Concept explainers

Estimating Exxon Mobil Corporation's Intrinsic Stock Value

Use online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions.

In this chapter, we described the various factors that influence stock prices and the approaches that analysts use to estimate a stock’s intrinsic value. By comparing these intrinsic value estimates to the current price, an investor can assess whether it makes sense to buy or sell a particular stock. Stocks trading at a price far below their estimated intrinsic values may be good candidates for purchase, whereas stocks trading at prices far in excess of their intrinsic value may be good stocks to avoid or sell Although estimating a stock's intrinsic value is a complex exercise that requires reliable data and good judgment, we can use the Internet to find financial data in order to arrive at a quick "back-of-the- envelope" calculation of intrinsic value.

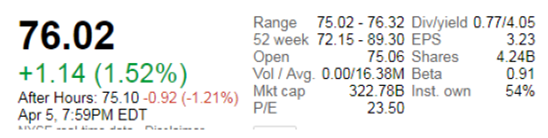

3. To provide a starting point for gauging a company's relative valuation, analysts often look at a company's price-to-earnings (P/E) ratio. Go to the website's summary quote or key statistics screen to see XOM's forward P/E ratio, which uses XOM's next 12-month estimate of earnings in the calculation, and to see its current P/E ratio. What are the firm’s forward and current P/E ratios?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Study Guide For Brigham/houston's Fundamentals Of Financial Management, 14th

- Don't used hand raiting and don't used Ai solutionarrow_forward3 years ago, you invested $9,200. In 3 years, you expect to have $14,167. If you expect to earn the same annual return after 3 years from today as the annual return implied from the past and expected values given in the problem, then in how many years from today do you expect to have $28,798?arrow_forwardPlease Don't use Ai solutionarrow_forward

- Ends Feb 2 Discuss and explain in detail the "Purpose of Financial Analysis" as well as the two main way we use Financial Ratios to do this.arrow_forwardWhat is the key arguments of the supporters of the EITC? Explain.arrow_forwardWhat is the requirements to be eligible to receive the EITC? Explain.arrow_forward

- Adidas annual income statement 2022-2023 and 2024arrow_forwardNikes annual balance sheet and income statement for 2022-2023 and 2024arrow_forwardWhat is the value at the end of year 3 of a perpetual stream of $70,000 semi-annual payments that begins at the end of year 7? The APR is 12% compounded quarterly.arrow_forward

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning