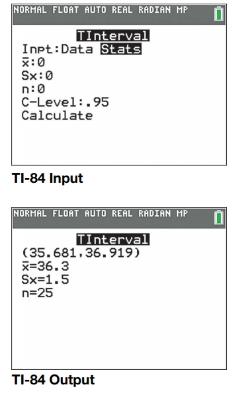

Problem 1SE: Ages A study of all the students at a small college showed a mean age of 20.7 and a standard... Problem 2SE: Units A survey of 100 random full-time students at a large university showed the mean number of... Problem 3SE: Exam Scores The distribution of the scores on a certain exam is N80,5 which means that the exam... Problem 4SE: Exam Scores The distribution of the scores on a certain exam is N100,10 which means that the exam... Problem 5SE: Showers According to home-water-works.org, the average shower in the United States lasts 8.2... Problem 6SE: Smartphones According to a 2017 report by ComScore .com, the mean time spent on smartphones daily by... Problem 7SE: Retirement Income Several times during the year, the U.S. Census Bureau takes random samples from... Problem 8SE: Time Employed A human resources manager for a large company takes a random sample of 50 employees... Problem 9SE: Driving (Example 1) Drivers in Wyoming drive more miles yearly than motorists in any other state.... Problem 10SE: Driving Drivers in Alaska drive fewer miles yearly than motorists in any other state. The annual... Problem 11SE: Babies Weights (Example 2) Some sources report that the weights of full-term newborn babies have a... Problem 12SE: Babies’ Weights, Again Some sources report that the weights of full-term newborn babies have a mean... Problem 13SE: (Example 3) Income in Maryland According to a 2018 Money magazine article, Maryland has one of the... Problem 14SE: Income in Kansas According to a 2018 Money magazine article, the average income in Kansas is... Problem 15SE: CLT Shapes (Example 4) One of the histograms is a histogram of a sample (from a population with a... Problem 16SE: Used Van Costs One histogram shows the distribution of costs for all used Toyota Sienna vans for... Problem 17SE: (Example 5) Age of Used Vans The mean age of all 118 used Toyota vans for sale (see exercise 9.16 )... Problem 18SE: Student Ages The mean age of all 2550 students at a small college is 22.8 years with a standard... Problem 19SE Problem 20SE Problem 21SE Problem 22SE Problem 23SE: Private University Tuition (Example 7) A random sample of 25 private universities was selected. A 95... Problem 24SE: Random Numbers If you take samples of 40 lines from a random number table and find that the... Problem 25SE: t* (Example 8) A researcher collects one sample of 27 measurements from a population and wants to... Problem 26SE: t* A researcher collects a sample of 25 measurements from a population and wants to find a 99... Problem 27SE: Heights of 12th Graders (Example 9) A random sample of 30 12th-grade students was selected. The... Problem 28SE: Drinks A fast-food chain sells drinks that it calls HUGE. When we take a sample of 25 drinks and... Problem 29SE: Men’s Pulse Rates (Example 10) A random sample of 25 men’s resting pulse rates shows a mean of 72... Problem 30SE: Travel Time to School A random sample of 50 12th-grade students was asked how long it took to get to... Problem 31SE: RBIs (Example 11) A random sample of 25 baseball players from the 2017 Major League Baseball season... Problem 32SE: RBIs Again In exercise 9.31, two intervals were given for the same data, one for 95 confidence and... Problem 33SE: Confidence Interval Changes State whether each of the following changes would make a confidence... Problem 34SE: Confidence Interval Changes State whether each of the following changes would make a confidence... Problem 35SE: Potatoes The weights of four randomly and independently selected bags of potatoes labeled 20 pounds... Problem 36SE: Tomatoes The weights of four randomly and independently selected bags of tomatoes labeled 5 pounds... Problem 37SE: Human Body Temperatures (Example 12) A random sample of 10 independent healthy people showed the... Problem 38SE: Reaction Distance Data on the disk and website show reaction distances in centimeters for the... Problem 39SE: Potatoes Use the data from exercise 9.35. a. If you use the four-step procedure with a two-sided... Problem 40SE: Tomatoes Use the data from exercise 9.36. a. Using the four-step procedure with a two-sided... Problem 41SE: Cholesterol In the U.S. Department of Health has suggested that a healthy total cholesterol... Problem 42SE: BMI A body mass index (BMI) of more than 25 is considered unhealthy. The Minitab output given is... Problem 43SE: Male Height In the United States, the population mean height for 3-year-old boys is 38 inches... Problem 44SE: Female Height In the United States, the population mean height for 10-year-old girls is 54.5 inches.... Problem 45SE: Deflated Footballs? Patriots In the 2015 AFC Championship game, there was a charge the New England... Problem 46SE: Deflated Footballs? Colts In the 2015 AFC Championship game, there was a charge the New England... Problem 47SE: Movie Ticket Prices According to Deadline.com, the average price for a movie ticket in 2018 was... Problem 48SE: Broadway Ticket Prices According to Statista.com, the average price of a ticket to a Broadway show... Problem 49SE: Atkins Diet Difference Ten people went on an Atkins diet for a month. The weight losses experienced... Problem 50SE: Pulse Difference The following numbers are the differences in pulse rate (beats per minute) before... Problem 51SE: Student Ages Suppose that 200 statistics students each took a random sample (with replacement) of 50... Problem 52SE: Presidents’ Ages at Inauguration A 95 confidence interval for the ages of the first six presidents... Problem 53SE: Independent or Paired (Example 13) State whether each situation has independent or paired... Problem 54SE: Independent or Paired State whether each situation has independent or paired (dependent) samples. a.... Problem 55SE: Televisions: CI (Example 14) Minitab output is shown for a two-sample t-interval for the number of... Problem 56SE: Pulse and Gender: CI Using data from NHANES, we looked at the pulse rate for nearly 800 people to... Problem 57SE: Televisions (Example 15) The table shows the Minitab output for a two-sample t-test for the number... Problem 58SE: Pulse Rates Using data from NHANES, we looked at the pulse rates of nearly 800 people to see whether... Problem 59SE: Triglycerides Triglycerides are a form of fat found in the body. Using data from NHANES, we looked... Problem 60SE: Systolic Blood Pressures When you have your blood pressure taken, the larger number is the systolic... Problem 61SE: Triglycerides, Again Report and interpret the 95 confidence interval for the difference in mean... Problem 62SE: Blood Pressures, Again Report and interpret the 95 confidence interval for the difference in mean... Problem 63SE: Baseball Salaries A random sample of 40 professional baseball salaries from 1985 through 2015 was... Problem 64SE: College Athletes’ Weights A random sample of male college baseball players and a random sample of... Problem 65SE: Baseball Salaries In exercise 9.63 you could not reject the null hypothesis that the mean salary for... Problem 66SE: College Athletes’ Weights In exercise 9.64, you could reject the null hypothesis that the mean... Problem 67SE: Textbook Prices, UCSB vs. CSUN (Example 16) The prices of a sample of books at University of... Problem 68SE: Textbook Prices. OC vs. CSUN The prices of a random sample of comparable (matched) textbooks from... Problem 69SE: Females’ Pulse Rates before and after a Fright (Example 17) In a statistics class taught by one of... Problem 70SE: Males’ Pulse Rates before and after a Fright Follow the instructions for exercise 9.69, but use the... Problem 71SE: Organic Food A student compared organic food prices at Target and Whole Foods. The same items were... Problem 72SE: Body Temperature The body temperatures of 65 men and 65 women were compared. The results of a... Problem 73SE: Ales vs. IPAs Data were collected on calorie content in ales and IPAs and is summarized in the... Problem 74SE: Surfers Surfers and statistics students Rex Robinson and Sandy Hudson collected data on the number... Problem 75SE: Self-Reported Heights of Men (Example 18) A random sample of students at Oxnard College reported... Problem 76SE: Eating Out Jacqueline Loya, a statistics student, asked students with jobs how many times they went... Problem 77SE Problem 78SE: Self-Driving Cars A survey of asked respondents how long (in years) they thought it would be before... Problem 79CRE: Women’s Heights Assume women’s heights are approximately Normally distributed with a mean of 65... Problem 80CRE: Showers According to home-water-works.org, the average shower in the United States lasts 8.2... Problem 81CRE: Choose a test for each situation: one-sample t-test, two-sample t-test, paired t-test, and no... Problem 82CRE: Choose a t-test for each situation: one-sample t-test, two-sample t-test, paired t-test, and no... Problem 83CRE: Cones: 3 Tests A McDonald’s fact sheet says its cones should weigh 3.18 ounces (converted from... Problem 84CRE Problem 85CRE: Brain Size Brain size for 20 random women and 20 random men was obtained and is reported in the... Problem 86CRE: Reducing Pollution A random sample of 12th-grade students were asked to rate the importance of... Problem 87CRE: Heart Rate before and after Coffee Elena Lucin, a statistics student, collected the data in the... Problem 88CRE: Exam Grades The final exam grades for a sample of day-time statistics students and evening... Problem 89CRE: Hours of Television Viewing The number of hours per week of television viewing for random samples of... Problem 90CRE: Reaction Distances Reaction distances in centimeters for a random sample of 40 college students were... Problem 91CRE: Ales vs. Lagers Data were collected on calorie content for a random sample of ales and lagers and... Problem 92CRE: Weights of Hockey and Baseball Players Data were collected on the weights of random samples of... Problem 93CRE: Grocery Delivery The table shows the prices for identical groceries at two online grocery delivery... Problem 94CRE: Parents The following table shows the heights (in inches) of a random sample of students and their... Problem 95CRE: Why Is n1 in the Sample Standard Deviation? Why do we calculate s by dividing by n1, rather than... Problem 96CRE Problem 97CRE: Construct two sets of body temperatures (in degrees Fahrenheit, such as 96.2F ), one for men and one... Problem 98CRE: Construct heights for 3 or more sets of twins (6 or more people). Make the twins similar, but not... format_list_bulleted

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt