Fundamental Accounting Principles

23rd Edition

ISBN: 9781259536359

Author: John J Wild, Ken Shaw Accounting Professor, Barbara Chiappetta Fundamental Accounting Principles

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 3APSA

Problem 9-3A

Aging

P2 P3

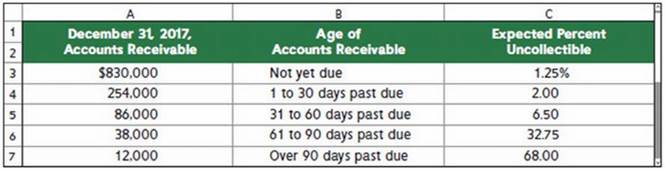

Jarden Company has credit sales of $3,600,000 for year 2017. On December 31, 2017, the company’s Allowance for Doubtful Accounts has an unadjusted credit balance of $14,500. Jarden prepares a schedule of its December 31, 2017, accounts receivable by age. On the basis of past experience, it estimates the percent of receivables in each age category that will become uncollectible. This information is summarized here.

Required

- Estimate the required balance of the Allowance for Doubtful Accounts at December 31, 2017, using the aging of accounts receivable method.

- Prepare the

adjusting entry to record bad debts expense at December 31, 2017.

Check (2) Dr. Bad Debts Expense, $27,150

Analysis Component

- 3. On June 30, 2018, Jarden Company concludes that a customer’s $4,750 receivable (created in 2017) is uncollectible and that the account should be written off. What effect will this action have on Jarden’s 2018 net income? Explain.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Find the rate of return on this investment for donne

Ingram Enterprises has variable expenses equal to 65% of sales. At a $500,000 sales level, the degree of operating leverage is 4.5. If sales increase by $50,000, what will be the new degree of operating leverage? Need answer

General Accounting question

Chapter 9 Solutions

Fundamental Accounting Principles

Ch. 9 - Prob. 1DQCh. 9 - Why does the direct write-off method of accounting...Ch. 9 - Prob. 3DQCh. 9 - Why might a business prefer a note receivable to...Ch. 9 - Prob. 5DQCh. 9 - Prob. 6DQCh. 9 - Prob. 7DQCh. 9 - Prob. 8DQCh. 9 - Prob. 9DQCh. 9 - Prob. 10DQ

Ch. 9 - Prob. 1QSCh. 9 - Prob. 2QSCh. 9 - Prob. 3QSCh. 9 - Distinguishing between allowance method and direct...Ch. 9 - Prob. 5QSCh. 9 - Prob. 6QSCh. 9 - Prob. 7QSCh. 9 - Prob. 8QSCh. 9 - Prob. 9QSCh. 9 - Prob. 10QSCh. 9 - Prob. 11QSCh. 9 - Prob. 12QSCh. 9 - Prob. 13QSCh. 9 - Prob. 1ECh. 9 - Prob. 2ECh. 9 - Prob. 3ECh. 9 - Prob. 4ECh. 9 - Prob. 5ECh. 9 - Prob. 6ECh. 9 - Prob. 7ECh. 9 - Prob. 8ECh. 9 - Prob. 9ECh. 9 - Prob. 10ECh. 9 - Prob. 11ECh. 9 - Prob. 12ECh. 9 - Prob. 13ECh. 9 - Prob. 14ECh. 9 - Prob. 15ECh. 9 - Prob. 16ECh. 9 - Prob. 17ECh. 9 - Prob. 1APSACh. 9 - Prob. 2APSACh. 9 - Problem 9-3A Aging accounts receivable and...Ch. 9 - Prob. 4APSACh. 9 - Prob. 5APSACh. 9 - Prob. 1BPSBCh. 9 - Prob. 2BPSBCh. 9 - Prob. 3BPSBCh. 9 - Prob. 4BPSBCh. 9 - Prob. 5BPSBCh. 9 - Business Solutions P1 P2 SP 9 Santana Rey, owner...Ch. 9 - Prob. 1GLPCh. 9 - Prob. 1BTNCh. 9 - Prob. 2BTNCh. 9 - Prob. 3BTNCh. 9 - Prob. 4BTNCh. 9 - Prob. 5BTNCh. 9 - Prob. 6BTNCh. 9 - Prob. 7BTNCh. 9 - Prob. 8BTNCh. 9 - Prob. 9BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License