Concept explainers

Accounting for the Use and Disposal of Long-Lived Assets

Nicole’s Getaway Spa (NGS) purchased a hydrotherapy tub system to add to the wellness programs at NGS. The machine was purchased at the beginning of the year at a cost of $7,000. The estimated useful life was five years and the residual value was $500. Assume that the estimated productive life of the machine is 13,000 hours. Expected annual production was year 1, 3,100 hours; year 2, 2,500 hours; year 3, 3,400 hours; year 4, 2,200 hours; and year 5, 1,800 hours.

Required:

- 1. Complete a

depreciation schedule for each of the alternative methods.- a. Straight-line.

- b. Units-of-production.

- c. Double-declining-balance.

- 2. Assume NGS sold the hydrotherapy tub system for $2,100 at the end of year 3. Prepare the

journal entry to account for the disposal of this asset under the three different methods. - 3. The following amounts were

forecast for year 3: Sales Revenues $42,000; Cost of Goods Sold $33,000; Other Operating Expenses $4,000; and Interest Expense $800. Create an income statement for year 3 for each of the different depreciation methods, ending at Income before Income Tax Expense. (Don’t forget to include a loss or gain on disposal for each method.)

(1) (a)

Prepare the depreciation expense schedule under straight-line method

Explanation of Solution

Straight-line method: The depreciation method which assumes that the consumption of economic benefits of long-term asset could be distributed equally throughout the useful life of the asset is referred to as straight-line method.

Formula for straight-line depreciation method:

Depreciation expense: Depreciation expense is a non-cash expense, which is recorded on the income statement reflecting the consumption of economic benefits of long-term asset.

Accumulated depreciation: The total amount of depreciation expense deducted, from the time asset acquired till date, as reported in the account as on a particular date, is referred to as accumulated depreciation.

Formula for accumulated depreciation:

Book value: The amount of acquisition cost of less accumulated depreciation as on a particular date is referred to as book value.

Formula for book value:

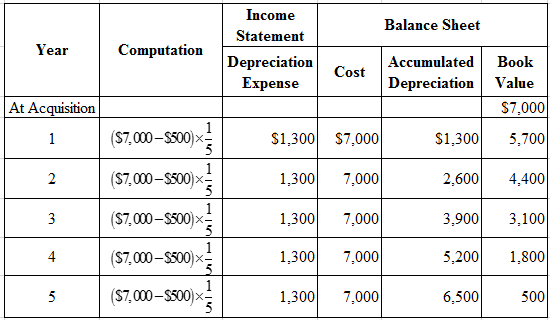

Depreciation schedule under straight-line method:

Figure (1)

(1) (b)

Prepare the depreciation expense schedule under units-of-production

Explanation of Solution

Units-of-production method: The depreciation method which assumes that the consumption of economic benefits of long-term asset is based on the production capacity or output is referred to as units-of-production method.

Formula for units-of-production depreciation method:

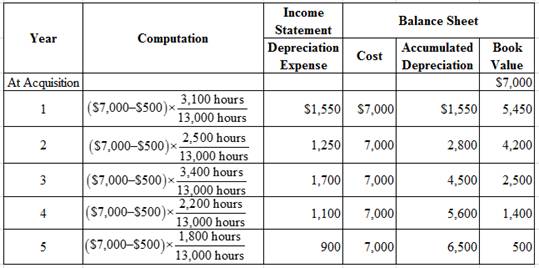

Depreciation schedule under units-of-production method:

Figure (2)

(1) (c)

Prepare the depreciation expense schedule under double-declining-balance method

Explanation of Solution

Double-declining-balance method: The depreciation method which assumes that the consumption of economic benefits of long-term asset is high in the early years but gradually declines towards the end of its useful life, is referred to as double-declining-balance method.

Formula for double-declining-balance depreciation method:

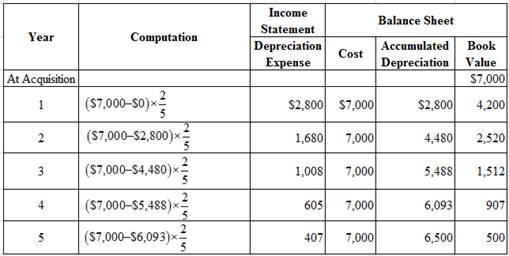

Depreciation schedule under double-declining-balance method:

Figure (3)

Note:

Compute depreciation expense in Year 5.

(2)

Prepare the journal entries for the sale of equipment under three methods

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare journal entry for the sale of building, under straight-line method.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Cash | 2,100 | |||||

| Accumulated Depreciation | 3,900 | |||||

| Loss on Disposal | 1,000 | |||||

| Equipment | 7,000 | |||||

| (To record sale of equipment) | ||||||

Table (1)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accumulated Depreciation–Building is a contra-asset account. Since the building is sold, the accumulated depreciation balance is reversed to reduce the balance in the account; hence, the account is debited.

- Loss on Disposal is an expense account. Since losses and expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Building is an asset account. Since building is sold, asset account decreased, and a decrease in asset is credited.

Working Notes:

Determine the gain on sale.

Step 1: Compute book value on the date of sale.

Step 2: Compute gain (loss) on sale.

Prepare journal entry for the sale of building, under units-of-production method.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Cash | 2,100 | |||||

| Accumulated Depreciation | 4,500 | |||||

| Loss on Disposal | 400 | |||||

| Equipment | 7,000 | |||||

| (To record sale of equipment) | ||||||

Table (2)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accumulated Depreciation–Building is a contra-asset account. Since the building is sold, the accumulated depreciation balance is reversed to reduce the balance in the account; hence, the account is debited.

- Loss on Disposal is an expense account. Since losses and expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Building is an asset account. Since building is sold, asset account decreased, and a decrease in asset is credited.

Working Notes:

Determine the gain on sale.

Step 1: Compute book value on the date of sale.

Step 2: Compute gain (loss) on sale.

Prepare journal entry for the sale of equipment, under double-declining-balance method.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Cash | 2,100 | |||||

| Accumulated Depreciation | 5,488 | |||||

| Equipment | 7,000 | |||||

| Gain on Disposal | 588 | |||||

| (To record sale of truck) | ||||||

Table (3)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accumulated Depreciation–Equipment is a contra-asset account. Since the equipment is sold, the accumulated depreciation balance is reversed to reduce the balance in the account; hence, the account is debited.

- Equipment is an asset account. Since equipment is sold, asset account decreased, and a decrease in asset is credited.

- Gain on Disposal is a revenue account. Since gains and revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Determine the gain on sale.

Step 1: Compute book value on the date of sale.

Step 2: Compute gain (loss) on sale.

(3)

Prepare the income statement of NG Spa for the Year 3, under three depreciation methods

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare income statement for NG Spa for the Year 3.

| NG Spa | |||

| Income Statement | |||

| For Year 3 | |||

| Particulars | Straight-Line | Units-of-Production | Double-Declining-Balance |

| Sales revenue | $42,000 | $42,000 | $42,000 |

| Cost of goods sold | 33,000 | 33,000 | 33,000 |

| Gross profit | 9,000 | 9,000 | 9,000 |

| Operating expenses: | |||

| Depreciation expense | $1,300 | $1,700 | $1,008 |

| Other operating expenses | 4,000 | 4,000 | 4,000 |

| Loss (Gain) on disposal | 1,000 | 400 | (588) |

| Total operating expenses | 6,300 | 6,100 | 4,420 |

| Income from operations | 2,700 | 2,900 | 4,580 |

| Interest expense | 800 | 800 | 800 |

| Income before income tax expense | $1,900 | $2,100 | $3,780 |

Table (4)

Want to see more full solutions like this?

Chapter 9 Solutions

Fundamentals Of Financial Accounting

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,