Survey Of Accounting

5th Edition

ISBN: 9781259631122

Author: Edmonds, Thomas P.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 21P

Problem 9-21 Ratio analysis

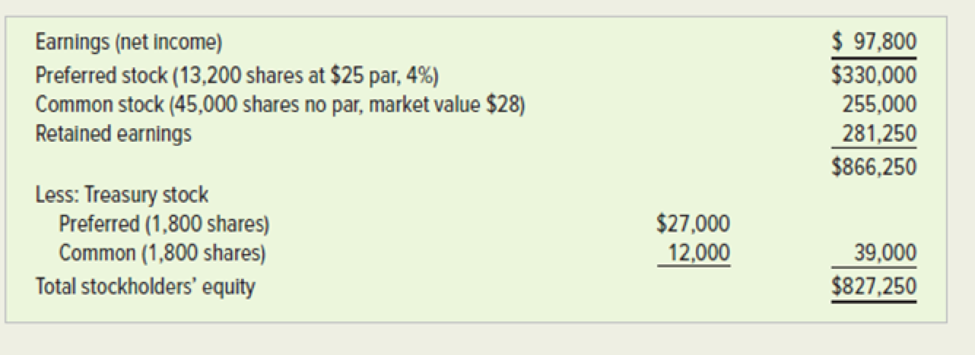

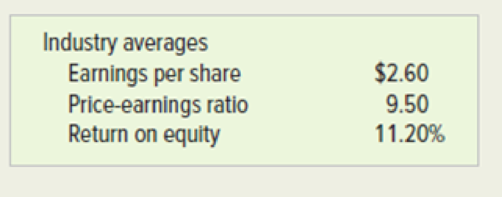

Selected data for Dalton Company for 2018 and additional information on industry averages follow:

Required

- a. Calculate and compare Dalton Company’s ratios with the industry averages.

- b. Discuss factors you would consider in deciding whether to invest in the company.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

On December 31, Strike Company decided to sell one

of its batting cages. The initial cost of the equipment

was $215,000 with accumulated depreciation of

$185,000. Depreciation has been taken up to the end

of the year. The company found a company that is

willing to buy the equipment for $30,000.

What is the amount of the gain or loss on this

transaction?

a. Gain of $30,000

b. Loss of $30,000

c. No gain or loss

d. Cannot be determined

What is the level of its accounts receivable?

Kindly help me with general accounting question

Chapter 9 Solutions

Survey Of Accounting

Ch. 9 - 1. Why are ratios and trends used in financial...Ch. 9 - Prob. 2QCh. 9 - Prob. 3QCh. 9 - 4. What is the significance of inventory turnover,...Ch. 9 - 5. What is the difference between the current...Ch. 9 - Prob. 6QCh. 9 - Prob. 7QCh. 9 - Prob. 8QCh. 9 - 9. What are some limitations of the earnings per...Ch. 9 - Prob. 10Q

Ch. 9 - Prob. 11QCh. 9 - Prob. 12QCh. 9 - Prob. 13QCh. 9 - Prob. 14QCh. 9 - Exercise 9-1 Horizontal analysis Winthrop...Ch. 9 - Prob. 2ECh. 9 - Prob. 3ECh. 9 - Prob. 4ECh. 9 - Prob. 5ECh. 9 - Prob. 6ECh. 9 - Prob. 7ECh. 9 - Prob. 8ECh. 9 - Comprehensive analysis The December 31, 2019,...Ch. 9 - Prob. 10ECh. 9 - Prob. 11ECh. 9 - Prob. 12ECh. 9 - Ratio analysis Compute the specified ratios using...Ch. 9 - Prob. 14ECh. 9 - LO 13-2, 13-3, 13-4, 13-5 Exercise 13-15A...Ch. 9 - Prob. 16PCh. 9 - Prob. 17PCh. 9 - Prob. 18PCh. 9 - Prob. 19PCh. 9 - Prob. 20PCh. 9 - Problem 9-21 Ratio analysis Selected data for...Ch. 9 - Prob. 22PCh. 9 - Problem 9-23 Ratio analysis The following...Ch. 9 - Prob. 24PCh. 9 - Prob. 1ATCCh. 9 - Prob. 3ATCCh. 9 - ATC 9-5 Ethical Dilemma Making the ratios look...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hello tutor please provide this question solution general accountingarrow_forwardAffordable Furniture makes sofas, loveseats, and recliners. The company allocates manufacturing overhead based on direct labor hours. Affordable estimated a total of $1.0 million of manufacturing overhead and 30,000 direct labor hours for the year. Job 310 consists of a batch of 8 recliners.arrow_forward1. Record the proper journal entry for each transaction. 2. By the end of January, was manufacturing overhead overallocated or underallocated? By how much?arrow_forward

- Rocky River Fast Lube does oil changes on vehicles in 15 minutes or less. The variable cost associated with each oil change is $12 (oil, filter, and 15 minutes of employee time). The fixed costs of running the shop are $8,000 each month (store manager salary, depreciation on shop and equipment, insurance, and property taxes). The shop has the capacity to perform 4,000 oil changes each month.arrow_forwardThe formula to calculate the amount of manufacturing overhead to allocate to jobs is: Question content area bottom Part 1 A. predetermined overhead rate times the actual amount of the allocation base used by the specific job. B. predetermined overhead rate divided by the actual allocation base used by the specific job. C. predetermined overhead rate times the estimated amount of the allocation base used by the specific job. D. predetermined overhead rate times the actual manufacturing overhead used on the specific job.arrow_forwardThe Fantastic Ice Cream Shoppe sold 9,000 servings of ice cream during June for $4 per serving. The shop purchases the ice cream in large tubs from the Dream Ice Cream Company. Each tub costs the shop $9 and has enough ice cream to fill 20 ice cream cones. The shop purchases the ice cream cones for $0.10 each from a local warehouse club. Located in an outdoor mall, the rent for the shop space is $2,050 per month. The shop expenses $290 a month for the depreciation of the shop's furniture and equipment. During June, the shop incurred an additional $2,700 of other operating expenses (75% of these were fixed costs).arrow_forward

- Hello tutor please provide correct answer general accounting questionarrow_forwardRobinson Manufacturing discovered the following information in its accounting records: $519,800 in direct materials used, $223,500 in direct labor, and $775,115 in manufacturing overhead. The Work in Process Inventory account had an opening balance of $72,400 and a closing balance of $87,600. Calculate the company’s Cost of Goods Manufactured.arrow_forwardSanjay would like to organize HOS (a business entity) as either an S corporation or as a corporation (taxed as a C corporation) generating a 16 percent annual before-tax return on a $350,000 investment. Sanjay’s marginal tax rate is 24 percent and the corporate tax rate is 21 percent. Sanjay’s marginal tax rate on individual capital gains and dividends is 15 percent. HOS will pay out its after-tax earnings every year to either its members or its shareholders. If HOS is taxed as an S corporation, the business income allocation would qualify for the deduction for qualified business income (assume no limitations on the deduction). Assume Sanjay does not owe any additional Medicare tax or net investment income tax. Required 1. For each scenario, C corporation and S corporation, calculate the total tax (entity level and owner level). 2. For each scenario, C corporation and S corporation, calculate the effective tax rate. C Corporation S Corporation 1. Total tax…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial Projections for Startups Basic Walkthrough; Author: Mike Lingle;https://www.youtube.com/watch?v=7avegQF4dxI;License: Standard youtube license