Concept explainers

Spiffy Shades Corporation manufactures artistic frames for sunglasses. Talia Demarest, controller, is responsible for preparing the company’s

Labor-related costs include pension contributions of $.50 per hour, workers’ compensation insurance of $.20 per hour, employee medical insurance of $.80 per hour, and employer contributions to Social Security equal to 7 percent of direct-labor wages. The cost of employee benefits paid by the company on its employees is treated as a direct-labor cost. Spiffy Shades Corporation has a labor contract that calls for a wage increase to $18.00 per hour on April 1, 20x1. Management expects to have 16,000 frames on hand at December 31, 20x0, and has a policy of carrying an end-of-month inventory of 100 percent of the following month’s sales plus 50 percent of the second following month’s sales.

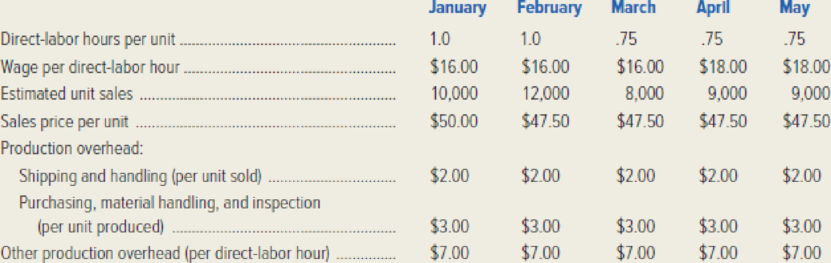

These and other data compiled by Demarest are summarized in the following table.

Required:

- 1. Prepare a production budget and a direct-labor budget for Spiffy Shades Corporation by month and for the first quarter of 20x1. Both budgets may be combined in one schedule. The direct-labor budget should include direct-labor hours and show the detail for each direct-labor cost category.

- 2. For each item used in the firm’s production budget and direct-labor budget, identify the other components of the master budget (except for financial statement budgets) that also would, directly or indirectly, use these data.

- 3. Prepare a production

overhead budget for each month and for the first quarter.

1.

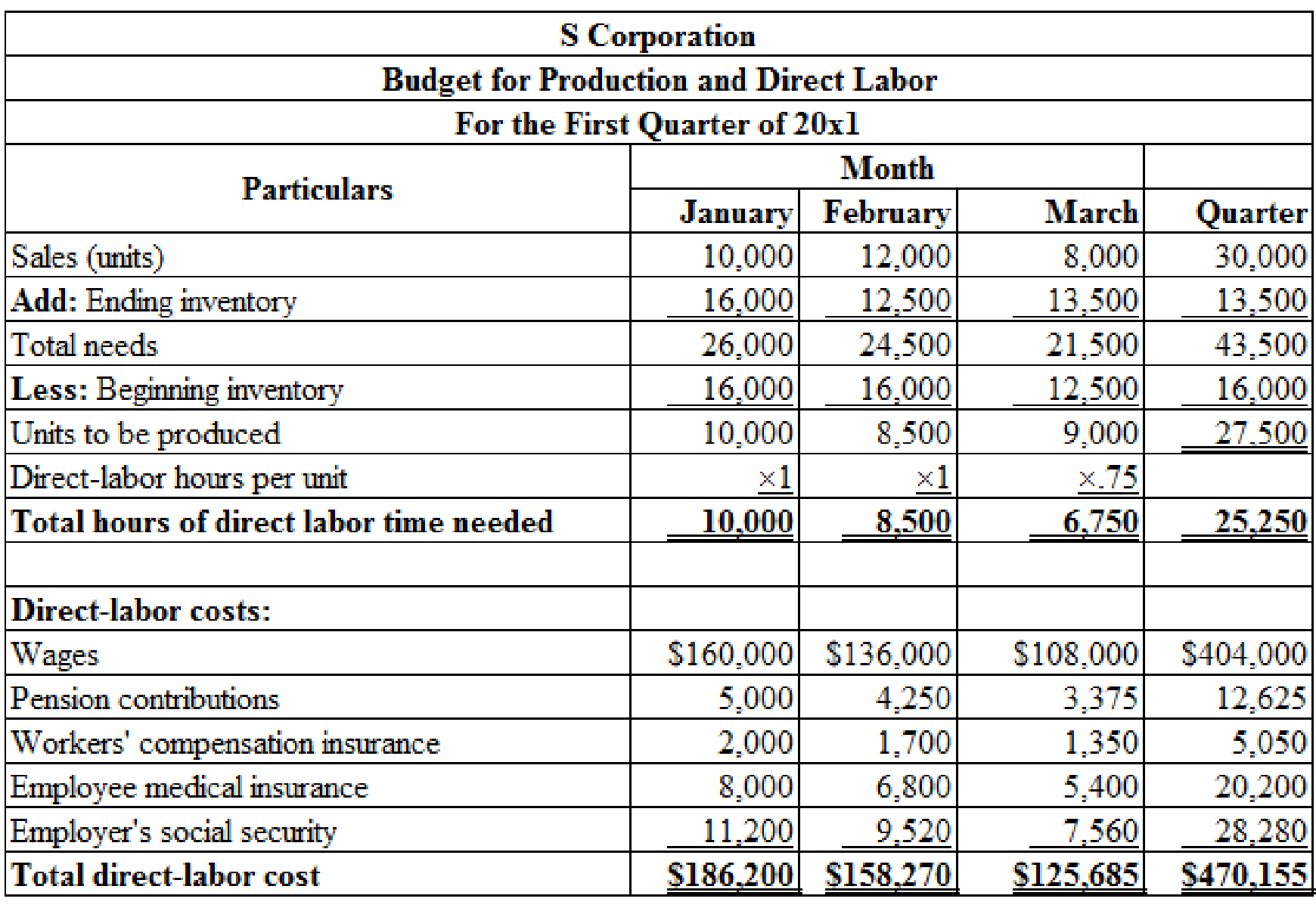

Prepare a production budget and a direct-labor budget for S Corporation by month and for the first quarter of 20x1.

Explanation of Solution

Production Budget: The production budget refers to that budget which forecasts the production for the future accounting period. The budgeted production for any financial period is planned by combining the forecasted unit of sales and the finished goods inventory and deducting the beginning goods inventory.

Direct labor budget: Direct labor budget is an estimation of direct labor hours required for the budgeted units of production is known as direct labor budget.

Prepare a production budget and a direct-labor budget for S Corporation by month and for the first quarter of 20x1:

Table (1)

Working note 1:

Calculate the amount of ending inventory for January:

Working note 2:

Calculate the amount of ending inventory for February:

Working note 3:

Calculate the amount of ending inventory for March:

Working note 4:

Calculate the amount of wages for January:

Working note 5:

Calculate the amount of wages for February:

Working note 6:

Calculate the amount of wages for March:

Working note 7:

Calculate the amount of pension contribution for January:

Working note 8:

Calculate the amount of pension contribution for February:

Working note 9:

Calculate the amount of pension contribution for March:

Working note 10:

Calculate the amount of workers’ compensation insurance for January:

Working note 11:

Calculate the amount of workers’ compensation insurance for February:

Working note 12:

Calculate the amount of workers’ compensation insurance for March:

Working note 13:

Calculate the amount of employee medical insurance for January:

Working note 14:

Calculate the amount of employee medical insurance for February:

Working note 15:

Calculate the amount of employee medical insurance for March:

Working note 16:

Calculate the amount of employee social security for January:

Working note 17:

Calculate the amount of employee social security for February:

Working note 18:

Calculate the amount of employee social security for March:

2.

Identify the other components of the master budget.

Explanation of Solution

Master Budget: The master budget is the core budget that describes the full process of budget. This budget shows all the operating and financial budgets of the company for a budgeted accounting period and this budget includes all the budgets and budgeted financial statements.

Identify the other components of the master budget:

The following are the components of the master budget except production budget and direct labor budget but use the sales data:

- Sales budget

- Cost of goods sold budget

- Selling and administrative expense budget

The following are the components of the master budget except production budget and direct labor budget but use the production data:

- Direct material budget

- Production-overhead budget

- Cost of goods sold budget

The following are the components of the master budget except production budget and direct labor budget but use the direct labor hour data:

- Production-overhead budget

The following are the components of the master budget except production budget and direct labor budget but use the direct labor cost data:

- Production-overhead budget

- Cost of goods sold budget

- Cash budget

- Budgeted income statement

3.

