MANAGERIAL ACCOUNTING (PRINT UPGRADE)

12th Edition

ISBN: 9781264119547

Author: HILTON

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 35P

Alpha-Tech, a rapidly growing distributor of electronic components, is formulating its plans for 20x5. Carol Jones, the firm’s marketing director, has completed the following sales

Phillip Smith, an accountant in the Planning and Budgeting Department, is responsible for preparing the

- Alpha-Tech’s excellent record in

accounts receivable collection is expected to continue. Sixty percent of billings are collected the month after the sale, and the remaining 40 percent two months after. - The purchase of electronic components is Alpha-Tech’s largest expenditure, and each month’s cost of goods sold is estimated to be 40 percent of sales. Seventy percent of the parts are received by Alpha-Tech one month prior to sale, and 30 percent are received during the month of sale.

- Historically, 75 percent of accounts payable has been paid one month after receipt of the purchased components, and the remaining 25 percent has been paid two months after receipt.

- Hourly wages and

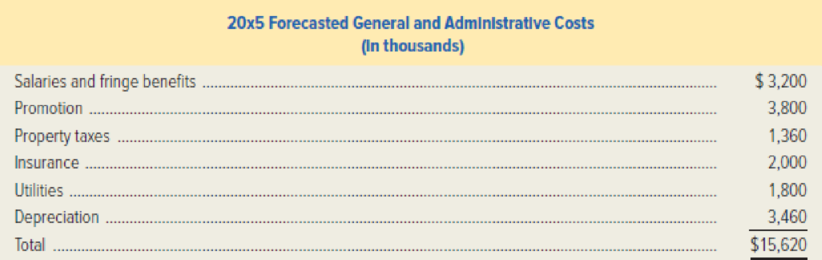

fringe benefits , estimated to be 30 percent of the current month’s sales, are paid in the month incurred. - General and administrative expenses are projected to be $15,620,000 for the year. The breakdown of these expenses is presented in the following schedule. All cash expenditures are paid uniformly throughout the year, except the property taxes, which are paid in four equal installments at the end of each quarter.

- Income-tax payments are made at the beginning of each calendar quarter based on the income of the prior quarter. Alpha-Tech is subject to an income-tax rate of 40 percent. Alpha-Tech’s operating income for the first quarter of 20x5 is projected to be $3,200,000. The company pays 100 percent of the estimated tax payment.

- Alpha-Tech maintains a minimum cash balance of $500,000. If the cash balance is less than $500,000 at the end of each month, the company borrows amounts necessary to maintain this balance. All amounts borrowed are repaid out of the subsequent positive cash flow. The projected April 1, 20x5, opening balance is $500,000.

- Alpha-Tech has no short-term debt as of April 1, 20x5.

- Alpha-Tech uses a calendar year for both financial reporting and tax purposes.

Required:

- 1. Prepare a

cash budget for Alpha-Tech by month for the second quarter of 20x5. For simplicity, ignore any interest expense associated with borrowing. - 2. Discuss why cash budgeting is important for Alpha-Tech.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Rolles Company has a contribution margin ratio of 27%. The company is considering a proposal that will increase sales by $130,000. What increase in profit can be expected assuming total fixed costs increase by $25,000?

answer is

answer please

Chapter 9 Solutions

MANAGERIAL ACCOUNTING (PRINT UPGRADE)

Ch. 9 - Explain how a budget facilitates communication and...Ch. 9 - Prob. 2RQCh. 9 - Prob. 3RQCh. 9 - Prob. 4RQCh. 9 - Prob. 5RQCh. 9 - What is meant by the term operational budgets?...Ch. 9 - How does activity-based budgeting explain the...Ch. 9 - Prob. 8RQCh. 9 - Give three examples of how the City of Boston...Ch. 9 - Describe the role of a budget director.

Ch. 9 - What is the purpose of a budget manual?Ch. 9 - Prob. 12RQCh. 9 - Prob. 13RQCh. 9 - Define the term budgetary slack, and briefly...Ch. 9 - How can an organization help to reduce the...Ch. 9 - Prob. 16RQCh. 9 - Discuss this comment by a small-town bank...Ch. 9 - List the steps you would go through in developing...Ch. 9 - Prob. 19RQCh. 9 - Prob. 20RQCh. 9 - Fill in the missing amounts in the following...Ch. 9 - Bodin Company budgets on an annual basis. The...Ch. 9 - Coyote Loco, Inc., a distributor of salsa, has the...Ch. 9 - Greener Grass Fertilizer Company plans to sell...Ch. 9 - The following information is from Tejas...Ch. 9 - Tanya Williams is the new accounts manager at East...Ch. 9 - Sound Investments, Inc. is a large retailer of...Ch. 9 - Handy Hardware is a retail hardware store....Ch. 9 - Prob. 30ECh. 9 - Spiffy Shades Corporation manufactures artistic...Ch. 9 - Western State University (WSU) is preparing its...Ch. 9 - Mary and Kay, Inc., a distributor of cosmetics...Ch. 9 - Prob. 34PCh. 9 - Alpha-Tech, a rapidly growing distributor of...Ch. 9 - Prob. 36PCh. 9 - Scholastic Furniture, Inc. manufactures a variety...Ch. 9 - Prob. 38PCh. 9 - Vista Electronics, Inc. manufactures two different...Ch. 9 - Prob. 40PCh. 9 - Toronto Business Associates, a division of Maple...Ch. 9 - FreshPak Corporation manufactures two types of...Ch. 9 - Healthful Foods Inc., a manufacturer of breakfast...Ch. 9 - We really need to get this new material-handling...Ch. 9 - City Racquetball Club (CRC) offers racquetball and...Ch. 9 - Patricia Eklund, controller in the division of...Ch. 9 - Jeffrey Vaughn, president of Frame-It Company, was...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the average investment in receivables of this financial accounting question?arrow_forwardIf the beginning inventory is $75,000, the cost of goods purchased is $420,000, and the ending inventory is $65,000, what is the cost of goods sold for Mayur Enterprises? a. $430,000 b. $440,000 c. $410,000 d. $460,000arrow_forwardhelp me to solve this questions managerial accountingarrow_forward

- Ans?arrow_forwardPlease provide answer this financial accounting questionarrow_forwardJob N5R was ordered by a customer on September 25. During the month of September, Jaycee Corporation requisitioned $2,650 of direct materials and used $5,200 of direct labor. The job was not finished by the end of September but needed an additional $3,150 of direct materials and additional direct labor of $7,800 to finish the job in October. The company applies overhead at the end of each month at a rate of 250% of the direct labor cost incurred. What is the total cost of the job when it is completed in October?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY