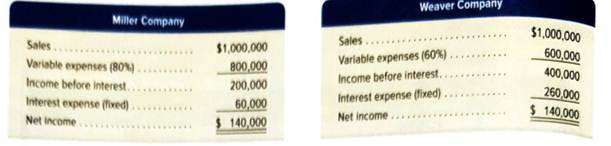

Shown here are condensed income statements for two different companies (both are organized as LLCs and pay no income taxes).

Required

- Compute times interest earned for Miller Company.

- Compute times interest earned for Weaver Company.

- What happens to each company’s net income if sales increase by 30%?

- What happens to each company’s net income if sales increase by 50%?

- What happens to each company’s net income if sales increase by 80%?

- What happens to each company’s net income if sales decrease by 10%?

- What happens to each company’s net income if sales decrease by 20%?

- What happens to each company’s net income if sales decrease by 40%? Analysis Component

- Comment on the results from parts 3 through 8 in relation to the fixed-cost strategies of the two companies and the ratio values you computed in parts 1 and 2.

1.

Introduction: The income statement also known as the profit and loss statement which consists of operating and non-operating expenses which are deducted from the revenue generated from the sales. The time’s interest earned refers to the ratio of income before interest and taxes to interest earned.

To calculate: Times interest earned for company M.

Explanation of Solution

Computation of times interest earned for company M;

2.

Introduction: The income statement also known as the profit and loss statement which consists of operating and non-operating expenses which are deducted from the revenue generated from the sales. The time’s interest earned refers to the ratio of income before interest and taxes to interest earned.

To calculate: Times interest earned for company W.

Explanation of Solution

Computation of times interest earned for company W:

3.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales increased by 30%.

Explanation of Solution

If sales increased by 30% for each company,

For company M;

For company W:

Computing net income for company M:

| Particular | Amount |

| Sales | $1,300,000 |

| Less: variable expense (80%) | (1,040,000) |

| Income before interest | 260,000 |

| Less: Interest expense(fixed) | (60,000) |

| Net income | $200,000 |

Computing net income for company W:

| Particular | Amount |

| Sales | $1,300,000 |

| Less: variable expense (60%) | (780,000) |

| Income before interest | 520,000 |

| Less: Interest expense(fixed) | (260,000) |

| Net income | $260,000 |

4.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales increased by 50%.

Explanation of Solution

If sales increased by 50% for each company,

For company M:

For company W:

Computing net income for company M:

| Particular | Amount |

| Sales | $1,500,000 |

| Less: variable expense (80%) | (1,200,000) |

| Income before interest | 3,000,000 |

| Less: Interest expense(fixed) | (60,000) |

| Net income | $240,000 |

Computing net income for company W:

| Particular | Amount |

| Sales | $1,300,000 |

| Less: variable expense (60%) | (900,000) |

| Income before interest | 400,000 |

| Less: Interest expense(fixed) | (260,000) |

| Net income | $140,000 |

5.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales increased by 80%.

Explanation of Solution

If sales increased by 80% for each company,

For company M;

For company W:

Computing net income for company M:

| Particular | Amount |

| Sales | $1,800,000 |

| Less: variable expense (80%) | (1,440,000) |

| Income before interest | 360,000 |

| Less: Interest expense(fixed) | (60,000) |

| Net income | $300,000 |

Computing net income for company W:

| Particular | Amount |

| Sales | $1,800,000 |

| Less: variable expense (60%) | (1,080,000) |

| Income before interest | 720,000 |

| Less: Interest expense(fixed) | (260,000) |

| Net income | $460,000 |

6.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales decreased by 10%.

Explanation of Solution

If sales decreased by 10% for each company,

For company M;

For company W:

Computing net income for company M:

| Particular | Amount |

| Sales | $900,000 |

| Less: variable expense (80%) | (720,000) |

| Income before interest | 180,000 |

| Less: Interest expense(fixed) | (60,000) |

| Net income | $120,000 |

Computing net income for company W:

| Particular | Amount |

| Sales | $900,000 |

| Less: variable expense (60%) | (540,000) |

| Income before interest | 360,000 |

| Less: Interest expense(fixed) | (260,000) |

| Net income | $100,000 |

7.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales decreased by 10%.

Explanation of Solution

If sales decreased by 20% for each company,

For company M;

For company W:

Computing net income for company M:

| Particular | Amount |

| Sales | $800.000 |

| Less: variable expense (80%) | (640,000) |

| Income before interest | 160,000 |

| Less: Interest expense(fixed) | (60,000) |

| Net income | $100,000 |

Computing net income for company W:

| Particular | Amount |

| Sales | $800,000 |

| Less: variable expense (60%) | (480,000) |

| Income before interest | 320,000 |

| Less: Interest expense(fixed) | (260,000) |

| Net income | $60,000 |

8.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales decreased by 10%.

Explanation of Solution

If sales decreased by 40% for each company,

For company M;

For company W:

Computing net income for company M:

| Particular | Amount |

| Sales | $600,000 |

| Less: variable expense (80%) | (480,000) |

| Income before interest | 120,000 |

| Less: Interest expense(fixed) | (60,0000) |

| Net income | $60,000 |

Computing net income for company W:

| Particular | Amount |

| Sales | $60,0000 |

| Less: variable expense (60%) | (360,000) |

| Income before interest | 240,000 |

| Less: Interest expense(fixed) | (260,000) |

| Net income | ($20,000) |

9.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

The time's interest earned refers to the ratio of income before interest and taxes to interest earned.

To comment: On the result for interest earned by both the companies and for part 3 to 8.

Explanation of Solution

Comments on times interest earned by both the companies are:

The time's interest earned by company M is 3.3 times which indicates a healthy position to invest in the company from the investor point of view.

For company W:

The time's interest earned by the company W is 1.5 times which lesser than 2.5 times this indicates the riskier to invest in the company from an investor point of view.

Comments on the fixed cost strategies for the company The company fixed cost is decreasing the net income of the company on different sales revenue. This leads the company W to lose on 40% sales.

Want to see more full solutions like this?

Chapter 9 Solutions

Financial Accounting: Information for Decisions

- Please answer the following requirements for these general accounting questionarrow_forward(a) A property lease includes a requirement that the premises are to be repainted every five years and the future cost is estimated at $100,000. The lessee prefers to spread the cost over the five years by charging $$20,000 against profits each year. Thereby creating a provision of $100,000 in five years’ time and affecting profits equally each year. Requirement: Was it correct for the lessee to provide for this cost? Explain your decision (b) A retail store has a policy of refunding purchases by dissatisfied customers, even though it is under no legal obligation. Its policy of making refunds is generally known. Requirements: Should a provision be made at year endarrow_forwardQuestion 3 Zanzibar Limited entered into a lease agreement on July 1 2016 to lease some highly customized hydraulic equipment to Kaizen Limited. The fair value of the equipment as at that date was $ 700,000. The terms of the lease agreement were: Lease term 5 years Equipment economic life 6 years Annual rental payment, in arrears (commencing June 30th 2017) $160,000 Equipment residual value $100,000 Guaranteed residual value by Zanzibar $60,000 Incremental borrowing rate 8% Interest rate implicit in the lease 6% Note: the lease is cancellable but only with Zanzibar’s permission At the end of the lease term, the equipment is to be returned to Zanzibar Limited. On July 1, 2016, Zanzibar incurred $12,000 in legal fees for setting up the lease. The annual rental payment includes $10, 000 to reimburse the lessor for maintenance fees incurred on behalf of the lessee. Requirements: a) Discuss the nature of the lease using the appropriate criteria. Justify your answer using calculations where…arrow_forward

- financial accountarrow_forwardanswer plzarrow_forwardRepsola is a drilling company that operates an offshore Oilfield in Feeland. Five years ago, Feeland had a major oil discovery and granted licenses to drill oil to reputable,experienced drilling companies. The licensing agreement requires the company to remove the oil rig at the end of production and restore the seabed. Ninety percent of the eventual costs of undertaking the work relate to the removal of the oil rig and restoration of damage caused by building it and ten percent arise through the extraction of the oil. At the Statement of Financial Position (SOFP) date (December 31 2025), the rig has been constructed but no oil has been extractedOn January 1st 2023, Repsola obtained the license to construct an oil rig at a cost of $500 million. Two years later the oil rig was completed. The rig is expected to be removed in 20 years from the date of acquisition. The estimated eventual cost is 100million. The company’s cost of capital is 10% and its year end is December 31st. Repsola…arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning