Concept explainers

Activity-Based Costing for an Administrative Service

The Personnel Department at LastCall Enterprises handles many administrative tasks for the two divisions that make up LastCall: LaidBack and StressedOut. LaidBack division manages the company’s traditional business line. This business, although lucrative, is currently not growing. StressedOut, on the other hand, is the company’s new business, which has experienced double-digit growth for each of the last three years.

The cost allocation system at LastCall allocates all corporate costs to the divisions based on a variety of cost allocation bases. Personnel costs are allocated based on the average number of employees in the two divisions.

There are two basic activities in the Personnel Department. The first, which is called employee maintenance, manages employee records. Virtually all of this activity occurs when employees are hired or leave the company. The other activity is payroll, which is an ongoing activity and requires the same amount of work for each employee regardless of the employee’s salary.

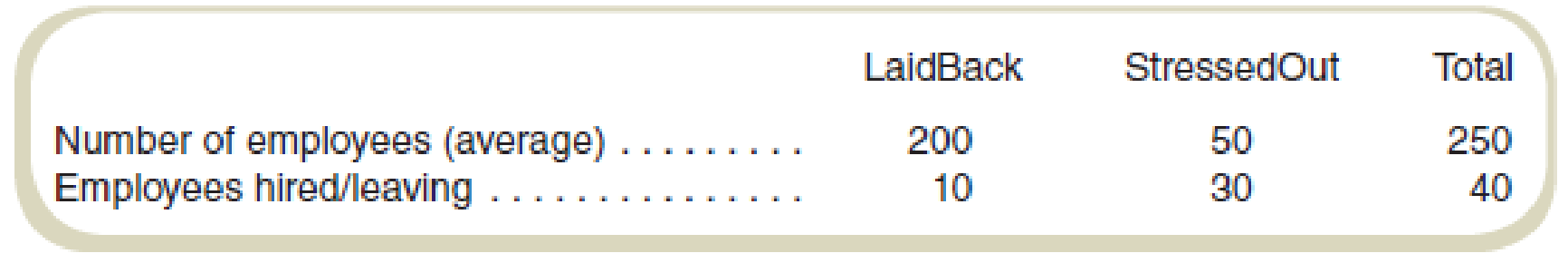

Assorted data for LastCall for the last year follow:

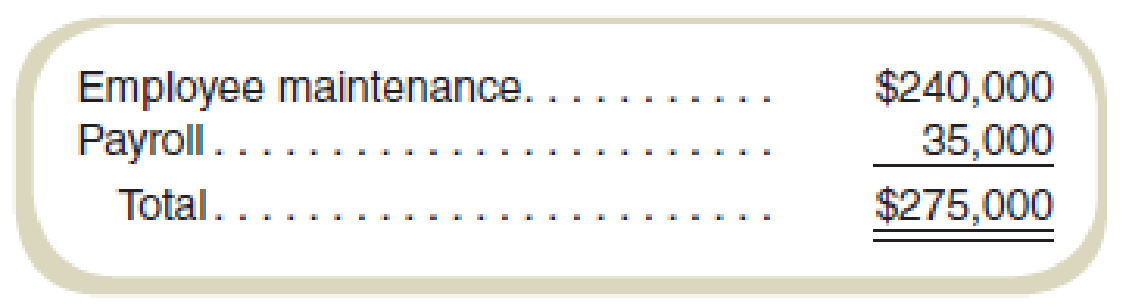

The Personnel Department incurred the following costs during the year:

Required

- a. Under the current allocation system, what are the costs that will be allocated from personnel to LaidBack? To StressedOut?

- b. Suppose the company implements an activity-based cost system for personnel with the two activities, employee maintenance and payroll. Use the number of employees hired/leaving as the cost driver for employee maintenance costs and the average number of employees for payroll costs. What are the costs that will be allocated from personnel to LaidBack? To StressedOut?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Fundamentals of Cost Accounting

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forward

- I am looking for help with this general accounting question using proper accounting standards.arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forward

- Can you solve this general accounting question with accurate accounting calculations?arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning