1.a.

Calculate the correct (reconciled) amount of ending balance of cash and the balance of omitted check.

1.a.

Explanation of Solution

| Calculation of Correct Ending Balance of Cash | |

| Particulars | Amount ($) |

| Balance per bank | 15,100 |

| Add: Deposit in transit | 2,450 |

| Less: Outstanding checks | (1,800) |

| Reconciled balance | $15,750 |

Table (1)

| Calculation of Omitted Check | |

| Particulars | Amount ($) |

| Balance per books | 17,000 |

| Add: Interest earned | 52 |

| Less: Service charges | (15) |

| Balance before omitted check | 17,037 |

| Less: Reconciled balance | 15,750 |

| Omitted check | $1,287 |

Table (2)

Hence, the correct (reconciled) amount of ending balance of cash and the amount of omitted check is $15,750 and $1,287.

1. b.

Calculate the adjustment amount for allowance for doubtful accounts.

1. b.

Explanation of Solution

| Calculation of adjustment amount for allowance for doubtful accounts | |

| Particulars | Amount ($) |

| Unadjusted balance | 828 |

| Less: Anticipated write-off | (679) |

| Revised unadjusted balance | 149 |

| Add: Desired ending balance | 700 |

| Necessary adjustment | $551 |

Table (3)

Hence, the adjustment amount for allowance for doubtful accounts is $551.

1.c.

Calculate the amount of

1.c.

Explanation of Solution

| Calculation of depreciation expense for the truck | |

| Particulars | Amount |

| Cost | $32,000 |

| Less: Salvage value | $(8,000) |

| Depreciable cost | $24,000 |

| Divide: Useful life in years | |

| Annual depreciation for 2017 | $6,000 |

Table (4)

Hence, the amount of depreciation expense for the truck used during year 2017 is $6,000.

1.d.

Calculate the amount of depreciation expense for two items of equipment used during year 2017.

1.d.

Explanation of Solution

| Calculation of depreciation expense for equipment | ||

| Particulars | Equipment S | Equipment I |

| Cost | $27,000 | $18,000 |

| Less: Salvage value | $(3,000) | $(2,500) |

| Depreciable cost | $24,000 | $15,500 |

| Divide: Useful life in years | ||

| Annual depreciation for 2017 | $3,000 | $3,100 |

Table (5)

Hence, the amount of depreciation expense for Equipment S and Equipment I used during year 2017 are $3,000 and $3,100 respectively.

1.e.

Calculate the balance amount of E Services revenue and unearned service revenue accounts.

1.e.

Explanation of Solution

Step 1: Calculate the amount of total earned during 2017.

Step 2: Calculate the amount of overstatement of revenue.

Step 3: Calculate the balance amount of E services revenue account.

| Calculation of balance amount of E services revenue account | |

| Particulars | Amount |

| Unadjusted balance | $60,000 |

| Less: Overstatement of revenue | $(2,240) |

| Adjusted balance | $57,760 |

Table (6)

Step 4: Calculate the balance amount of unearned services revenue account.

| Calculation of balance amount of unearned services revenue account | |

| Particulars | Amount |

| Unadjusted balance | $0 |

| Add: Overstatement of revenue | $2,240 |

| Adjusted balance | $2,240 |

Table (7)

Hence, the adjusted balance amount of E Services revenue and unearned service revenue accounts are $57,760 and $2,240 respectively.

1.f.

Calculate the amount for warranty expense and estimated warranty liability.

1.f.

Explanation of Solution

Hence, the amount of warranty expense and estimated warranty liability is $1,444 and $2,844.

1.g.

Calculate the adjusted amount of interest expense and interest payable.

1.g.

Explanation of Solution

The annual interest expense on note is $1,200

2.

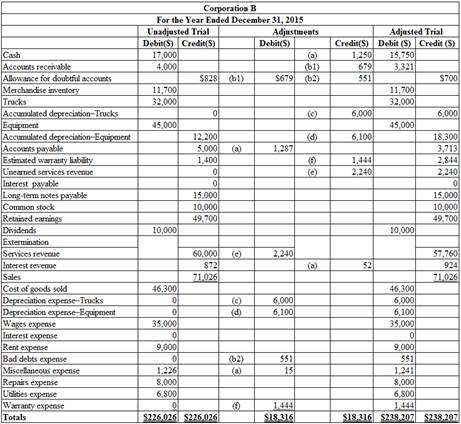

Complete the six-column table by entering the adjustments for items a through g and then complete the adjusted trail balance.

2.

Explanation of Solution

Table (8)

3

Prepare

3

Explanation of Solution

| Date | Accounts and Explanation | Post Ref | Debit ($) | Credit ($) | |||

| 2017 | Miscellaneous Expense (E–) | 15 | |||||

| December | 31 | ||||||

| Accounts Payable (L–) | 1,287 | ||||||

| Interest Revenue (E+) | 52 | ||||||

| Cash (A–) | 1,250 | ||||||

| (To record the adjustment of cash account) | |||||||

Table (9)

Description:

- Miscellaneous expense is an expense. There is an increase in the expenses, and therefore, it is debited.

- Accounts payable is a liability. There is a decrease in the liabilities, and therefore, it is debited.

- Interest revenue is a component of equity. There is an increase in the equity, and therefore, it is credited.

- Cash is an asset. There is a decrease in the assets, and therefore, it is credited.

Adjustment entry for allowance for doubtful account:

| Date | Accounts and Explanation | Post Ref | Debit ($) | Credit ($) | |||

| 2017 | Allowance for Doubtful Accounts (A+) | 679 | |||||

| December | 31 | ||||||

| Accounts Receivable (A–) | 679 | ||||||

| (To record wrote-off uncollectible accounts) | |||||||

Table (10)

Description:

- Allowance for doubtful account is a contra-asset. There is an increase in the assets, and therefore, it is debited.

- Accounts receivable is an asset. There is a decrease in the assets, and therefore, it is credited.

Adjustment entry for bad debt expense:

| Date | Accounts and Explanation | Post Ref | Debit ($) | Credit ($) | |||

| 2017 | 551 | ||||||

| December | 31 | ||||||

| Allowance for Doubtful Accounts (A–) | 551 | ||||||

| (To record the recognize of bad debts expense) | |||||||

Table (11)

Description:

- Bad debts expense is an expense. There is an increase in the expenses, and therefore, it is debited.

- Allowance for doubtful account is a contra-asset. There is a decrease in the assets, and therefore, it is credited.

Adjustment entry for depreciation expense – Trucks:

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) | |

| 2017 | Depreciation Expense- Trucks (E–) | 6,000 | |||

| December | 31 | ||||

| 6,000 | |||||

| (To record the amount of depreciation expense for trucks for the year) | |||||

Table (12)

Description:

- Depreciation expense is an expense. There is an increase in the expenses, and therefore it is debited.

- Accumulated Depreciation is a contra-asset account. There is decrease in assets, and therefore it is credited.

Adjustment entry for depreciation expense – Equipment:

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) | |

| 2017 | Depreciation Expense- Equipment (E–) | 6,100 | |||

| December | 31 | ||||

| Accumulated Depreciation- Equipment (A–) | 6,100 | ||||

| (To record the amount of depreciation expense for equipment the year) | |||||

Table (13)

Description:

- Depreciation expense is an expense. There is an increase in the expenses, and therefore it is debited.

- Accumulated Depreciation is a contra-asset account. There is decrease in assets, and therefore it is credited.

Adjustment entry for unearned services revenue:

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) | |

| 2017 | E Services Revenue (E–) | 2,240 | |||

| December | 31 | ||||

| Unearned Services Revenue (L+) | 2,240 | ||||

| (To record the adjustment for unearned revenue) | |||||

Table (14)

Description:

- E Service revenue is a component of equity account. There is a decrease in equity, and therefore it is debited.

- Unearned service revenue is a liability. There is an increase in liabilities, and therefore it is credited.

Adjustment entry for warranty expense:

| Date | Accounts and Explanation | Post Ref | Debit ($) | Credit ($) | |||

| 2017 | Warranty Expense (E–) | 1,444 | |||||

| December | 31 | ||||||

| Estimated Warranty Payable (L+) | 1,444 | ||||||

| (To record the estimated warranty expense) | |||||||

Table (15)

Description:

- Warranty expense is an expense. There is an increase in the expenses, and therefore, it is debited.

- Estimated warranty payable is a liability. There is an increase in the liabilities, and therefore, it is credited.

Adjustment entry for accrual interest expense:

There is no interest accrual for 2017. Hence, no adjustment entry is required.

4.

Prepare a single-step income statement,

4.

Explanation of Solution

Single-step income statement for the year ended December 31, 2017:

|

Corporation B Income Statement For the Year Ended December 31, 2017 | ||

| Revenues: | ||

| E services revenue | $57,760 | |

| Sales | $71,026 | |

| Interest revenue | $924 | |

| Total revenues | $129,710 | |

| Expenses: | ||

| Cost of goods sold | $46,300 | |

| Depreciation expense- Office equipment | $6,000 | |

| Depreciation expense- Equipment | $6,100 | |

| Wages expense | $35,000 | |

| Interest expense | 0 | |

| Rent expense | $9,000 | |

| Bad debts expense | $551 | |

| Miscellaneous expense | $1,241 | |

| Repairs expense | $8,000 | |

| Utilities expense | $6,800 | |

| Warranty expense | $1,444 | |

| Total expenses | $120,436 | |

| Net Income | $9,274 | |

Table (16)

Statement of retained earnings for Corporation B for the year ended December 31, 2017:

|

Corporation B Statement of Retained Earnings For the Year Ended December 31, 2017 | |

| Retained earnings, December 31, 2016 | $49,700 |

| Add: Net income for the year | $9,274 |

| $58,974 | |

| Less: Dividends | (10,000) |

| Retained earnings, December 31, 2017 | $48,974 |

Table (17)

Classified balance sheet for Corporation B as of December 31, 2017:

|

Corporation B Balance Sheet As of December 31, 2017 | ||

| Assets | Amount ($) |

Amount ($) |

| Current assets: | ||

| Cash | 15,750 | |

| Accounts receivable | 3,321 | |

| Less: Allowance for doubtful accounts | (700) | 2,621 |

| Merchandise inventory | 11,700 | |

| Total current assets | 30,071 | |

| Plant assets: | ||

| Trucks | 32,000 | |

| Less: Accumulated depreciation | (6,000) | 26,000 |

| Equipment | 45,000 | |

| Less: Accumulated depreciation | (18,300) | 26,700 |

| Total plant assets | 52,700 | |

| Total assets | $82,771 | |

| LIABILITIES AND | ||

| Current liabilities: | ||

| Accounts payable | 3,713 | |

| Estimated warranty payable | 2,844 | |

| Unearned service revenue | 2,240 | |

| Total current liabilities | 8,797 | |

| Long-term liabilities: | ||

| Notes payable | 15,000 | |

| Total liabilities | 23,797 | |

| STOCKHOLDERS’ EQUITY | ||

| Common stock | 10,000 | |

| Retained earnings | 48,974 | |

| Total stockholders’ equity | 58,974 | |

| Total liabilities and stockholders’ equity | $82,771 | |

Table (18)

Want to see more full solutions like this?

Chapter 9 Solutions

Connect Access Card For Financial Accounting Fundamentals

- Nonearrow_forwardXavi Enterprises has provided the following projections for 2025: The company's fixed costs are expected to be $194,000. The selling price per unit is $16, while the variable cost per unit is $6. The company aims to earn a net income of $82,000 during 2025. The required sales units to meet the target net income during 2025 is _ (rounded up to the nearest whole number).arrow_forwardEquivalent units for materials are_.arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardThe cost od goods sold by kraft corporation for the period isarrow_forwardKelvin Apparel uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. Four years after its purchase, one of Kelvin's warehouses has a carrying value of $520,000 and a tax basis of $410,000. There were no other temporary differences and no permanent differences. Taxable income was $5.5 million and Kelvin's tax rate is 35%. What is the deferred tax liability to be reported in the balance sheet?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education