The City of Lynnwood was recently incorporated and had the following transactions for the fiscal year ended December 31.

- 1. The city council adopted a General Fund budget for the fiscal year. Revenues were estimated at $2,000,000 and appropriations were $1,990,000.

- 2. Property taxes in the amount of $1,940,000 were levied. It is estimated that $9,000 of the taxes levied will be uncollectible.

- 3. A General Fund transfer of $25,000 in cash and $300,000 in equipment (with

accumulated depreciation of $65,000) was made to establish a central duplicating internal service fund. - 4. A citizen of Lynnwood donated marketable securities with a fair value of $800,000. The donated resources are to be maintained in perpetuity with the city using the revenue generated by the donation to finance an afterschool program for children, which is sponsored by the culture and recreation function. Revenue earned and received as of December 31 was $40,000.

- 5. The city’s utility fund billed the city’s General Fund $125,000 for water and sewage services. As of December 31, the General Fund had paid $124,000 of the amount billed.

- 6. The central duplicating fund purchased $4,500 in supplies.

- 7. Cash collections recorded by the general government function during the year were as follows:

- 8. During the year, the internal service fund billed the city’s general government function $15,700 for duplicating services and it billed the city’s utility fund $8,100 for services.

- 9. The city council decided to build a city hall at an estimated cost of $5,000,000. To finance the construction, 6 percent bonds were sold at the face value of $5,000,000. A contract for $4,500,000 has been signed for the project; however, no expenditures have been incurred as of December 31.

- 10. The general government function issued a purchase order for $32,000 for computer equipment. When the equipment was received, a voucher for $31,900 was approved for payment and payment was made.

Required

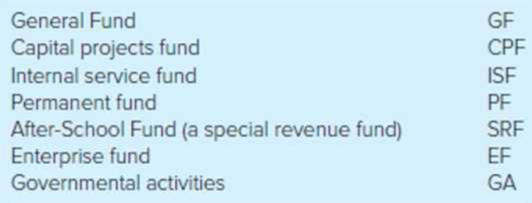

Prepare all journal entries to properly record each transaction for the fiscal year ended December 31. Use the following funds and government-wide activities, as necessary:

Each

Your answer sheet should be organized as follows:

Prepare necessary journal entries to properly record each transaction for the fiscal year ended December 31.

Explanation of Solution

Government-wide financial statement: This statement provides a combined summary of the net position and the changes in the net position of the government.

Fund financial statement: The fund financial statement provides detail financial information on the governmental, proprietary and fiduciary activities of the primary government.

Prepare necessary journal entries to properly record each transaction for the fiscal year ended December 31.

| Transaction Number | Fund or Activity | Account Title | Debit ($) | Credit ($) |

| 1. | GF | Estimated Revenues | 2,000,000 | |

| Appropriations | 1,990,000 | |||

| Budgetary fund balance | 10,000 | |||

| (To record the general fund receipt) | ||||

| 2. | GF | Taxes receivable-current | 1,940,000 | |

| Allowance for uncollectible current taxes | 9,000 | |||

| Revenues | 1,931,000 | |||

| (To record the property tax levy and uncollectible portion) | ||||

| GA | Taxes receivable- Current | 1,940,000 | ||

| Allowance for uncollectible current taxes | 9,000 | |||

| General revenues-property taxes | 1,931,000 | |||

| (To record the amount of property tax and amount of general revenue) | ||||

| 3. | GF | Interfund transfers out | 25,000 | |

| Cash | 25,000 | |||

| (To record the general fund transfer) | ||||

| ISF | Cash | 25,000 | ||

| Equipment | 300,000 | |||

| Accumulated Depreciation | 65,000 | |||

| Interfund Transfer In | 260,000 | |||

| (To record the inter-fund Transfer In) | ||||

| 4. | PF | Investment –marketable securities | 800,000 | |

| Revenues-contributions for endowment | 800,000 | |||

| (To record the donated marketable security) | ||||

| Cash | 40,000 | |||

| Revenues –Investment earnings | 40,000 | |||

| (To record the revenue at the end) | ||||

| PF | Interfund Transfer Out | 40,000 | ||

| Cash | 40,000 | |||

| (To record the Inter-fund Transfer Out) | ||||

| SRF | Cash | 40,000 | ||

| Interfund Transfers In | 40,000 | |||

| (To record the Inter-fund Transfer In) | ||||

| GA | Investment –marketable securities | 800,000 | ||

| General revenues-contributions for endowment | 800,000 | |||

| (To record marketable securities and general revenues) | ||||

| Cash | 40,000 | |||

| Programs revenues-culture and recreation- operating grants and contributions | 40,000 | |||

| (To record the donation made on culture and creation) | ||||

| 5. | EF | Due from other funds | 125,000 | |

| Charges for services | 125,000 | |||

| (To record the general fund for sewage and water services) | ||||

| Cash | 124,000 | |||

| Due from other funds | 124,000 | |||

| (To record the amount paid) | ||||

| GF | Expenditures | 125,000 | ||

| Due from other funds | 125,000 | |||

| (To record the actual due amount) | ||||

| Due from other funds | 124,000 | |||

| Cash | 124,000 | |||

| (To record the funds due to other funds) | ||||

| GA | Expense-general government | 125,000 | ||

| Internal balances | 125,000 | |||

| (To record the internal balance) | ||||

| Internal balances | 124,000 | |||

| Cash | 124,000 | |||

| (To record the cash settlement) | ||||

| 6. | ISF & GA | Inventory of supplies | 4,500 | |

| Cash | 4,500 | |||

| (To record the purchase of central duplicating fund) | ||||

| 7. | GF | Cash | 1,988,000 | |

| Taxes receivable-current | 1,925,000 | |||

| Revenues | 63,000 | |||

| (To record the cash collection) | ||||

| GA | Cash | 1,988,000 | ||

| Taxes receivable-current | 1,925,000 | |||

| Program revenue-general government-charges for services | 63,000 | |||

| (To record the cash collection) | ||||

| 8. | ISF | Due from other funds | 23,800 | |

| Billings to departments | 23,800 | |||

| (To record the total funds due from department) | ||||

| EF | Expense-administrative | 8,100 | ||

| Due to other funds | 8,100 | |||

| (To record the City’s utility fund) | ||||

| GF | Expenditures-General government | 15,700 | ||

| Due to other funds | 15,700 | |||

| (To record the internal service fund) | ||||

| GA | Internal balances | 8,100 | ||

| Program revenues-general government-charges for services | 8,100 | |||

| (To record the government charges for service) | ||||

| 9. | CPF | Cash | 5,000,000 | |

| Proceeds of bonds | 5,000,000 | |||

| (To record the sale of bond) | ||||

| Encumbrance | 4,500,000 | |||

| Encumbrances outstanding | 4,500,000 | |||

| (To record the amount of contract) | ||||

| GA | Cash | 5,000,000 | ||

| Bond payable | 5,000,000 | |||

| (To record the cash receipt on bond) | ||||

| 10. | GF | Encumbrance | 32,000 | |

| Encumbrances outstanding | 32,000 | |||

| (To record the issue of purchase order) | ||||

| Encumbrance Outstanding | 32,000 | |||

| Expenditures | 31,900 | |||

| Encumbrances | 32,000 | |||

| Cash | 31,900 | |||

| (To record the cash payment of purchase) | ||||

| GA | Equipment | 31,900 | ||

| Cash | 31,900 | |||

| (To record the purchase of equipment on cash) |

(Table 1)

Want to see more full solutions like this?

Chapter 9 Solutions

Accounting For Governmental & Nonprofit Entities

- General Accountarrow_forwardLabor data for making one gallon of the finished product in Nien Company are as follows: 1. Price-hourly wage rate $13.80, payroll taxes $0.80, and fringe benefits $1.50. 2. Quantity-actual production time 1.1 hours, rest periods and clean up 0.30 hours, and set up and downtime 0.40 hours. Compute the following. a. Standard direct labor rate per hour. b. Standard direct labor hours per gallon. Standard labor cost per gallon.arrow_forwardGeneral Accountarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education