Concept explainers

David R. and Ella M. Cole (ages 39 and 38, respectively) are husband and wife who live at 1820 Elk Avenue, Denver, CO 80202. David is a self-employed consultant specializing in retail management, and Ella is a dental hygienist for a chain of dental clinics.

- David earned consulting fees of $145,000 in 2018. He maintains his own office and pays for all business expenses. The Coles are adequately covered by the medical plan provided by Ella’s employer but have chosen not to participate in its § 401(k) retirement plan.

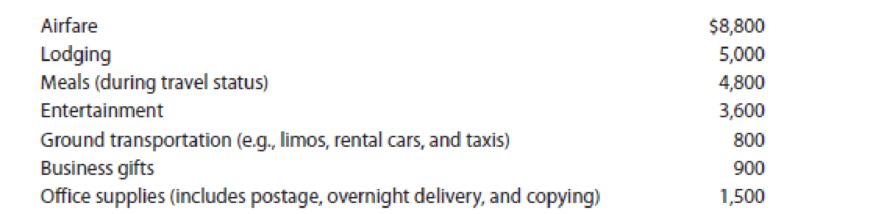

David’s employment-related expenses for 2018 are summarized below.

The entertainment involved taking clients to sporting and musical events. The business gifts consisted of $50 gift certificates to a national restaurant. These were sent by David during the Christmas holidays to 18 of his major clients.

In addition, David drove his 2016 Ford Expedition 11,000 miles for business and 3,000 for personal use during 2018. He purchased the Expedition on August 15, 2015, and has always used the automatic (standard) mileage method for tax purposes. Parking and tolls relating to business use total $340 in 2018.

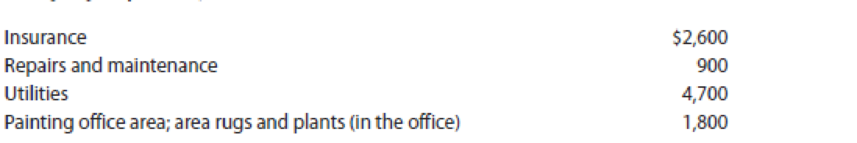

When the Coles purchased their present residence in April 2015, they devoted 450 of the 3,000 square feet of living space to an office for David. The property cost $440,000 ($40,000 of which is attributable to the land) and has since appreciated in value. Expenses relating to the residence in 2018 (except for mortgage interest and property taxes; see below) are as follows:

In terms of depreciation, the Coles use the MACRS percentage tables applicable to 39-year nonresidential real property. As to

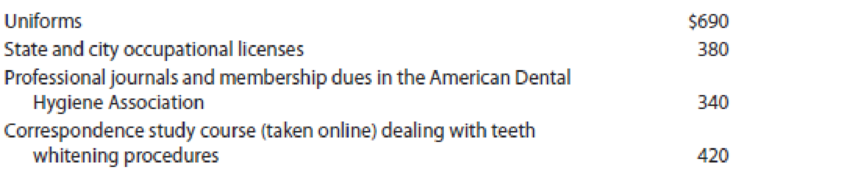

Ella works at a variety of offices as a substitute when a hygienist is ill or on vacation or when one of the clinics is particularly busy (e.g., prior to the beginning of the school year). Besides her transportation, she must provide and maintain her own uniforms. Her expenses for 2018 appear below.

Ella’s salary for the year is $42,000, and her Form W-2 for the year shows income tax withholdings of $5,000 (Federal) and $1,000 (state) and the proper amount of Social Security and Medicare taxes.

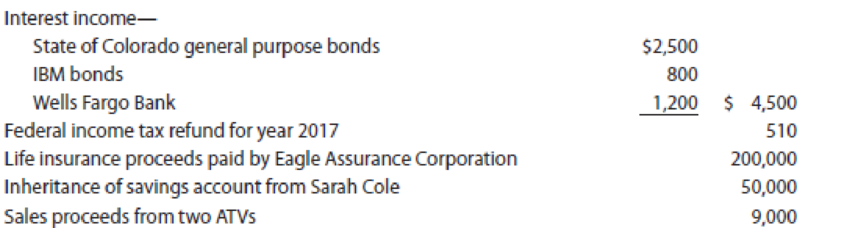

Besides die items already mentioned, die Coles had the following receipts during 2018.

For several years, the Coles’ household has included David’s divorced mother, Sarah, who has been claimed as their dependent. In late December 2017, Sarah unexpectedly died of coronary arrest in her sleep. Unknown to Ella and David, Sarah had a life insurance policy and a savings account (with David as the designated beneficiary of each). In 2017, the Coles purchased two ATVs for $14,000. After several near mishaps, they decided that the sport was too dangerous. In 2018, they sold the ATVs to their neighbor.

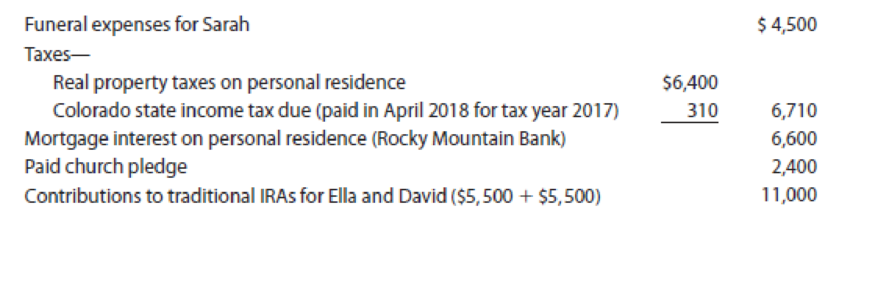

- Additional expenditures for 2018 include:

In 2018, the Coles made quarterly estimated tax payments of $6,000 (Federal) and $500 (state) for a total of $24,000 (Federal) and $2,000 (state).

Part 1—Tax Computation

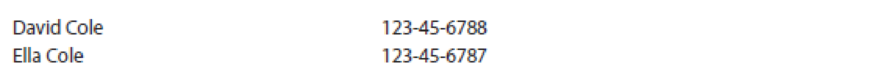

Using the appropriate forms and schedules, compute the Coles’ Federal income tax for 2018. Disregard the alternative minimum tax (AMT) and various education credits since these items are not discussed until later in the text (Chapters 12 and 13). Relevant Social Security numbers are:

The Coles do not want to contribute to the Presidential Election Campaign Fund. Also, they want any overpayment of tax refunded to them and not applied toward next year’s tax liability*. David will have a self-employment tax liability; refer to Exhibit 13 9 in Chapter 13 to compute this liability. Suggested software: ProConnect Tax Online.

Part 2—Follow-Up Advice

Ella has always wanted to pursue a career in nursing. To this end, she has earned a substantial number of college credits on a part-time basis. With Sarah no longer requiring home care, Ella believes that she can now complete her degree by attending college on a full-time basis.

David would like to know how Ella’s plans will affect their income tax position. Specifically, he wants to know:

- How much Federal income tax they will save if Ella quits her job.

- Any tax benefits that might be available from the cost of the education.

Write a letter to David addressing these concerns. Note: In making your projections, use the information generated in Part 1 and assume that the year remains 2018. Also disregard any consideration of the educational tax credits (i.e., American Opportunity and lifetime learning) since they are not discussed until Chapter 13.

1.

Calculate the Mrs. C’s federal income tax.

Explanation of Solution

Federal Income Tax: Federal income tax is the tax imposed by the federal government on the income of an individual and business organization. Federal income tax has a standard base for certain level of income.

Calculate the Mrs. C’s federal income tax.

| Particulars | Amount ($) | Amount ($) |

| Consulting practice (Mr. D) | ||

| Consulting fees | 145,000 | |

| Less: Business expenses | (31,803) | 113,197 |

| Earnings (Mrs. E) | 42,000 | |

| Interest income (Note 1) | ||

| Colorado bonds | 0 | |

| IBM bonds | 800 | |

| Wells F bank | 1,200 | 2,000 |

| Federal income tax refund (Note 2) | 0 | |

| Life insurance proceeds (Note 3) | 0 | |

| Inherited saving account (Note 4) | 0 | |

| One-half of self-employment taxes (Note 12) | (7,997) | |

| Sale of ATVs (Note 5) | 0 | |

| IRA contributions | (11,000) | |

| AGI | 138,200 | |

| Itemized deductions: | ||

| Medical (Note 7) | 0 | |

| Taxes: (Note 8) | ||

| Property | 5,440 | |

|

Income | 3,310 | |

| Interest (Note 9) | 5,610 | |

| Contributions | 2,400 | |

| Miscellaneous (Note 10) | 0 | |

| Total itemized deductions | 16,760 | |

| The Mr. & Mrs. C and will use the married, filing joint standard deduction since it is greater than their total itemized deductions | (24,000) | |

| Deduction for qualified business income (Note 11) | (21,040) | |

| Taxable income | $93,160 | |

| Tax on $93,160 using the 2018 tax tables | 12,378 | |

| 15,994 | ||

| Self-employment (Note 12) | 28,372 | |

| Less: Federal tax withheld and estimated tax payments | (29,000) | |

| Net tax due | (628) |

Table (1)

Notes:

- (1) On state and local bonds is an exclusion under § 103, interest.

- (2) Federal tax refunds are nontaxable.

- (3) Life insurance proceeds are exclusions under § 101.

- (4) Exclusions under § 102 are Inheritances.

- (5) Since, Sale of the ATV is zero because Mr. C paid $14,000 as a result its $5,000 loss. Therefore, it is not deductible in case of personal losses.

- (6) Compute Mr. D’s job expenses.

| Particulars | Amount ($) | Amount ($) |

| Airfare | 8,800 | |

| Lodging | 5,000 | |

| Meals | 2,400 | |

| Entertainment | 0 | |

| Transportation | 800 | |

| Business gifts | 450 | |

| Office supplies | 1,500 | |

| Business mileage | 5,995 | |

| Business parking and tolls | 340 | |

| Office in the home: 15%(business use) | ||

| Insurance | 390 | |

| Repairs and maintenance | 135 | |

| Utilities | 705 | |

| Interest | 990 | |

| Taxes | 960 | |

| Painting, area rugs, and plants | 1,800 | |

| Depreciation | 1,538 | 6,518 |

| Total | 31,803 |

Table (2)

Mr. D’s office in the home deduction under the simplified method would have been only $1,500.

(7) Mrs. S funeral expenses are not deductible because Mr. C did not provide any information.

(8) As part of the office in the home deduction property taxes of $960 have already been claimed. It includes 2017’s final amount of state income taxes, 2018’s state income taxes paid plus withholdings from salary of Mrs. E and 2018’s estimated state tax payments.

(9) As part of the office in home deduction interest of $990 is claimed.

(10) Miscellaneous expense is zero because Mrs. E is an employee, so job related expenses are miscellaneous itemized deductions.

(11) Mr. D is consulting is a “specified services” business, the Mr. C’s taxable income before the QBI deduction is less than where the phase out limitations apply. Mr. D’s QBI is $105,200 and less Mr. D’s self-employment tax deduction ($7,997). The modified taxable income is taxable income before the QBI deduction lee any net capital gain. Modified taxable income is $114,200 since they used the standard deduction.

20% of qualified business income $21,040

(Or)

20% of modified taxable income $22,840

Whichever is less is the deduction for qualified business income is $21,040.

(12) Compute self-employment tax.

| Particulars | Amount ($) |

| Schedule C net income | 113,197 |

| x 0.9235 | |

| Self-employment tax base (a) | $104,537 |

| Self-employment tax rate (b) | 15.3% |

| Self-employment tax (a x b) | 15,994 |

Table (3)

One-half of Mr. D’s self-employment taxes ($7,997) are allowed for AGI deduction.

2.

Write a report to Mr. D.

Explanation of Solution

Young, Nellen, Hoffman, Raabe, & Maloney, CPAs 5

5191 Natorp Boulevard

Mason, OH 45040

February 6, 2019

Mr. D

1820 Elk Avenue

Denver, CO 80202

Dear Mr.D:

From the enquiry regarding the job status of Ms. E, I can make certain projections with respect to the tax saving involved. Your joint tax liability would be reduced by $5,826 without her salary. This amount is based on the gross income falling by an amount of $42,000 along with your deductions for qualified business income reducing to $14,440. Your revised taxable income would be concluded to $57,760 and your tax liability that is based on 2018 Tax Tables amounts to $6,552.

You will be substituting her out-of-pocket job-related expenses of $1,830 that do not generate any tax benefit in terms of deductions. It will be substituted up to $4,000 in tuition expenses that would generate a tax benefit. Since you belong in the 12% tax bracket, a deduction of $4,000 will save you up to $480 in taxes.

My projections can be more accurate if you are aware about the college expense of Ms. E.

Sincerely,

Mr. J, Manager

Want to see more full solutions like this?

Chapter 9 Solutions

Individual Income Taxes

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardQuestion 1181 28 Current Attempt in Progress Here are comparative balance sheets for Migitsu Company. Prepare a statement of cash flows-indirect method. MIGITSU COMPANY Comparative Balance Sheets December 31 Assets 2020 2019 Cash $73,000 $22,000 Accounts receivable 87,000 76.000 Inventory 170,000 191.000 Land 72,000 100.000 Equipment 260,000 200.000 Accumulated depreciation - equipment (66,000) (32.000) Total $596,000 $557,000 Liabilities and Stockholders' Equity Accounts payable $37,000 $47.000 Bonds payable 150,000 210,000 Common stock ($1 par) 216.000 174,000 Retained earnings 193,000 126.000 Total $596,000 $557,000 Additional information: 1 Net income for 2020 was $100,000. N Cash dividends of $33,000 were declared and paid. 3. Bonds payable amounting to $60,000 were redeemed for cash $60,000. -18 4. Common stock was issued for $42,000 cash. 5. Equipment that cost $50,000 and had a book value of $30,000 was sold for $36,000 during 2020; land was sold at cost.arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning