Concept explainers

Accounting for the Use and Disposal of Long-Lived Assets

Nicole’s Getaway Spa (NGS) purchased a hydrotherapy tub system to add to the wellness programs at NGS. The machine was purchased at the beginning of the year at a cost of $7,000. The estimated useful life was five years and the residual value was $500. Assume that the estimated productive life of the machine is 13,000 hours. Expected annual production was year 1, 3,100 hours; year 2, 2,500 hours; year 3, 3,400 hours; year 4, 2,200 hours; and year 5, 1,800 hours.

Required:

- 1. Complete a

depreciation schedule for each of the alternative methods.- a. Straight-line.

- b. Units-of-production.

- c. Double-declining-balance.

- 2. Assume NGS sold the hydrotherapy tub system for $2,100 at the end of year 3. Prepare the

journal entry to account for the disposal of this asset under the three different methods. - 3. The following amounts were

forecast for year 3: Sales Revenues $42,000; Cost of Goods Sold $33,000; Other Operating Expenses $4,000; and Interest Expense $800. Create an income statement for year 3 for each of the different depreciation methods, ending at Income before Income Tax Expense. (Don’t forget to include a loss or gain on disposal for each method.)

(1) (a)

Prepare the depreciation expense schedule under straight-line method

Explanation of Solution

Straight-line method: The depreciation method which assumes that the consumption of economic benefits of long-term asset could be distributed equally throughout the useful life of the asset is referred to as straight-line method.

Formula for straight-line depreciation method:

Depreciation expense: Depreciation expense is a non-cash expense, which is recorded on the income statement reflecting the consumption of economic benefits of long-term asset.

Accumulated depreciation: The total amount of depreciation expense deducted, from the time asset acquired till date, as reported in the account as on a particular date, is referred to as accumulated depreciation.

Formula for accumulated depreciation:

Book value: The amount of acquisition cost of less accumulated depreciation as on a particular date is referred to as book value.

Formula for book value:

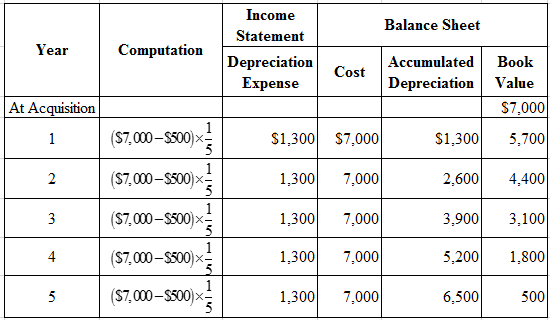

Depreciation schedule under straight-line method:

Figure (1)

(1) (b)

Prepare the depreciation expense schedule under units-of-production

Explanation of Solution

Units-of-production method: The depreciation method which assumes that the consumption of economic benefits of long-term asset is based on the production capacity or output is referred to as units-of-production method.

Formula for units-of-production depreciation method:

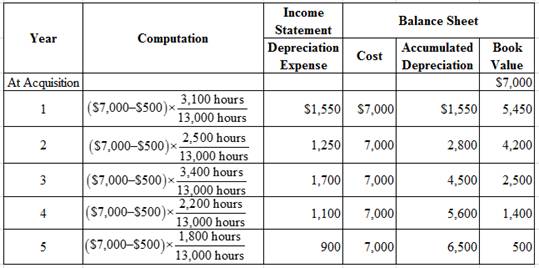

Depreciation schedule under units-of-production method:

Figure (2)

(1) (c)

Prepare the depreciation expense schedule under double-declining-balance method

Explanation of Solution

Double-declining-balance method: The depreciation method which assumes that the consumption of economic benefits of long-term asset is high in the early years but gradually declines towards the end of its useful life, is referred to as double-declining-balance method.

Formula for double-declining-balance depreciation method:

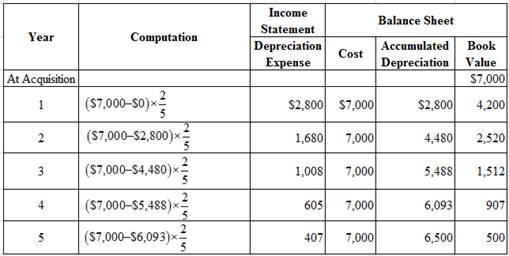

Depreciation schedule under double-declining-balance method:

Figure (3)

Note:

Compute depreciation expense in Year 5.

(2)

Prepare the journal entries for the sale of equipment under three methods

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare journal entry for the sale of building, under straight-line method.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Cash | 2,100 | |||||

| Accumulated Depreciation | 3,900 | |||||

| Loss on Disposal | 1,000 | |||||

| Equipment | 7,000 | |||||

| (To record sale of equipment) | ||||||

Table (1)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accumulated Depreciation–Building is a contra-asset account. Since the building is sold, the accumulated depreciation balance is reversed to reduce the balance in the account; hence, the account is debited.

- Loss on Disposal is an expense account. Since losses and expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Building is an asset account. Since building is sold, asset account decreased, and a decrease in asset is credited.

Working Notes:

Determine the gain on sale.

Step 1: Compute book value on the date of sale.

Step 2: Compute gain (loss) on sale.

Prepare journal entry for the sale of building, under units-of-production method.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Cash | 2,100 | |||||

| Accumulated Depreciation | 4,500 | |||||

| Loss on Disposal | 400 | |||||

| Equipment | 7,000 | |||||

| (To record sale of equipment) | ||||||

Table (2)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accumulated Depreciation–Building is a contra-asset account. Since the building is sold, the accumulated depreciation balance is reversed to reduce the balance in the account; hence, the account is debited.

- Loss on Disposal is an expense account. Since losses and expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Building is an asset account. Since building is sold, asset account decreased, and a decrease in asset is credited.

Working Notes:

Determine the gain on sale.

Step 1: Compute book value on the date of sale.

Step 2: Compute gain (loss) on sale.

Prepare journal entry for the sale of equipment, under double-declining-balance method.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Cash | 2,100 | |||||

| Accumulated Depreciation | 5,488 | |||||

| Equipment | 7,000 | |||||

| Gain on Disposal | 588 | |||||

| (To record sale of truck) | ||||||

Table (3)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accumulated Depreciation–Equipment is a contra-asset account. Since the equipment is sold, the accumulated depreciation balance is reversed to reduce the balance in the account; hence, the account is debited.

- Equipment is an asset account. Since equipment is sold, asset account decreased, and a decrease in asset is credited.

- Gain on Disposal is a revenue account. Since gains and revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Determine the gain on sale.

Step 1: Compute book value on the date of sale.

Step 2: Compute gain (loss) on sale.

(3)

Prepare the income statement of NG Spa for the Year 3, under three depreciation methods

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare income statement for NG Spa for the Year 3.

| NG Spa | |||

| Income Statement | |||

| For Year 3 | |||

| Particulars | Straight-Line | Units-of-Production | Double-Declining-Balance |

| Sales revenue | $42,000 | $42,000 | $42,000 |

| Cost of goods sold | 33,000 | 33,000 | 33,000 |

| Gross profit | 9,000 | 9,000 | 9,000 |

| Operating expenses: | |||

| Depreciation expense | $1,300 | $1,700 | $1,008 |

| Other operating expenses | 4,000 | 4,000 | 4,000 |

| Loss (Gain) on disposal | 1,000 | 400 | (588) |

| Total operating expenses | 6,300 | 6,100 | 4,420 |

| Income from operations | 2,700 | 2,900 | 4,580 |

| Interest expense | 800 | 800 | 800 |

| Income before income tax expense | $1,900 | $2,100 | $3,780 |

Table (4)

Want to see more full solutions like this?

Chapter 9 Solutions

CONNECT CODE F/FINANCIAL ACCOUNTING

- If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forwardWhich of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- No chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardWhat type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenueneed helparrow_forwardno ai What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersno aiarrow_forward

- Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customerhelo mearrow_forwardHelp Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,