1.

Compute the break-even point in total units and the number of units to be sold using weighted average contribution margin approach.

1.

Explanation of Solution

Compute the break-even point in total units and the number of units to be sold using weighted average contribution margin approach.

| Particulars | Total |

| Overall break-even point: | |

| Fixed costs (A) | $400,000 |

| Weighted average contribution per unit (B) | $20.00 |

| Break-even point | 20,000 units |

| Breakdown of overall breakeven sales in units: | |

| Product A: | 16,000 units |

| Product B: | 4,000 units |

Table (1)

2.

Compute the overall break even point using goal seek tool in excel.

2.

Explanation of Solution

Compute the overall break-even point using goal seek tool in excel.

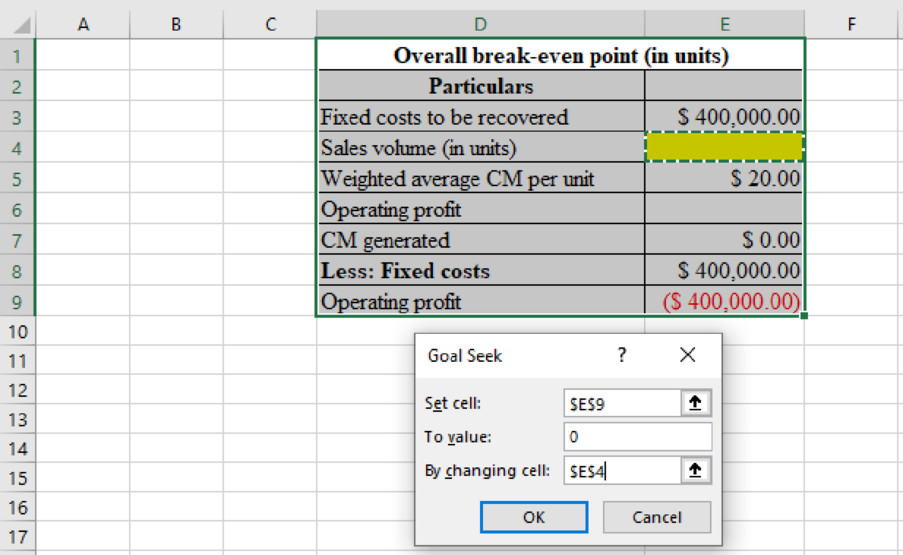

Step 1: Go to "Data," then "What-If Analysis," then "Goal Seek." The following window should appear:

Figure (1)

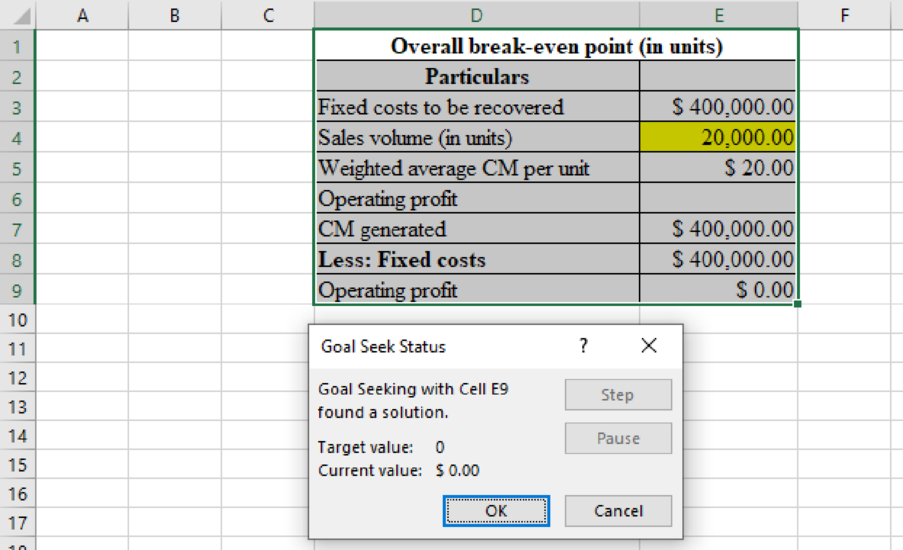

Step 2: After clicking OK the Goal seek function returns the value as shown below:

Figure (2)

3.

Compute the break-even in units and the breakdown of the total breakeven point into sales (in units) of each of the two products using sales basket approach.

3.

Explanation of Solution

Compute the units of each product to be sold.

| Contribution margin per sales basket | |||

| Product | Units | Unit price | Total |

| A | 4 units | $15 per unit | $60.00 |

| B | 1 unit | $40 per unit | $40.00 |

| Total contribution margin per sales basket (B) | $100.00 | ||

| Overall break-even point | |||

| Fixed cost (A) | $400,000 | ||

| Overall break-even point | 4,000 baskets | ||

| Overall breakeven point in units | 20,000 | ||

| Breakdown of overall breakeven point: | |||

| Product | Units | Unit per basket | Total |

| A | 4,000 baskets | 4 | 16,000 units |

| B | 4,000 baskets | 1 | 4,000 units |

Table (2)

4.

Compute the breakeven point in sales dollars using weighted average contribution margin ratio.

4.

Explanation of Solution

Compute the breakeven point in terms of dollars using weighted average contribution margin ratio.

| Step 1: Computation of total sales in dollars | |||||

| Product | Units sold | Unit sales price | Total | ||

| A | 18,000 units | $80 per unit | $1,440,000.00 | ||

| B | 4,500 unit | $140 per unit | $630,000.00 | ||

| Total sales in dollars | $2,070,000 | ||||

| Step 2: Compute the weights assigned to each product | |||||

| Product |

Sales dollars (1) |

Total sales in dollars (2) |

Assigned weights | ||

| A | $1,440,000.00 | $2,070,000 | 0.6956522 | ||

| B | $630,000.00 | $2,070,000 | 0.3043478 | ||

| Step 3: Computation of weighted average contribution margin ratio | |||||

| Product |

Assigned weights (1) |

Sales per unit (2) |

Contribution margin per unit (3) |

Weighted average contribution margin ratio | |

| A | 0.6956522 | $80 | $15 | 0.13043478 | |

| B | 0.3043478 | $140 | $40 | 0.08695652 | |

| 0.21739130 | |||||

| Break-even point overall dollars | $1,840,000 | ||||

| Breakdown of total breakeven sales dollars, by product | |||||

| Product A | $1,280,000 | ||||

| Product B | $560,000 | ||||

Table (3)

5.

Describe the statement “For the multiproduct firm, there is no breakeven point independent of

the sales-mix assumption”.

5.

Explanation of Solution

“For the multiproduct firm, there is no breakeven point independent of the sales mix assumption.” The companies dealing in multi products, it is presumed that the output that are sold in some standard mix are based either on relative physical units or relative sales dollars. If the individual products differ in terms of their contribution margins per unit (or contribution margin ratios), then the weighted-average contribution margin (and weighted-average contribution margin ratio) will change with respect to the changes in the sales mix. This, in turn, affects the breakeven point since that point is defined as the ratio of fixed costs to the weighted-average contribution margin per unit Certainly, if the unit contribution margins are the same for each product, then the assumed mix has no mathematical impact on the breakeven calculation.

6.

Explain the manner in which the break-even points will be affected by the increase in fixed costs. Explain the manner in which the percentage change in the break-even point will differ to the percentage change in fixed cost and explain the inference that could be drawn on the basis of calculation.

6.

Explanation of Solution

Explain the manner in which the break-even points will be affected by the increase in fixed costs.

| Change in the breakeven point (in total units) in response to a 10% change in fixed costs: | |

| New level of fixed costs | $440,000 |

| Original level of fixed costs (B) | $400,000 |

| Change in fixed costs | $40,000 |

| Percentage change in fixed costs | 10.00% |

| New breakeven point | 22,000 units |

| Less: Original breakeven point (E) | 20,000 units |

| Change in breakeven point (F) | 2,000 units |

| Percentage change in break-even point | 10.00% |

Table (4)

The percentage change in fixed costs of 10%t led to an identical percentage change in the breakeven point. Because of the linear cost functions assumed in a conventional CVP model, this finding can be generalized as follows: Keeping everything constant, a given percentage change (+ or −) in the amount of fixed costs leads to an equivalent percentage change in the breakeven point.

Want to see more full solutions like this?

Chapter 9 Solutions

COST MANAGMENT WITH CONNECT ACCESS

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education