Concept explainers

Activity-Based Costing: Cost Flows through T-Accounts

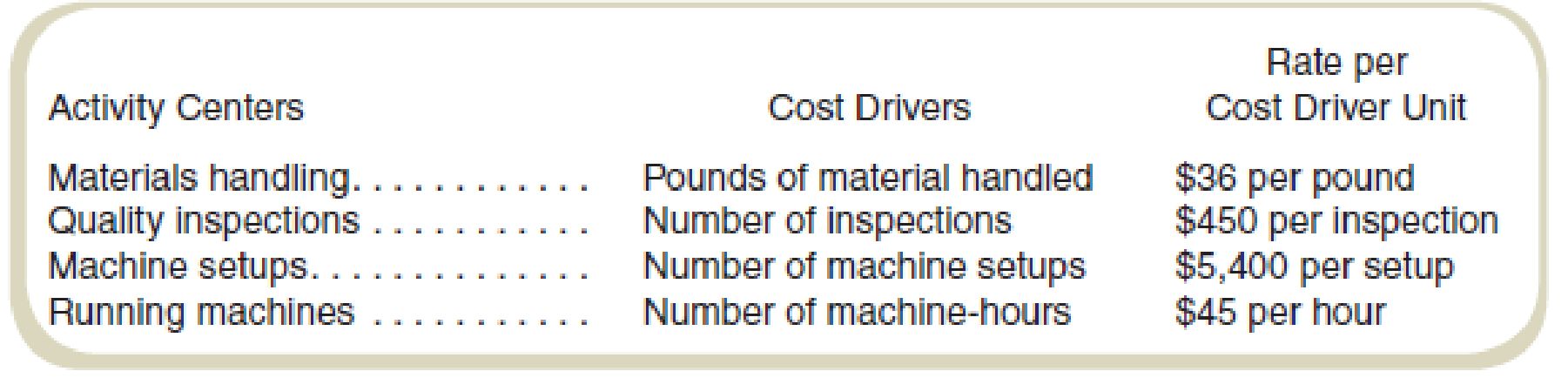

Southwest Components recently switched to activity-based costing from the department allocation method. The Fabrication Department manager has estimated the following cost drivers and rates:

Direct materials costs were $600,000 and direct labor costs were $300,000 during July, when the Fabrication Department handled 3,000 pounds of materials, made 500 inspections, had 25 setups, and ran the machines for 10,000 hours.

Required

Use T-accounts to show the flow of materials, labor, and

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Fundamentals of Cost Accounting

- Don't use ai given answer accountingarrow_forwardIf a company uses the FIFO method of inventory valuation and has the following purchases: 100 units at $10 each 150 units at $12 eachWhat is the value of inventory if 120 units are sold?helparrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,