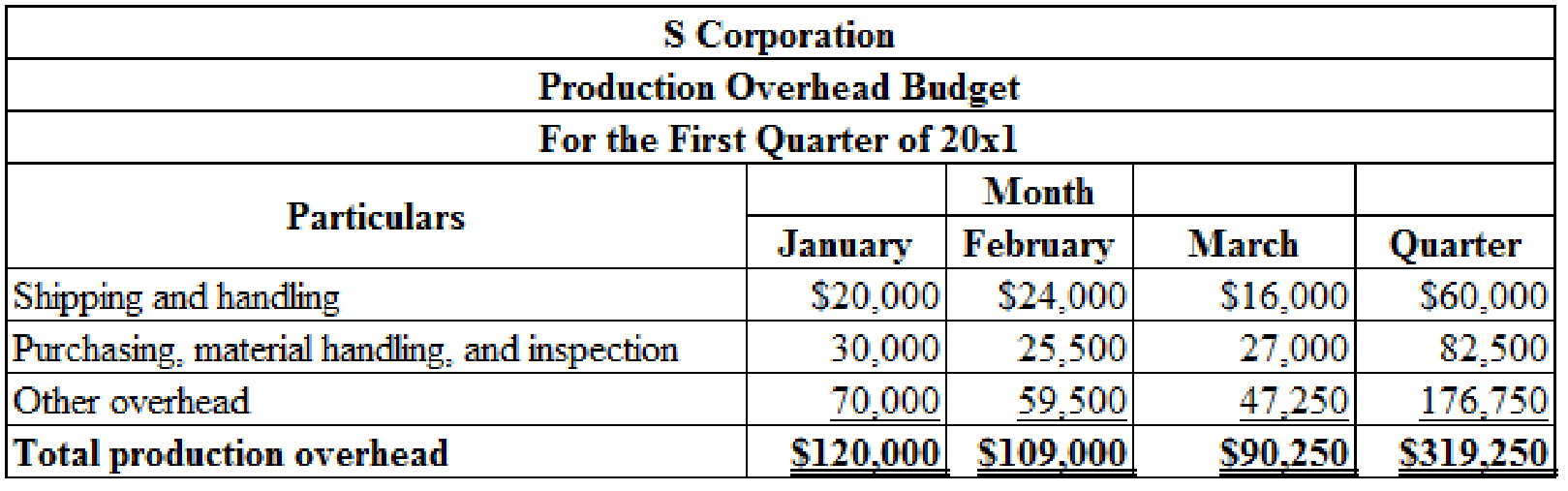

Prepare a production overhead budget for each month and for the first quarter.

Explanation of Solution

Manufacturing Overhead Budget: Manufacturing overhead budget is prepared to predict all indirect manufacturing costs. It excludes direct materials and direct labor. It is necessary to anticipate overhead budget to meet the budgeted production for the next accounting period.

Prepare a production overhead budget for each month and for the first quarter:

Table (2)

Want to see more full solutions like this?

Chapter 9 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Repsola is a drilling company that operates an offshore Oilfield in Feeland. Five yearsago, Feeland had a major oil discovery and granted licenses to drill oil to reputable,experienced drilling companies. The licensing agreement requires the company toremove the oil rig at the end of production and restore the seabed. Ninety percent ofthe eventual costs of undertaking the work relate to the removal of the oil rig andrestoration of damage caused by building it and ten percent arise through theextraction of the oil. At the Statement of Financial Position (SOFP) date (December 312025), the rig has been constructed but no oil has been extractedOn January 1st 2023, Repsola obtained the license to construct an oil rig at a cost of$500 million. Two years later the oil rig was completed. The rig is expected to beremoved in 20 years from the date of acquisition. The estimated eventual cost is 100million. The company’s cost of capital is 10% and its year end is December 31st. Repsolauses…arrow_forwardMaharaj Garage & Car Supplies sells a variety of automobile cleaning gadgets including a variety of hand vacuums. The business began the first quarter (January to March) of 2024 with 20 (Mash up Dirt) deep clean, cordless vacuums at a total cost of $126,800. During the quarter, the business completed the following transactions relating to the "Mash up Dirt" brand. January 8 January 31 February 4 February 10 February 28 March 4 March 10 March 31 March 31 105 vacuums were purchased at a cost of $6,022 each. In addition, the business paid a freight charge of $518 cash on each vacuum to have the inventory shipped from the point of purchase to their warehouse. The sales for January were 85 vacuums which yielded total sales revenue of $768,400. (25 of these units were sold on account to Mandys Cleaning Supplies, a longstanding customer) A new batch of 65 vacuums was purchased at a total cost of $449,800 8 of the vacuums purchased on February 4 were returned to the supplier, as they were…arrow_forwardTutor give me ansarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College