Concept explainers

Critical Thinking: Analyzing the Effects of

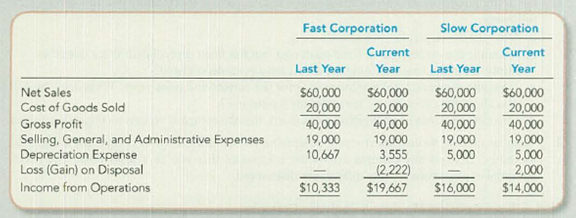

As an aspiring financial analyst, you have applied to a major Wall Street firm for a summer job. To screen potential applicants, the firm provides you a short case study and asks you to evaluate the financial success of two hypothetical companies that started operations last year on January 1. Both companies operate in the same industry, use very similar assets, and have very similar customer bases. Among the additional information provided about the companies are the following comparative income statements.

Required:

Prepare an analysis of the two companies with the goal of determining which company is better managed. If you could request two additional pieces of information from these companies’ financial statements, describe specifically what they would be and explain how they would help you to make a decision.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Fundamentals Of Financial Accounting

- What is the company's plantwide overhead ratearrow_forwardI want to correct answer general accounting questionarrow_forwardSwift Manufacturing has the following financial ratios: . Tax Burden Ratio: 0.75 Leverage Ratio: 1.8 . Interest Burden: 0.65 Return on Sales: 12% . Asset Turnover: 2.8 Required: What is the company's Return on Equity (ROE)?arrow_forward

- please provide correct answerarrow_forwardBradford Enterprises sells two products, blue pens and green notebooks. Bradford predicts that it will sell 3,200 blue pens and 900 green notebooks in the next period. The unit contribution margins for blue pens and green notebooks are $2.80 and $4.20, respectively. What is the weighted average unit contribution margin?arrow_forwardWhat was the country's deficit for the year?arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning