The Mega Supply Corporation has three divisions: Commercial Products, Consumer Products, and Corporate Offices, which are located in Hatfield, South Carolina; Palo Alto, California; and Tulsa, Oklahoma, respectively. The Commercial Products division deals exclusively in sales of industrial products and supplies to business organizations. The Consumer Products division sells nonindustrial products to private consumers. Both divisions have dedicated inventory warehouses at their respective locations in Hatfield and Palo Alto. Because of the dissimilar nature of the commercial and consumer division product lines, they do not share customers or vendors.

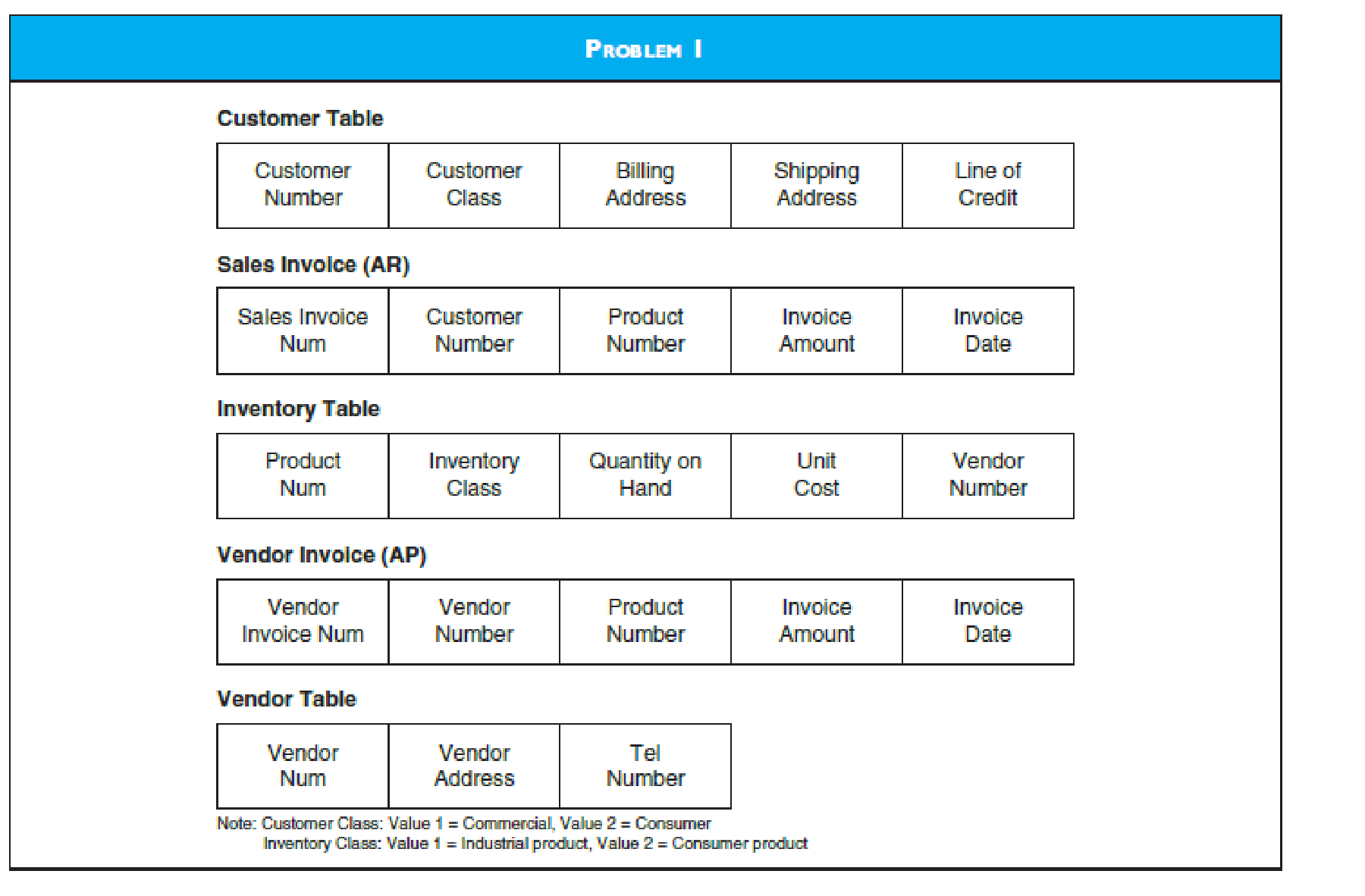

Currently Mega Supply uses a centralized database, which is located at their Corporate Division in Tulsa. Some relevant database tables and attributes are presented in the figure designated Problem 1.

When customers contact their respective sales division, the sales clerk logs into the corporate database, checks credit, determines product availability, and creates a sales invoice. The corporate office typically bills the customer within 3 or 4 days and extends terms of net 30. Inventory control,

Due to Mega’s rapid growth, the company has seen a significant increase in sales and purchase transactions, which has resulted in excessive delays in processing transactions from the central database. Since customer service, including rapid response to customer inquiries and sales order processing, is a cornerstone of Mega’s business model, these delays are unacceptable.

Required

Mega wants to improve response time by distributing some parts of the corporate database while keeping other parts of it centralized.

- (A) Develop a schema for distributing Mega Supply Corporation’s database. Add new tables and attributes as needed but limit the schema to the tables needed to support sales, cash receipts, purchases/AP, and cash disbursements. In your schema, indicate whether tables are centralized, replicated, or partitioned.

- (B) Explain how the new system will operate.

Trending nowThis is a popular solution!

Chapter 9 Solutions

Accounting Information Systems

- At the beginning of its current fiscal year, Willie Corp.'s balance sheet showed assets of $14,800 and liabilities of $5,100. During the year liabilities decreased by $1,500. Net income for the year was $2,600, and net assets at the end of the year were $10,200. There were no changes in paid-in capital during the Calculate the dividends, if any, declared during the year. year.arrow_forwardPlease provide answer this general accounting questionarrow_forwardGive this question general accounting answerarrow_forward

- Anderson Company's break-even point in units is 2,150. The sales price per unit is $10 and the variable cost per unit is $5. If the company sells 5,200 units, what will its net income be? a. $25,500 b. $15,250 c. $11,700 d. $19,750 e. $26,000arrow_forwardCalculate the net income for trenton corporationarrow_forwardGEM Company has a unit selling price of $790, variable costs per unit of $545, and fixed costs of $285,000. Compute the break-even point in units using the mathematical equation and (b) the unit contribution margin.arrow_forward

- Armstrong Industries has an employee earning $7,200 per month. The FICA tax rate for Social Security is 6.2%, and the FICA tax rate for Medicare is 1.45%. The current FUTA tax rate is 0.8%, and the SUTA tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee’s pay. The employee has $275 in federal income taxes withheld. The employee also has voluntary deductions for health insurance of $210 and contributes $120 to a retirement plan each month. What is the employee’s net pay for the month of January?arrow_forwardNet income for the year?arrow_forwardNeed answer pleasearrow_forward

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT