Concept explainers

Project Evaluation. Aria Acoustics, Inc. (AAI), projects unit sales for a new seven-octave voice emulation implant as follows:

| Year | Unit Sales |

| 1 | 67,500 |

| 2 | 83,900 |

| 3 | 98,700 |

| 4 | 86,000 |

| 5 | 72,000 |

Production of the implants will require $1,500,000 in net working capital to start and additional net working capital investments each year equal to 15 percent of the projected sales increase for the following year. Total fixed costs are $1,950,000 per year, variable production costs are $230 per unit, and the units are priced at $355 each. The equipment needed to begin production has an installed cost of $18,500,000. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus qualifies as seven-year MACRS property. In five years, this equipment can be sold for about 20 percent of its acquisition cost. AAI is in the 35 percent marginal tax bracket and has a required return on all its projects of 15 percent. Based on these preliminary project estimates, what is the

To find: The net present value and the internal rate of return.

Introduction:

The variation between the present value of the cash outflows and the present value of the cash inflows is known as net present value. In capital budgeting, the net present value is utilized to analyze the profitability of a project or investment. The rate of return which equates the initial investment and the present value of net cash inflows are referred to as internal rate of return. This is also called as actual rate of return.

Answer to Problem 25QP

The net present value is $3,643,713.77 and the internal rate of return is 21.47%.

Explanation of Solution

Given information:

Company A projects the unit sale for the new 7-octave voice emulation implant as follows:

- The year 1 unit sales is 67,500.

- The year 2 unit sales is 83,900.

- The year 3 unit sales is 98,700.

- The year 4 unit sales is 86,000.

- The year 5 unit sales is 72,000.

The production implant needs $1,500,000 in the net working capital to begin their production activities. The extra net working capital investment for every year is equivalent to the 15% of the projected sales, which has to rise for the following year. The total fixed cost is $1,950,000 for a year, the unit price is $230, and the variable production cost is $355. The installation cost of the equipment is $18,500,000.

The equipment is qualified in the 7-Year MACRS depreciation under the property class. In 5 years, the equipment sale can be sold for 20% of its acquisition cost. The marginal tax bracket is 35% and has the required rate of return of 15%.

MACRS depreciation table for year 7:

| MACRS Depreciation table for seven year | |

| Year | Seven year |

| 1 | 14.29% |

| 2 | 24.49% |

| 3 | 17.49% |

| 4 | 12.49% |

| 5 | 8.93% |

| 6 | 8.92% |

| 7 | 8.93% |

| 8 | 4.46% |

Computation of the cash outflow:

Calculations:

The sales figure for every year along with the unit price is given. The variable cost for a unit is utilized to compute the total variable cost and the fixed cost are stated as $1,950,000 for a year.

The depreciation is calculated by using the initial cost of the equipment, which is $18,500,000 times the actual MACRS depreciation for every year. At the bottom of the of the income statement, the depreciation is added back to determine the operating cash flow for every year.

Table showing the cash inflows:

| Year | 1 | 2 | 3 | 4 | 5 |

| Ending book value | $15,856,350 | $11,325,700 | $8,090,050 | $5,779,400 | $4,127,350 |

| Sales | $23,962,500 | $29,784,500 | $35,038,500 | $30,530,000 | $25,560,000 |

| Less: Variable costs | 15,525,000 | 19,297,000 | 22,701,000 | 19,780,000 | 16,560,000 |

| Fixed costs | 1,950,000 | 1,950,000 | 1,950,000 | 1,950,000 | 1,950,000 |

| Depreciation | 2,643,650 | 4,530,650 | 3,235,650 | 2,310,650 | 1,652,050 |

| EBIT | 3,843,850 | 4,006,850 | 7,151,850 | 6,489,350 | 5,397,950 |

| Less: Taxes | 1,345,348 | 1,402,398 | 2,503,148 | 2,271,273 | 1,889,283 |

| Net income | 2,498,503 | 2,604,453 | 4,648,703 | 4,218,078 | 3,508,668 |

| Add: Depreciation | 2,643,650 | 4,530,650 | 3,235,650 | 2,310,650 | 1,652,050 |

| Operating cash flow | $5,142,153 | $7,135,103 | $7,884,353 | $6,528,728 | $5,160,718 |

| Net cash inflows: | |||||

| Operating cash flow | $5,142,153 | $7,135,103 | $7,884,353 | $6,528,728 | $5,160,718 |

| Change in net working capital | –873,300 | –788,100 | 676,275 | 745,500 | 1,739,625 |

| Capital spending | 3,849,573 | ||||

| Total cash inflows | $4,268,853 | $6,347,003 | $8,560,628 | $7,274,228 | $10,749,915 |

After the calculations of the operating cash flows for every year, it is essential to account for other cash flows. The other cash flows are the net working capital and the capital spending, that is, the after-tax salvage of the equipment.

Formula to calculate the net working capital:

Computation of the net working capital:

Note: The total net working capital in year 1 will be 15% of the sales, which may increase in year 1 or year 2. The net working capital cash flow is negative because of the increasing sales; thus the company will spend more money on the net working capital to maximize it. In year 3, the net working capital is positive because of the decline in sales. In year 5, the net working capital is the recovery of all the net working capital of the project.

Computation of the ending book value:

Formula to calculate the after-tax salvage value:

Computation of the after-tax salvage value:

Note: The market value of the equipment is 20% of the purchase price of the equipment and it is $3,700,000.

Formula to calculate the net present value:

Computation of the net present value:

Hence, the net present value is $3,643,713.77.

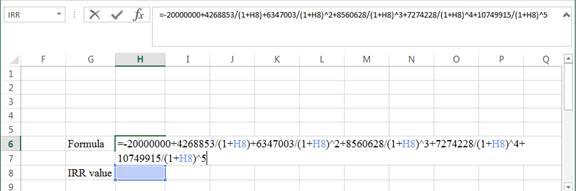

Computation of the internal rate of return:

The internal rate of return is calculated by the spreadsheet method.

Step 1:

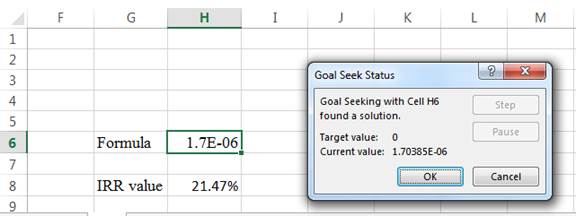

- Type the formula of the internal rate of return in H6 in the spreadsheet and consider the IRR value as H8.

Step 2:

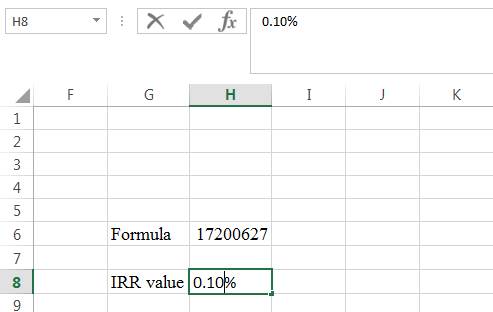

- Assume the IRR value as 0.10%.

Step 3:

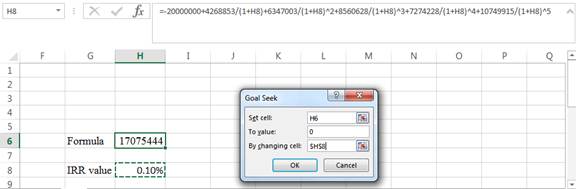

- In the spreadsheet, go to data and select What-if analysis.

- In What-if analysis, select Goal Seek.

- In ‘Set cell’ select H6 (the formula).

- The ‘To value’ is considered as 0.

- The H8 cell is selected for ‘By changing cell’.

Step 4:

- Following the previous step, click OK in the Goal Seek Status. The Goal Seek Status appears.

Step 5:

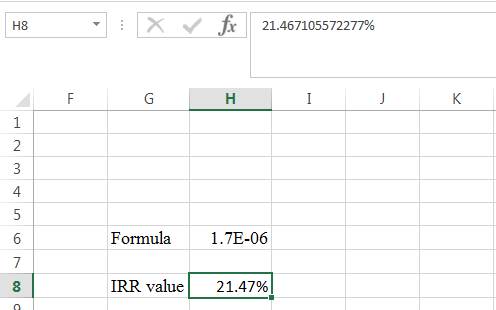

- The IRR value appears to be 21.467105572277%.

Hence, the internal rate of return is 21.47%.

Want to see more full solutions like this?

Chapter 9 Solutions

ESSENTIALS CORPORATE FINANCE + CNCT A.

- Use the binomial method to determine the value of an American Put option at time t = 0. The option expires at time t = T = 1/2 and has exercise price E = 55. The current value of the underlying is S(0) = 50 with the underlying paying continuous dividends at the rate D = 0.05. The interest rate is r = 0.3. Use a time step of St = 1/6. Consider the case of p = 1/2 and suppose the volatility is σ = 0.3. Perform all calculations using a minimum of 4 decimal places of accuracy. =arrow_forwardConsider a European chooser option with exercise price E₁ and expiry date T₁ where the relevant put and call options, which depend on the value of the same underlying asset S, have the same exercise price E2 and expiry date T₂. Determine, in terms of other elementary options, the value of the chooser option for the special case when T₁ = T2. Clearly define all notation that you use.arrow_forwardThe continuous conditional probability density function pc(S, t; S', t') for a risk neutral lognormal random walk is given by Pc(S, t; S', t') = 1 σS'√2π(t' - t) - (log(S/S) (ro²)(t − t)] exp 202 (t't) In the binomial method, the value of the underlying is Sm at time step môt and the value of the underlying at time step (m + 1)St is Sm+1. For this case evaluate Ec[(Sm+1)k|Sm] = [°° (S')*pc(S™, mdt; S', (m + 1)8t)dS' showing all steps, where k is a positive integer with k ≥ 1. You may assume that 1 e (x-n)2 2s2dx = 1 for all real numbers n and s with s > 0.arrow_forward

- John and Jane Doe, a married couple filing jointly, have provided you with their financial information for the year, including details of federal income tax withheld. They need assistance in preparing their tax return. W-2 Income: John earns $150,000 with $35,000 withheld for federal income tax. Jane earns $85,000 with $15,500 withheld for federal income tax. Interest Income: They received $2500 in interest from a savings account, with no tax withheld. Child Tax Credit: They have two children under the age of 17. Mortgage Interest: Paid $28,000 in mortgage interest on their primary residence. Property Taxes: Paid $4,800 in property taxes on their primary residence. Charitable Donations: Donated $22,000 to qualifying charitable organizations. Other Deductions: They have no other deductions to claim. You will gather the appropriate information and complete the forms provided in Blackboard (1040, Schedule A, and Schedule B in preparation of their tax file.arrow_forwardOn the issue date, you bought a 20-year maturity, 5.85% semi-annual coupon bond. The bond then sold at YTM of 6.25%. Now, 5 years later, the similar bond sells at YTM of 5.25%. If you hold the bond now, what is your realized rate of return for the 5-year holding period?arrow_forwardBond Valuation with Semiannual Payments Renfro Rentals has issued bonds that have an 11% coupon rate, payable semiannually. The bonds mature in 17 years, have a face value of $1,000, and a yield to maturity of 9.5%. What is the price of the bonds? Round your answer to the nearest cent.arrow_forward

- analyze at least three financial banking products from both the liability side (like time deposits, fixed income, stocks, structure products, etc). You will need to examine aspects such as liquidity, risk, and profitability from a company and an individual point of view.arrow_forwardHow a does researcher ensure that consulting recommendations are data-driven? What does make it effective, and sustainable? Please help explain and give the example How does DMAC help researchers to improve their business processes? How to establish feedback loops for ongoing refinement. Please give the examplesarrow_forwardDon't used hand raiting and don't used Ai solutionarrow_forward

- Explain what the business model of payday lenders, title pawn lenders, and “credit approved” used car dealers.arrow_forwardThe current NPV of a $30 million bond with 9% interest, 8% coupon rate, and discounted at $95arrow_forwardCould you please help to explain the DMAIC phases and how a researcher would use them to conduct a consulting project? What is a measure process performance and how to analyze the process? What is an improve process performance and how the control improves process and future process performance?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College