Concept explainers

Optima Company is a high-technology organization that produces a mass-storage system. The design of Optima’s system is unique and represents a breakthrough in the industry. The units Optima produces combine positive features of both compact and hard disks. The company is completing its fifth year of operations and is preparing to build its

- a. Fourth-quarter sales for 20X0 are 55,000 units.

- b. Unit sales by quarter (for 20X1) are projected as follows:

The selling price is $400 per unit. All sales are credit sales. Optima collects 85% of all sales within the quarter in which they are realized; the other 15% is collected in the following quarter. There are no

- c. There is no beginning inventory of finished goods. Optima is planning the following ending finished goods inventories for each quarter:

- d. Each mass-storage unit uses 5 hours of direct labor and three units of direct materials. Laborers are paid $10 per hour, and one unit of direct materials costs $80.

- e. There are 65,700 units of direct materials in beginning inventory as of January 1, 20X1. At the end of each quarter, Optima plans to have 30% of the direct materials needed for next quarter’s unit sales. Optima will end the year with the same amount of direct materials found in this year’s beginning inventory.

- f. Optima buys direct materials on account. Half of the purchases are paid for in the quarter of acquisition, and the remaining half are paid for in the following quarter. Wages and salaries are paid on the 15th and 30th of each month.

- g. Fixed

overhead totals $1 million each quarter. Of this total, $350,000 represents depreciation. All other fixed expenses are paid for in cash in the quarter incurred. The fixed overhead rate is computed by dividing the year’s total fixed overhead by the year’s budgeted production in units. - h. Variable overhead is budgeted at $6 per direct labor hour. All variable overhead expenses are paid for in the quarter incurred.

- i. Fixed selling and administrative expenses total $250,000 per quarter, including $50,000 depreciation.

- j. Variable selling and administrative expenses are budgeted at $10 per unit sold. All selling and administrative expenses are paid for in the quarter incurred.

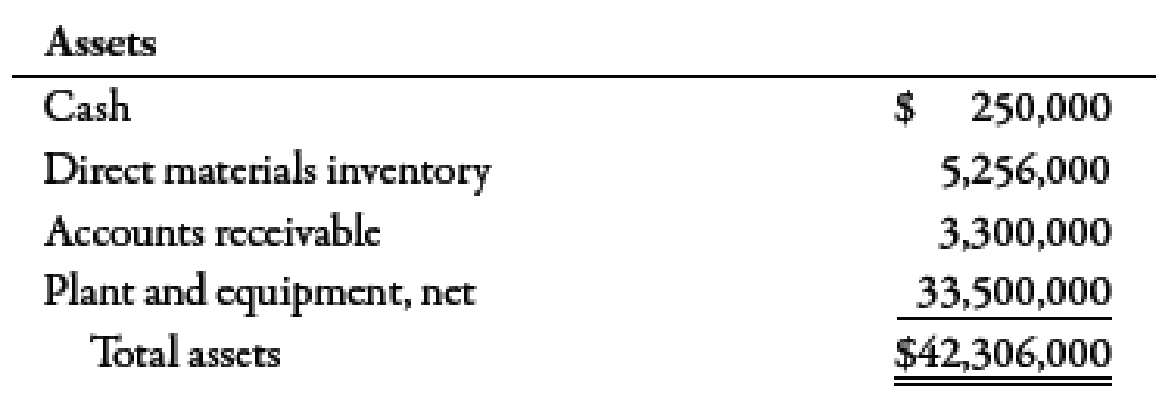

- k. The

balance sheet as of December 31, 20X0, is as follows:

- l. Optima will pay quarterly dividends of $300,000. At the end of the fourth quarter, $2 million of equipment will be purchased.

Required:

Prepare a master budget for Optima Company for each quarter of 20X1 and for the year in total. The following component budgets must be included:

- 1. Sales budget

- 2. Production budget

- 3. Direct materials purchases budget

- 4. Direct labor budget

- 5. Overhead budget

- 6. Selling and administrative expenses budget

- 7. Ending finished goods inventory budget

- 8. Cost of goods sold budget (Note: Assume that there is no change in work-in-process inventories.)

- 9.

Cash budget - 10. Pro forma income statement (using absorption costing) (Note: Ignore income taxes.)

- 11. Pro forma balance sheet (Note: Ignore income taxes.)

1.

Construct sales budget.

Explanation of Solution

Budgets:

Budgets are prepared for the planning and controlling purposes. Budgets facilitate planning and making decisions to achieve the desired objectives and are prepared to enable comparison between actual and expected outcomes.

Sales budget:

| Particulars |

Q1 ($) |

Q2 ($) |

Q3 ($) |

Q4 ($) |

Total ($) |

| Sales units (A) | 65,000 | 70,000 | 75,000 | 90,000 | 300,000 |

| Selling price (B) | 400 | 400 | 400 | 400 | |

| Sales | 26,000,000 | 28,000,000 | 30,000,000 | 36,000,000 | 120,000,000 |

Table (1)

2.

Construct production budget.

Explanation of Solution

Production budget:

| Particulars |

Q1 ($) |

Q2 ($) |

Q3 ($) |

Q4 ($) |

Total ($) |

| Expected sales | 65,000 | 70,000 | 75,000 | 90,000 | 300,000 |

| Add: Closing units. | 13,000 | 15,000 | 20,000 | 10,000 | 58,000 |

| Less: Opening units. | 0 | 13,000 | 15,000 | 20,000 | 48,000 |

| Production units | 78,000 | 72,000 | 80,000 | 80,000 | 310,000 |

Table (2)

Working Notes:

- Opening units are closing units of previous quarter.

- Production units are computed by adding closing units and subtracting opening units from the expected sales.

3.

Construct direct material purchases budget.

Explanation of Solution

Materials purchases budget:

| Particulars |

Q1 ($) |

Q2 ($) |

Q3 ($) |

Q4 ($) |

Total ($) |

| Expected material required for production | 234,000 | 216,000 | 240,000 | 240,000 | 930,000 |

| Add: Closing units. 30% of sales units of next month | 63,000 | 67,500 | 81,000 | 65,700 | 65,700 |

| Less: Opening units. | 65,700 | 63,000 | 67,500 | 81,000 | 65,700 |

| Material units expected to be purchased (A) | 231,300 | 220,500 | 253,500 | 224,700 | 930,000 |

|

Material cost: $80 per unit | 18,504,000 | 17,640,000 | 20,280,000 | 17,976,000 | 74,400,000 |

Table (3)

4.

Construct direct labor budget.

Explanation of Solution

Direct labor budget:

| Particulars |

Q1 ($) |

Q2 ($) |

Q3 ($) |

Q4 ($) |

Total ($) |

| Expected production (A) | 78,000 | 72,000 | 80,000 | 80,000 | 310,000 |

| Hours per unit (B) | 5 | 5 | 5 | 5 | 5 |

|

Number of hours | 390,000 | 360,000 | 400,000 | 400,000 | 1,550,000 |

| Rate per hour | 10 | 10 | 10 | 10 | 10 |

| Labor cost | 3,900,000 | 3,600,000 | 4,000,000 | 4,000,000 | 15,500,000 |

Table (4)

5.

Construct overhead budget.

Explanation of Solution

Overhead budget:

| Particulars |

Q1 ($) |

Q2 ($) |

Q3 ($) |

Q4 ($) |

Total ($) |

| Number of hours (sub-part 4) (A) | 390,000 | 360,000 | 400,000 | 400,000 | 1,550,000 |

| Variable overhead | 2,340,000 | 2,160,000 | 2,400,000 | 2,400,000 | 9,300,000 |

| Fixed overhead (C) | 1,000,000 | 1,000,000 | 1,000,000 | 1,000,000 | 4,000,000 |

|

Total overhead | 3,340,000 | 3,160,000 | 3,400,000 | 3,400,000 | 13,300,000 |

Table (5)

6.

Construct selling and administrative expenses budget.

Explanation of Solution

Selling and administrative expenses budget:

| Particulars |

Q1 ($) |

Q2 ($) |

Q3 ($) |

Q4 ($) |

Total ($) |

| Number of sales units (A) | 65,000 | 70,000 | 75,000 | 90,000 | 300,000 |

| Variable expense | 650,000 | 700,000 | 750,000 | 900,000 | 3,000,000 |

| Fixed expense(C) | 250,000 | 250,000 | 250,000 | 250,000 | 1,000,000 |

|

Total overhead | 900,000 | 950,000 | 1,000,000 | 1,150,000 | 4,000,000 |

Table (6)

7.

Construct ending finished goods inventory budget.

Explanation of Solution

Ending goods inventory budget:

| Particulars |

Amount ($) |

| Material cost | 240 |

| Add: Labor cost | 50 |

| Add: Variable overheads | 30 |

| Add: Fixed overheads | 12.90 |

| Unit cost | 332.90 |

| Cost of ending goods | 3,329,000 |

Table (7)

8.

Construct COGS budget.

Explanation of Solution

Cost of goods sold budget:

| Particulars |

Amount ($) |

| Material cost | 74,400,000 |

| Add: Labor cost | 15,500,000 |

| Add: Variable overheads | 9,300,000 |

| Add: Fixed overheads | 4,000,000 |

| Manufacturing cost (A) | 103,200,000 |

| Add: Beginning finished goods | 0 |

| Cost of goods available for sale (A) | 103,200,000 |

| Less: Ending goods (sub-part 7) (B) | 3,329,000 |

| COGS | 99,871,000 |

Table (8)

9.

Construct cash budget.

Explanation of Solution

Cash Budget:

| Particulars |

Q1 ($) |

Q2 ($) |

Q3 ($) |

Q4 ($) |

Total ($) |

| Opening balance | 250,000 | 1,110,000 | 3,128,000 | 5,568,000 | 250,000 |

| Receipt from sales of current quarter |

22,100,000 |

25,500,000 | 102,000,000 | ||

| Receipts from sales of previous quarter | 3,300,000 |

3,900,000 |

4,200,000 |

4,500,000 | 15,900,000 |

| Less: Payment for material purchased in preceding quarter1 | 7,248,000 | 9,252,000 | 8,820,000 | 10,140,000 | 35,460,000 |

| Less: Payment for material purchased in current quarter |

9,252,000 |

8,820,000 |

10,140,000 |

8,988,000 | 37,200,000 |

| Less: labor cost | 3,900,000 | 3,600,000 | 4,000,000 | 4,000,000 | 15,500,000 |

| Less: Variable manufacturing Overhead cost | 2,340,000 | 2,160,000 | 2,400,000 | 2,400,000 | 9,300,000 |

| Less: Fixed manufacturing Overhead cost | 650,000 | 650,000 | 650,000 | 650,000 | 2,600,000 |

| Less: Variable Selling and administrative expense | 650,000 | 700,000 | 750,000 | 900,000 | 3,000,000 |

| Less: Fixed Selling and administrative expense | 200,000 | 200,000 | 200,000 | 200,000 | 800,000 |

| Less: Dividends | 300,000 | 300,000 | 300,000 | 300,000 | 1,200,000 |

| Less: acquisition of equipment | 2,000,000 | 2,000,000 | |||

| Closing balance | 1,110,000 | 3,128,000 | 5,568,000 | 11,090,000 | 11,090,000 |

Table (9)

Working Notes:

1. Computation of payment for material purchased in quarter 4 of the last year:

10.

Construct pro forma income statement.

Explanation of Solution

Budgeted income statement:

| Particulars |

Amount ($) |

| Sales | 120,000,000 |

| Less: COGS (sub-part 8) | 99,871,000 |

| Operating profit | 20,129,000 |

| Less: Selling and administrative expenses | 4,000,000 |

| Income | 16,129,000 |

Table (10)

11.

Construct pro forma balance sheet.

Explanation of Solution

Budgeted Balance Sheet:

| Particulars |

Amount ($) |

| Assets: | |

| Cash | 11,090,000 |

| Direct material inventory | 5,256,000 |

| Accounts receivable | 5,400,000 |

| Finished goods inventory | 3,329,000 |

| Plant and equipment | 33,900,000 |

| Total Assets | 58,975,000 |

| Liabilities and Equity: | |

| Accounts payable | 8,988,000 |

| Capital stock | 27,000,000 |

| Retained Earnings | 22,987,000 |

| Total liabilities and equity | 58,975,000 |

Table (11)

Working Notes:

1.

Computation of opening retained earnings:

Capital stock of $27,000,000 has been assumed.

Want to see more full solutions like this?

Chapter 9 Solutions

Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

- Profit margin??arrow_forwardChapter 18 Homework 8 1 points QS 18-4 (Algo) Measuring costs using high-low method LO P1 The following information is available for a company's maintenance cost over the last seven months. Month June July Units Produced 190 eBook 110 140 200 230 August September October November December Maintenance Cost $ 3,950 5,390 4,110 5,558 6,038 3,150 Using the high-low method, estimate both the fixed and variable components of its maintenance cost. Print References High-Low method - Calculation of variable cost per unit produced Cost at highest volume - Cost at lowest volume Highest volume - Lowest volume Total cost at the highest volume Variable costs at highest volume Highest volume Variable cost per unit produced Total variable costs at highest volume Total fixed costs Total cost at the lowest volume Variable costs at lowest volume: Lowest volume Variable cost per unit produced Total variable costs at lowest volume Total fixed costs Mc Graw Hill Help Save & Exit Submit Check my workarrow_forwardGiven answer with step by step solutionarrow_forward

- Whitney received $75,200 of taxable income in 2024. All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations. She is married but files a separate tax return. Her taxable income is $75,200. What is her income tax liability?arrow_forwardLacy is a single taxpayer. In 2024, her taxable income is $56,000. What is her tax liability in each of the following alternative situations.Her $56,000 of taxable income includes $10,000 of qualified dividends. What is her tax liability?arrow_forwardAccounting problemarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning