CONNECT CODE F/FINANCIAL ACCOUNTING

6th Edition

ISBN: 9781260685978

Author: PHILLIPS

Publisher: MCGRAW-HILL CUSTOM PUBLISHING

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 10E

Evaluating the Impact of Estimated Useful Lives of Intangible Assets

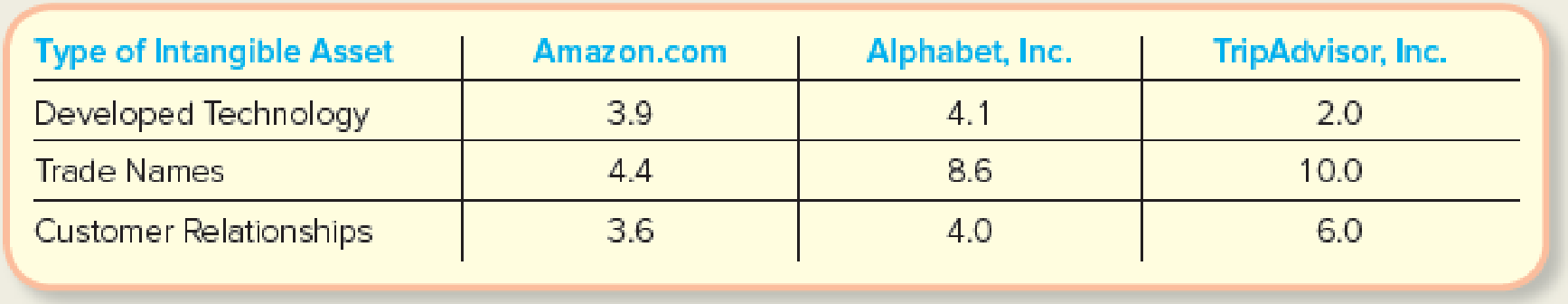

Amazon, Alphabet, and TripAdvisor rely on various intangible assets to operate their businesses. These companies amortize the cost of these assets using the straight-line method over the following average estimated useful lives (in years), as reported in their 2015 annual reports.

Required:

Based on these estimates, identify the company that uses the longest periods for amortizing most of its classes of intangible assets. Will these estimates increase or decrease that company’s net income relative to its competitors? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please explain the solution to this general accounting problem with accurate principles.

Kindly help me with this General accounting questions not use chart gpt please fast given solution

I am searching for the correct answer to this Financial accounting problem with proper accounting rules.

Chapter 9 Solutions

CONNECT CODE F/FINANCIAL ACCOUNTING

Ch. 9 - Define long-lived assets. What are the two common...Ch. 9 - Under the cost principle, what amounts should be...Ch. 9 - What is the term for recording costs as assets...Ch. 9 - 4. Waste Management, Inc., regularly incurs costs...Ch. 9 - Distinguish between ordinary repairs and...Ch. 9 - Describe the relationship between the expense...Ch. 9 - Why are different depreciation methods allowed?Ch. 9 - In computing depreciation, three values must be...Ch. 9 - Prob. 9QCh. 9 - After merging with Northwest Airlines, Delta...

Ch. 9 - A local politician claimed, to reduce the...Ch. 9 - What is an asset impairment? How is it accounted...Ch. 9 - What is book value? When equipment is sold for...Ch. 9 - Prob. 14QCh. 9 - Prob. 15QCh. 9 - FedEx Corporation reports the cost of its aircraft...Ch. 9 - Prob. 17QCh. 9 - Prob. 18QCh. 9 - (Supplement 9A) How does depletion affect the...Ch. 9 - (Supplement 9B) Over what period should an...Ch. 9 - Prob. 1MCCh. 9 - Prob. 2MCCh. 9 - Prob. 3MCCh. 9 - A company wishes to report the highest earnings...Ch. 9 - Barber, Inc., depreciates its building on a...Ch. 9 - Thornton Industries purchased a machine on July 1...Ch. 9 - ACME. Inc., uses straight-line depreciation for...Ch. 9 - What assets should be amortized using the...Ch. 9 - Prob. 9MCCh. 9 - The Simon Company and the Allen Company each...Ch. 9 - Classifying Long-Lived Assets and Related Cost...Ch. 9 - Prob. 2MECh. 9 - Prob. 3MECh. 9 - Computing Book Value (Straight-Line Depreciation)...Ch. 9 - Computing Book Value (Units-of-Production...Ch. 9 - Computing Book Value (Double-Declining-Balance...Ch. 9 - Calculating Partial-Year Depreciation Calculate...Ch. 9 - Recording Asset Impairment Losses After recording...Ch. 9 - Recording the Disposal of a Long-Lived Asset...Ch. 9 - Reporting and Recording the Disposal of a...Ch. 9 - Prob. 11MECh. 9 - Prob. 12MECh. 9 - Computing and Evaluating the Fixed Asset Turnover...Ch. 9 - (Supplement 9A) Recording Depletion for a Natural...Ch. 9 - Prob. 15MECh. 9 - Prob. 1ECh. 9 - Prob. 2ECh. 9 - Determining Financial Statement Effects of an...Ch. 9 - Prob. 4ECh. 9 - Determining Financial Statement Effects of...Ch. 9 - Computing Depreciation under Alternative Methods...Ch. 9 - Computing Depreciation under Alternative Methods...Ch. 9 - Prob. 8ECh. 9 - Demonstrating the Effect of Book Value on...Ch. 9 - Evaluating the Impact of Estimated Useful Lives of...Ch. 9 - Calculating the Impact of Estimated Useful Lives...Ch. 9 - Prob. 12ECh. 9 - Prob. 13ECh. 9 - Computing and Interpreting the Fixed Asset...Ch. 9 - Computing Depreciation and Book Value for Two...Ch. 9 - Prob. 16ECh. 9 - Prob. 17ECh. 9 - Computing Acquisition Cost and Recording...Ch. 9 - Prob. 2CPCh. 9 - Analyzing and Recording Long-Lived Asset...Ch. 9 - Computing Acquisition Cost and Recording...Ch. 9 - Recording and Interpreting the Disposal of...Ch. 9 - Prob. 3PACh. 9 - Prob. 4PACh. 9 - Computing Acquisition Cost and Recording...Ch. 9 - Recording and Interpreting the Disposal of...Ch. 9 - Analyzing and Recording Long-Lived Asset...Ch. 9 - Prob. 4PBCh. 9 - Accounting for Operating Activities (Including...Ch. 9 - Prob. 1SDCCh. 9 - Prob. 2SDCCh. 9 - Ethical Decision Making: A Mini-Case Assume you...Ch. 9 - Critical Thinking: Analyzing the Effects of...Ch. 9 - Prob. 7SDCCh. 9 - Accounting for the Use and Disposal of Long-Lived...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I am looking for the correct answer to this Financial accounting question with appropriate explanations.arrow_forwardEcho Tone Technologies reports annual sales of $90,000, and it expects sales to increase to $135,000 next year. The company has a degree of operating leverage (DOL) of 4.2. By what percentage should net income increase? A. 70% B. 189% C. 150% D. 210%arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forward

- No chatgpt Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forwardI need help Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forward

- Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalhelparrow_forwardAccounting solution with right answerarrow_forwardWhich account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Asset impairment explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=lWMDdtHF4ZU;License: Standard Youtube License