Concept explainers

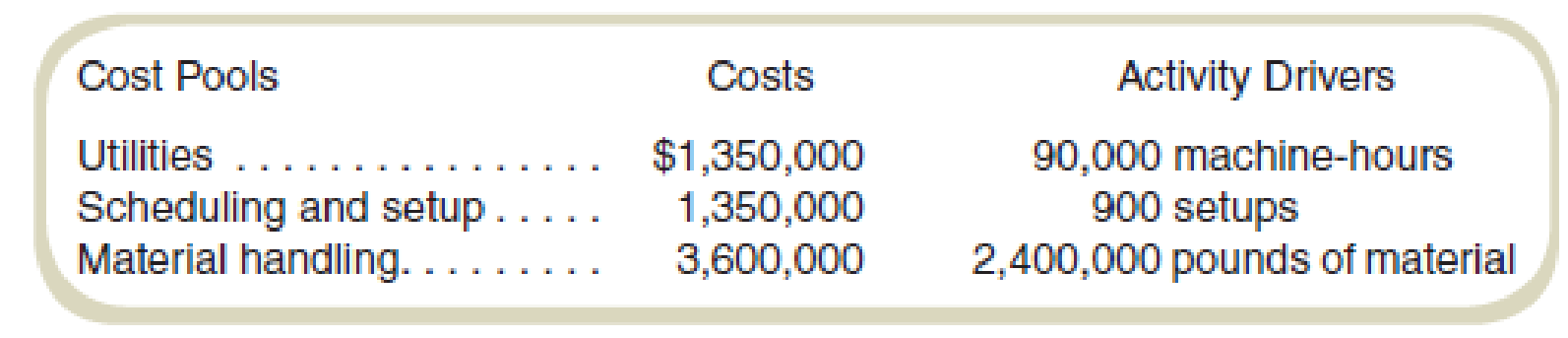

Churchill Products is considering updating its cost system to an activity-based costing system and is interested in understanding the effects. The company’s cost accountant has identified three

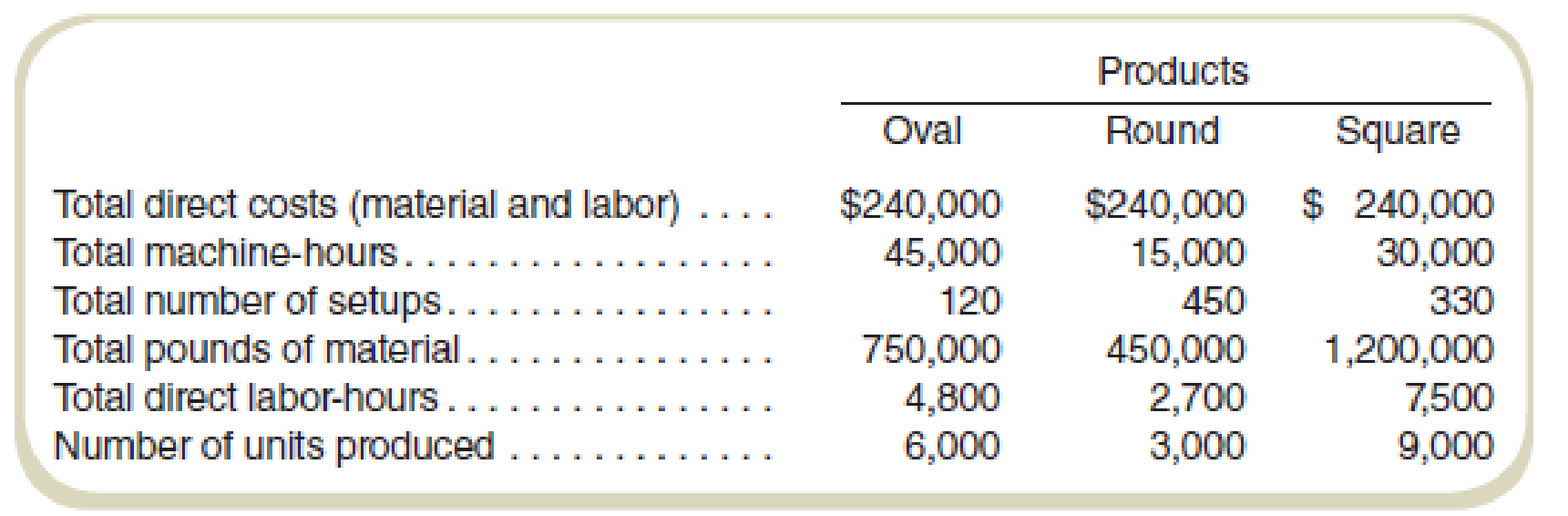

The company manufactures three models of water basins (Oval, Round, and Square). The plans for production for the next year and the budgeted direct costs and activity by product line are as follows:

Required

- a. The current cost accounting system charges overhead to products based on direct labor-hours. What unit product costs will be reported for the three products if the current cost system continues to be used?

- b. A consulting firm has recommended using an activity-based costing system, with the activities based on the cost pools identified by the cost accountant. Prepare a cost flow diagram of the proposed ABC system.

- c. What are the cost driver rates for the three cost pools identified by the cost accountant?

- d. What unit product costs will be reported for the three products if the ABC system suggested by the cost accountant’s classification of cost pools is used?

- e. If management should decide to implement an activity-based costing system, what benefits should it expect?

a.

Determine the unit product costs according to the information given in the question.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

Compute the unit cost:

| Particulars | Oval | Round | Square |

| Direct costs | $240,000 | $240,000 | $240,000 |

|

Add: Overhead | $2,016,000 | $1,134,000 | $3,150,000 |

| Total costs | $2,256,000 | $1,374,000 | $3,390,000 |

| Number of units | 6,000 | 3,000 | 9,000 |

| Unit cost | $376 | $458 | $377 |

Table: (1)

Compute the burden rate:

b.

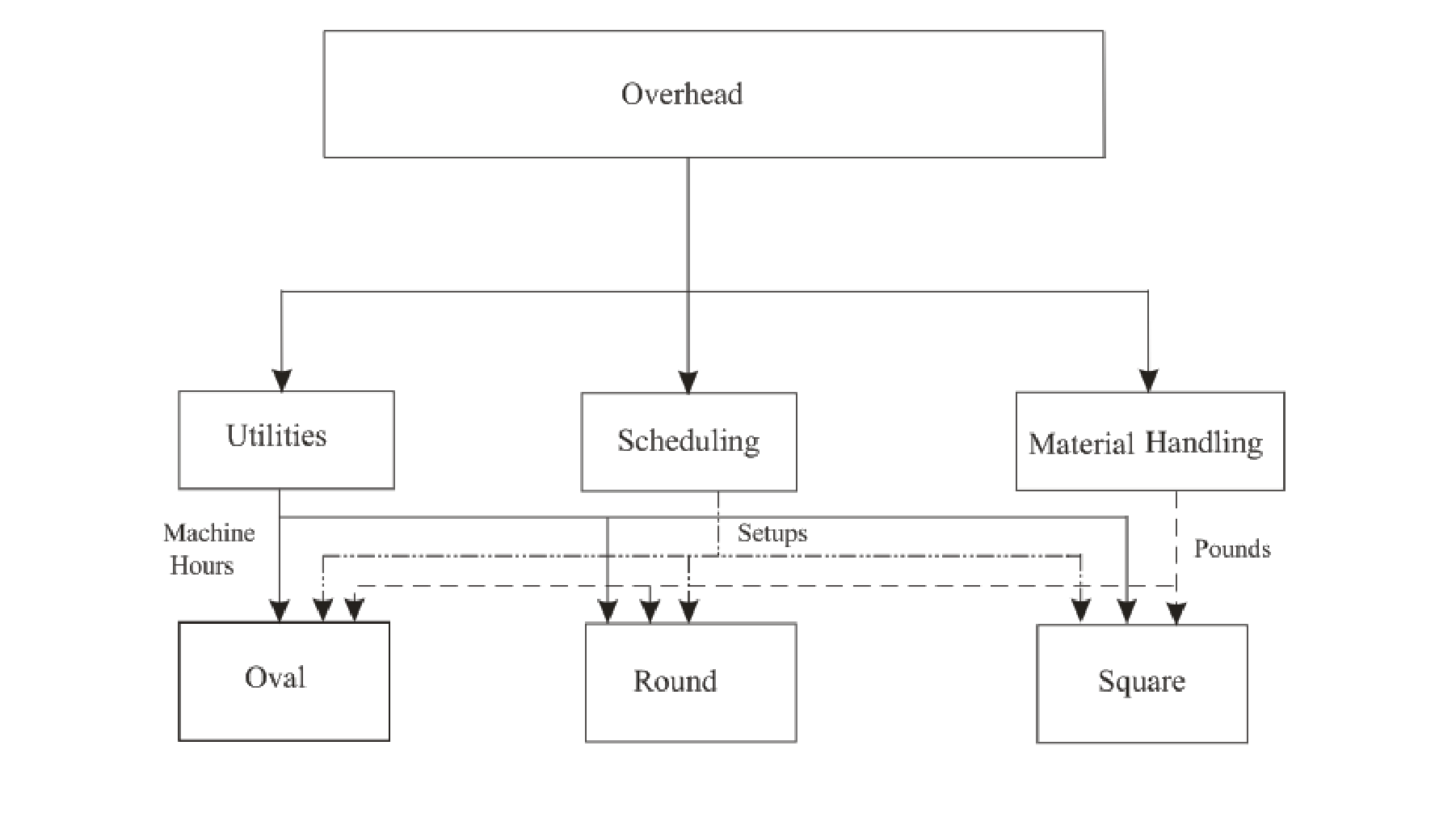

Prepare a cost flow diagram according to the information given in the question.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

Cost flow diagram:

Cost flow diagram determines the flow of the cost of the operations through working dynamics of the cost flow system.

Figure (1)

c.

Determine the cost driver rate according to the information given in the question.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

Determine the cost drivers and cost drivers rate:

| Particulars | Cost | Cost driver |

Cost per cost driver |

| Utilities | $1,350,000 | 90,000 machine hours | $15 |

| Scheduling and setup | $1,350,000 | 900 setups | $1,500 |

| Material handling | $3,600,000 | 2,400,000 lbs. | $1.50 |

Table: (2)

d.

Determine the unit product costs according to the information given in the question.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

Compute the unit cost:

| Particulars | Oval | Round | Square |

| Direct costs | $240,000 | $240,000 | $240,000 |

| Add:Overhead: | |||

|

Utilities | $675,000 | $225,000 | $450,000 |

|

Scheduling and setup | $180,000 | $675,000 | $495,000 |

|

Material handling | $1,125,000 | $675,000 | $1,800,000 |

| Total costs | $2,220,000 | $1,815,000 | $2,985,000 |

| Number of units | $6,000 | $3,000 | $9,000 |

|

Unit cost | $370 | $605 | $332 |

Table: (3)

e.

Determine the effect of implementing activity-based costing system.

Explanation of Solution

Activity-based costing (ABC):

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

The relevance of the ABC system according to the information given in the question:

The implementation of the ABC system would make the understanding of product costs. The cost drivers would be determined by breaking down the costs with respect to the cost drivers. The determination and analysis of the product complexity, product cost, and product volume would provide the correlation between the three. This vital information would be critical for pricing decisions and profitability strategies.

Want to see more full solutions like this?

Chapter 9 Solutions

Fundamentals of Cost Accounting

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardQuestion 1181 28 Current Attempt in Progress Here are comparative balance sheets for Migitsu Company. Prepare a statement of cash flows-indirect method. MIGITSU COMPANY Comparative Balance Sheets December 31 Assets 2020 2019 Cash $73,000 $22,000 Accounts receivable 87,000 76.000 Inventory 170,000 191.000 Land 72,000 100.000 Equipment 260,000 200.000 Accumulated depreciation - equipment (66,000) (32.000) Total $596,000 $557,000 Liabilities and Stockholders' Equity Accounts payable $37,000 $47.000 Bonds payable 150,000 210,000 Common stock ($1 par) 216.000 174,000 Retained earnings 193,000 126.000 Total $596,000 $557,000 Additional information: 1 Net income for 2020 was $100,000. N Cash dividends of $33,000 were declared and paid. 3. Bonds payable amounting to $60,000 were redeemed for cash $60,000. -18 4. Common stock was issued for $42,000 cash. 5. Equipment that cost $50,000 and had a book value of $30,000 was sold for $36,000 during 2020; land was sold at cost.arrow_forward

- I need guidance with this general accounting problem using the right accounting principles.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forward

- Please provide the solution to this general accounting question with accurate financial calculations.arrow_forwardMeena manufacturing company has budgeted overhead costs of $750,000 and expected machine hours of 25,000. During the period, actual overhead costs were $765,000 and actual machine hours were 24,000. Calculate the amount of over or underapplied overhead.arrow_forwardexplain properly all the answer for General accounting question Please given fastarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning