Concept explainers

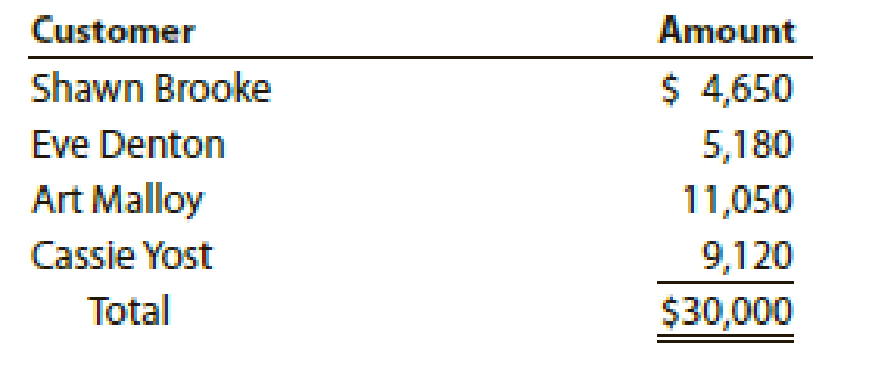

Casebolt Company wrote off the following

a. Journalize the write-offs under the direct write-off method.

b. Journalize the write-offs under the allowance method. Also, journalize the

c. How much higher (lower) would Casebolt Company’s net income have been under the direct write-off method than under the allowance method?

Trending nowThis is a popular solution!

Chapter 9 Solutions

Cengagenowv2, 1 Term Printed Access Card For Warren/reeve/duchac's Financial Accounting, 15th

- General accounting questionarrow_forwardWhat is the budgeted cost of direct materials?arrow_forwardWagner Manufacturing uses direct labor-hours to calculate its predetermined overhead rate. At the beginning of the year, the estimated manufacturing overhead was $420,000. At year-end, actual direct labor-hours were 30,000 hours, the actual manufacturing overhead was $410,000, and the company had overapplied overhead of $10,000. Calculate the predetermined overhead rate per direct labor-hour.arrow_forward

- The following labor standards have been established for a particular product: • • Standard labor hours per unit = 2.0 hours Standard labor rate = $15.50 per hour The following data pertain to operations concerning the product for the last month: • Actual hours worked = 4,200 hours • Actual total labor cost = $63,000 • Actual output = 2,000 units Compute the labor rate variance for the month.arrow_forwardThe CV Company has just purchased $75,000,000 of plant and equipment that has an estimated useful life of 20 years. The expected salvage value at the end of 20 years is $7,500,000. What will the book value of this purchase (excluding all other plant and equipment) be after its fifth year of use?arrow_forwardMaxwell Industries uses flexible budgets. At a normal capacity of 25,000 units, the budgeted manufacturing overhead is $75,000 variable and $300,000 fixed. If Maxwell Industries had actual overhead costs of $385,500 for 27,000 units produced, what is the difference between actual and budgeted costs?arrow_forward

- Provide correct solution and accountingarrow_forwardQuick answer of this accounting questionsarrow_forwardParker Manufacturing calculates its predetermined overhead rate annually based on direct labor-hours. At the beginning of the year, the company estimated that 40,000 direct labor-hours would be required for production. The estimated fixed manufacturing overhead was $720,000, and the estimated variable manufacturing overhead was $4.50 per direct labor- hour. What is the predetermined overhead rate per direct labor-hour? (Round your answer to two decimal places.)arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning