last day of the year and you are given the projected sales, profit margin, and dividend payout ratio; these figures allow you to calculate the 2019 addition toretained earnings for the balance sheet without actually constructing a full income statement.)

a)

To determine: Company U’s projected external capital requirements.

Explanation of Solution

Calculation of company’s horizon value at year 3:

Therefore, AFN is $13.44 million.

b)

To determine: Self-supporting growth rate of Company U.

Explanation of Solution

Calculation of self-supporting growth rate:

Therefore, self-supporting growth rate is 6.38%.

c)

To construct: Balance sheet of Company U for December 31, 2019.

Explanation of Solution

Given information:

Forecasted sales is $420 million,

Profit margin is 3% ($10.5/$350),

Calculation of pay-out ratio:

Hence, pay-out ratio is 40%.

Calculation of net income:

Hence, net income is $12.6

The additional investment in assets is identical to the change in total assets because there are not short-term investments,

The additional financing from the increase in spontaneous liabilities and from the reinvested earnings is,

Calculation of financing surplus (deficit):

Therefore, financing deficit is -$13.44

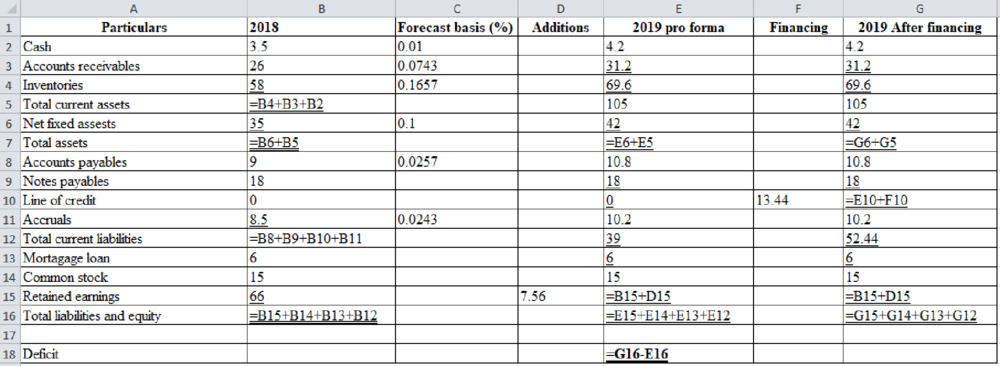

Excel workings:

Excel spread sheet:

Want to see more full solutions like this?

Chapter 9 Solutions

Intermediate Financial Management (MindTap Course List)

- Does Airbnb have any impaired assets? If so, what are they?arrow_forward1. Consider two assets with the following returns: State Prob. of state R1 R2 1 2/3 .03 .05 2 1/3 .09 .02arrow_forwardBright wood! Seating sells reclining chairs for $55.00 per unit. The variable cost is 322 per unit. Each reclining chair requires 5 direct labor hours and 3 machine hours to produce. ibution margin pemachine hon Wrightwood Manufacturing has a break-even point of 1,500 units. The sales price per unit is $18. and the variable cost per us $13. If the company sells 3,500 units, what will its net income be? Crestwood Industries provides the following budget data for its Processing Department for the year 2022: ⚫ Manufacturing Overhead Costs=250 ⚫ Direct Labor Costs $1,234,500 Determine the manufacturing overhead application rate under the base of Direct Labor Costs. Modesto Accessories manufactures two types of wallets leather and canvas. The company allocates manufacturing overhead using a single plant wide rate with direct labor cost as the allocation base. $48 Estimated Overhead Costs = 30,600 Direct Labor Cost per Leather Wallet Direct Labor Cost per Canvas Wallet = $52 Number of…arrow_forward

- Provide Answer of This Financial Accounting Question And Please Don't Use Ai Becouse In all Ai give Wrong Answer. And Provide All Question Answer If you will use AI will give unhelpful.arrow_forwardYou plan to save $X per year for 6 years, with your first savings contribution in 1 year. You and your heirs then plan to withdraw $43,246 per year forever, with your first withdrawal expected in 7 years. What is X if the expected return per year is 18.15 percent per year? Input instructions: Round your answer to the nearest dollar. 59 $arrow_forwardAre there assets for which a value might be considered to be hard to determine?arrow_forward

- You plan to save $X per year for 7 years, with your first savings contribution in 1 year. You and your heirs then plan to make annual withdrawals forever, with your first withdrawal expected in 8 years. The first withdrawal is expected to be $43,596 and all subsequent withdrawals are expected to increase annually by 1.84 percent forever. What is X if the expected return per year is 11.34 percent per year? Input instructions: Round your answer to the nearest dollar. $arrow_forwardYou plan to save $41,274 per year for 4 years, with your first savings contribution later today. You then plan to make X withdrawals of $41,502 per year, with your first withdrawal expected in 4 years. What is X if the expected return per year is 8.28 percent per year? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardYou plan to save $X per year for 10 years, with your first savings contribution in 1 year. You then plan to withdraw $58,052 per year for 9 years, with your first withdrawal expected in 10 years. What is X if the expected return is 7.41 percent per year? Input instructions: Round your answer to the nearest dollar. 69 $arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning