Concept explainers

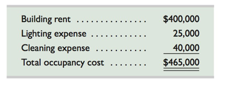

Harmon’s has several departments that occupy all floors of a two-story building that includes a basement floor. Harmon rented this building under a long-term lease negotiated when rental rates were low. The departmental accounting system has a single account, Building Occupancy Cost, in its ledger. The types and amounts of occupancy costs recorded in this account for the current period follow.

The building has 7,500 square feet on each of the upper two floors but only 5,000 square feet in the basement. In prior periods, the

20,000 square feet to find an average cost of $23.25 per square foot and then charged each department a building occupancy cost equal to this rate times the number of square feet that it occupies.

Jordan Style manages a department that occupies 2,000 square feet of basement floor space. In discussing the departmental reports with other managers, she questions whether using the same rate per square for all departments makes sense different floor space has different values. Style checked a recent real estate report of average local rental costs for similar space that shows first-floor space worth $40 per square foot, second-floor space worth $20 per square foot, and basement space worth $10 per square foot (excluding costs for lighting and Cleaning).

Required

1. Allocate occupancy costs to Style’s department using the current allocation method.

2. Allocate the building rent cost to Style’s department in proportion to the relative market value of the floor space. Allocate to Style’s department the lighting and cleaning costs in proportion to the square feet occupied (ignoring floor space market values). Then, compute the total occupancy cost allocated to Style’s department.

Analysis Component

3. Which allocation method would you prefer if you were a manager of a basement department?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Managerial Accounting

- Halle Manufacturing has an overhead application rate of 125% and allocates overhead based on direct materials. During the current period, direct labor is $78,000, and direct materials used are $112,000. Determine the amount of overhead Halle Manufacturing should record in the current period. a. $78,000 b. $97,500 c. $112,000 d. $140,000 e. $190,000arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forwardBentley industries applied manufacturing overhead on the basis of direct labor hours.arrow_forward

- Solve this question and accountingarrow_forwardDaley Industries wishes to develop a single predetermined overhead rate. The company's expected annual fixed overhead is $420,000, and its variable overhead cost per machine hour is $3.25. The company's relevant range is from 200,000 to 650,000 machine hours. Daley expects to operate at 520,000 machine hours for the coming year. The plant's theoretical capacity is 850,000 machine hours. The predetermined overhead rate per machine hour should be: a. $3.85 b. $4.06 c. $3.75 d. $4.25arrow_forwardAccounting question ?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning