Concept explainers

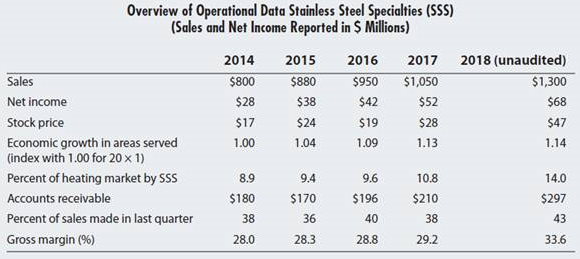

Stainless Steel Specialties (SSS) is a manufacturer of hot water—based heating systems for homes and commercial businesses. The company has grown about 10% in each of the past five years. The company has not made any acquisitions. Following are some statistics for the company:

Additional information available to the auditor includes:

- The company has touted its new and improved technology for the increase both in sales and in gross margin.

- The company claims to have decreased administrative expenses, thus increasing net profits.

- The company has reorganized its sales process to a more centralized approach and has empowered individual sales managers to negotiate better prices to drive sales as long as the amounts are within corporate guidelines.

- The company has changed its salesperson compensation by increasing the commission on sales to new customers.

- Sales commissions are no longer affected by returned goods if the goods are returned more than 90 days after sale and/or by not collecting the receivables. SSS has justified the changes in sales commissions on the following grounds:

- The salesperson is not responsible for quality issues—the main reason that customers return products.

- The salesperson is not responsible for approving credit; rather credit approval is under the direction of the global sales manager.

a. What is the importance of the information about salesperson compensation to the audit of receivables and revenue? Explain how the auditor would use this information in planning analytical procedures.

b. Perform planning analytical procedures using the data included in the table and the information about the change in performance. For each year, you will most likely want to focus on the % change of the various statistics over the prior year. Focus on Steps 3, 4, and 5 of the planning analytical procedures process. What are the important insights that the auditor should gain from performing such procedures?

c. Why should the auditor be interested in a company’s stock price when performing an audit, as stock price is dependent, at least in part, on audited financial reports?

d. What information about SSS might the auditor consider as fraudrisk factors?

e. Identify specific substantive

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Bundle: Auditing: A Risk Based-Approach, Loose-leaf Version, 11th + MindTap Accounting, 1 term (6 months) Printed Access Card

- KIARA LIMITED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER: ASSETS Property, plant and equipment (cost) Accumulated depreciation Long-term investments Inventory Accounts receivable Company tax paid in advance Bank EQUITY AND LIABILITIES 2024 2023 R R 2 490 000 1 620 000 (630 000) 660 000 1 050 000 1 230 000 30 000 (480 000) 450 000 1 290 000 900 000 0 750 000 660 000 5 580 000 4 440 000 Ordinary share capital 2 700 000 2 000 000 Retained income 1 500 000 1 158 000 Long-term loan from Kip Bank (15%) 900 000 1 000 000 Accounts payable 480 000 228 000 Company tax payable 0 54 000 5 580 000 4 440 000 ADDITIONAL INFORMATION All purchases and sales are on credit. Interim dividends paid during the year amounted to R150 750. Credit terms of 3/10 net 60 days are granted by creditors.arrow_forwardAccounting Questionarrow_forwardREQUIRED Study the information given below and answer the following questions. Where discount factors are required use only the four decimals present value tables that appear after the formula sheet or in the module guide. Ignore taxes. 5.1 Calculate the Accounting Rate of Return on average investment of the second alternative (expressed to two decimal places). 5.2 Determine which of the two investment opportunities the company should choose by calculating the Net Present Value of each alternative. Your answer must include the calculation of the present values and NPV. 5.3 Calculate the Internal Rate of Return of the first alterative (expressed to two decimal places). Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. INFORMATION The management of Bentall Incorporated is considering two investment opportunities: (5 marks) (9 marks) (6 marks) The first alternative involves the purchase of a new machine for R900 000 which…arrow_forward

- REQUIRED Use the information provided below to answer the following questions: 4.1 Calculate the weighted average cost of capital (expressed to two decimal places). Your answer must include the calculations of the cost of equity, preference shares and the loan. 4.2 Calculate the cost of equity using the Capital Asset Pricing Model (expressed to two decimal places). (16 marks) (4 marks) INFORMATION Cadmore Limited intends raising finance for a proposed new project. The financial manager has provided the following information to determine the present cost of capital to the company: The capital structure consists of the following: ■3 million ordinary shares issued at R1.50 each but currently trading at R2 each. 1 200 000 12%, R2 preference shares with a market value of R2.50 per share. R1 000 000 18% Bank loan, due in March 2027. Additional information The company's beta coefficient is 1.3. The risk-free rate is 8%. The return on the market is 18%. The Gordon Growth Model is used to…arrow_forwardA dog training business began on December 1. The following transactions occurred during its first month. Use the drop-downs to select the accounts properly included on the income statement for the post-closing balancesarrow_forwardWhat is the expected return on a portfolio with a beta of 0.8 on these financial accounting question?arrow_forward

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning