Concept explainers

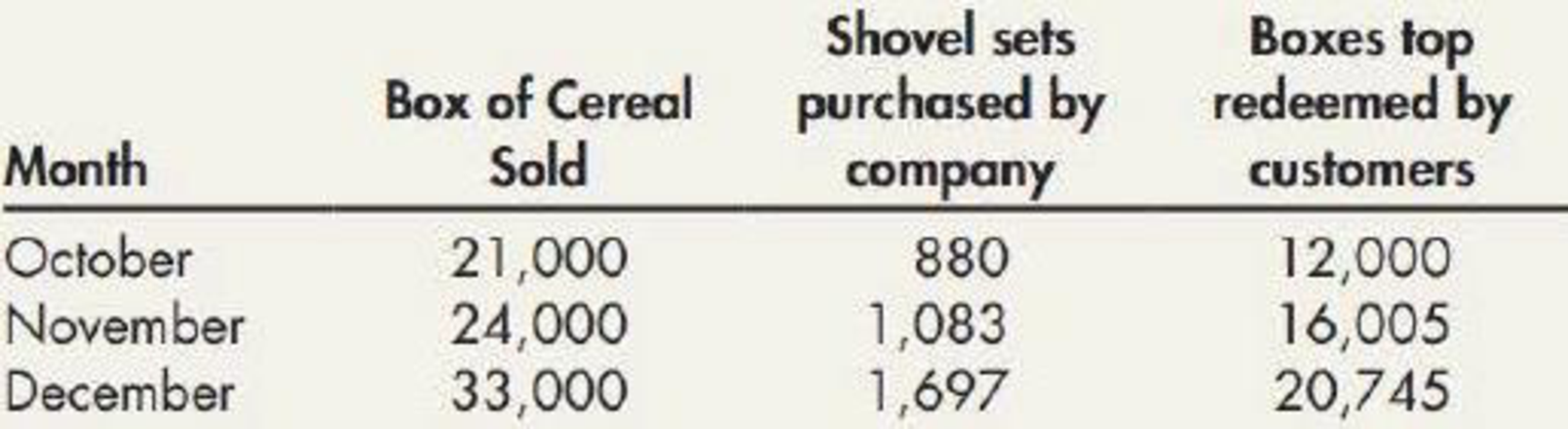

Premium Obligation Yummy Cereal Company is offering one toy shovel set for 15 box tops of its cereal. Year-to-date sales have been off, and it is hoped that this offer will stimulate demand. Each shovel set costs the company $3. The following data are available for the last 3 months of 2019:

It is estimated that only 70% of the box tops will be redeemed. The cereal sells for $2.80 per box.

Required:

- 1. Prepare

journal entries for each month to record sales, shovel set purchases, and redemptions. - 2. Assuming Yummy prepares monthly financial statements, indicate how the inventory of premiums and the estimated liability would be disclosed on Yummy’s ending

balance sheets for October, November, and December.

1.

Prepare the journal entry to record the sales, shovel set purchases and redemption for each month in the books of Company YC.

Explanation of Solution

Prepare the journal entry to record the sales made during October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Cash or Accounts receivable | 58,800 | |

| Sales | 58,800 | ||

| (To record the sale of 21,000 cereal boxes) |

Table (1)

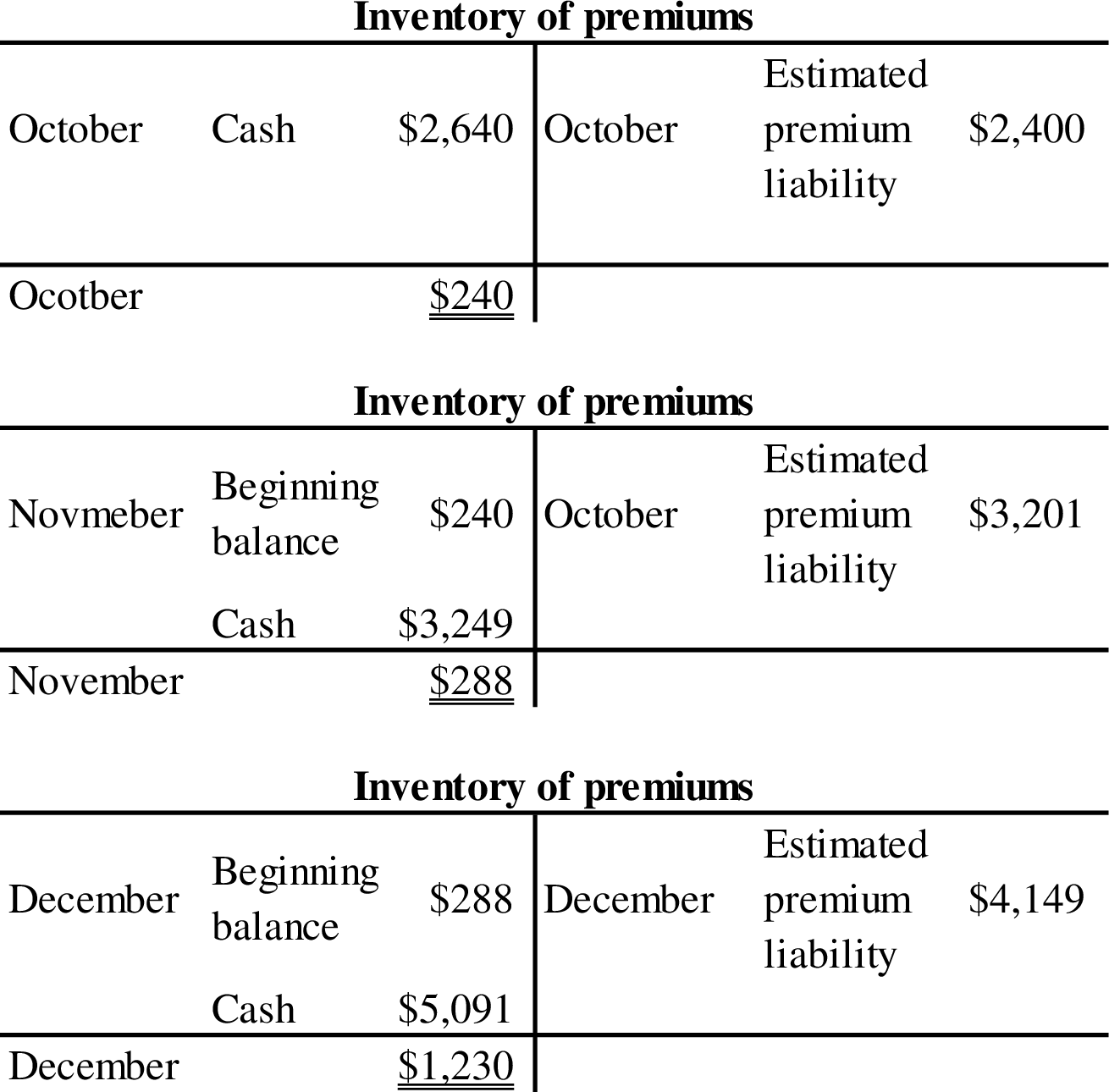

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Inventory of premiums | 2,640 | |

| Cash | 2,640 | ||

| (To record the purchase of toy shovel sets) |

Table (2)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Premium expenses (2) | 2,940 | |

| Estimated premium liability | 2,940 | ||

| (To record the recognition of estimated premium liability) |

Table (3)

Working note (1):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in October 2019 (A) | 21,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | 14,700 |

Table (4)

Working note (2):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 12,000 top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (3) | 2,400 | |

| Inventory of premiums | 2,400 | ||

| (To record the redemption of 12,000 top boxes of cereals) |

Table (5)

Working note (3):

Calculate the amount of estimated premium liability:

Prepare the journal entry to record the sales made during November:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Cash or Accounts receivable | 67,200 | |

| Sales | 67,200 | ||

| (To record the sale of 24,000 cereal boxes) |

Table (6)

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Inventory of premiums | 3,249 | |

| Cash | 3,249 | ||

| (To record the purchase of toy shovel sets) |

Table (7)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Premium expenses (4) | 3,360 | |

| Estimated premium liability | 3,360 | ||

| (To record the recognition of estimated premium liability) |

Table (8)

Working note (3):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in November 2019 (A) | 24,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | $16,800 |

Table (9)

Working note (4):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 16,005 top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (5) | 3,201 | |

| Inventory of premiums | 3,201 | ||

| (To record the redemption of 16,005 top boxes of cereals) |

Table (10)

Working note (5):

Calculate the amount of estimated premium liability:

Prepare the journal entry to record the sales made during December:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| December | Cash or Accounts receivable | 92,400 | |

| Sales | 92,400 | ||

| (To record the sale of 33,000 cereal boxes) |

Table (11)

Prepare the journal entry to record the purchase of shovel set:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| December | Inventory of premiums | 5,091 | |

| Cash | 5,091 | ||

| (To record the purchase of toy shovel sets) |

Table (12)

Prepare the journal entry to record the estimated total premium liability:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| November | Premium expenses (7) | 4,620 | |

| Estimated premium liability | 4,620 | ||

| (To record the recognition of estimated premium liability) |

Table (13)

Working note (6):

Calculate the total box tops estimated for redemption:

| Particulars | Amount ($) | Amount ($) |

| Total box tops outstanding in December 2019 (A) | 33,000 | |

| Estimated percent redeemed (B) | 70% | |

| Total box tops estimated for redemption (C) | $23,100 |

Table (14)

Working note (7):

Calculate the amount of premium expenses:

Prepare the journal entry to record the redemption of 20,475top boxes in October:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) |

| October | Estimated premium liability (8) | 4,149 | |

| Inventory of premiums | 4,149 | ||

| (To record the redemption of 20,475 top boxes of cereals) |

Table (15)

Working note (8):

Calculate the amount of estimated premium liability:

2.

Indicate the way in which the inventory of premiums and the estimated liability would be disclosed in the ending balance sheets of Company YC for the months October, November and December.

Explanation of Solution

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

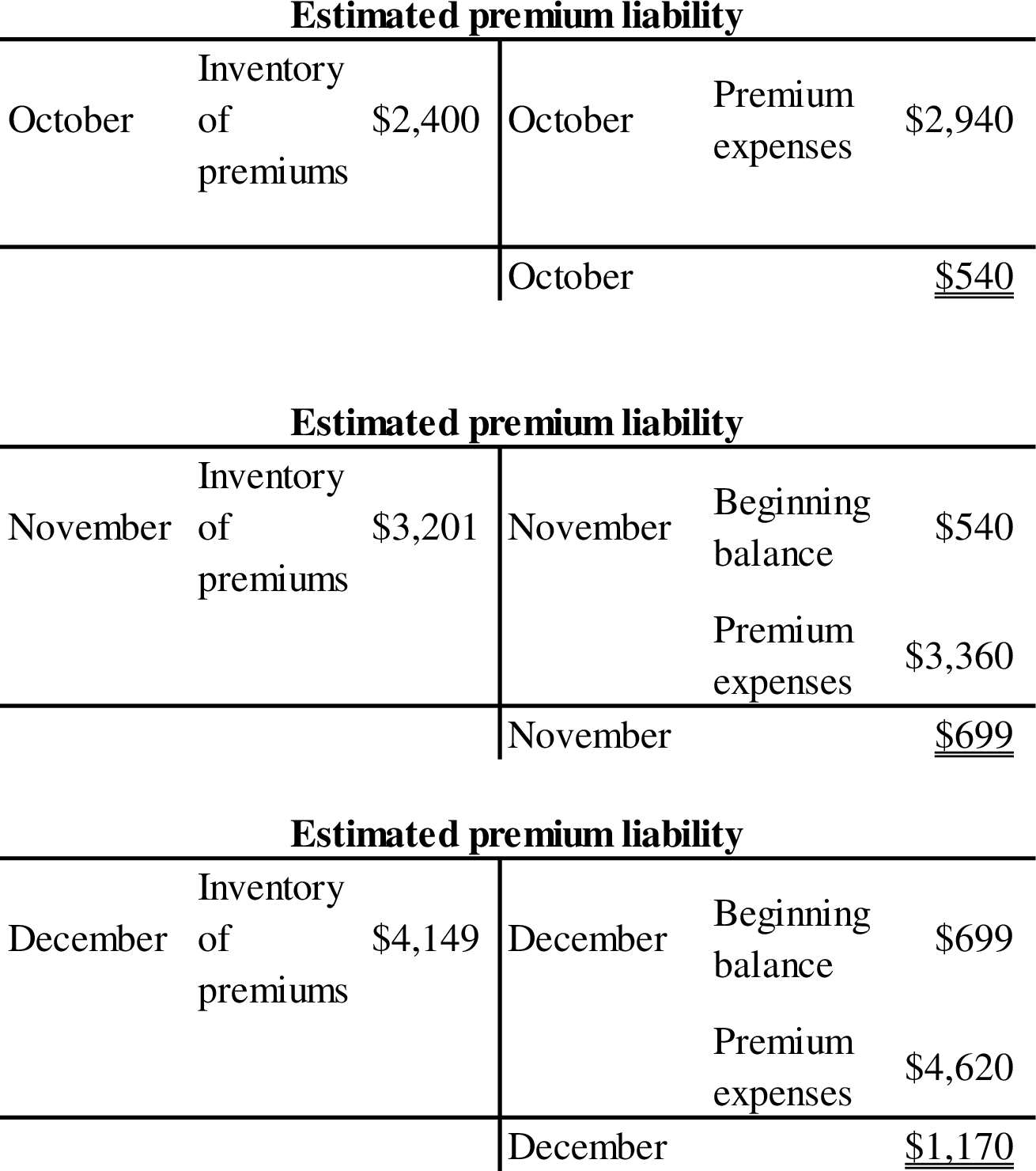

Prepare the partial balance sheet to record the inventory of premiums and the estimated liability:

| Company YC | |||

| Balance Sheet Statement (Partial) | |||

| At The End of | |||

| Assets | October | November | December |

| Current assets: | |||

| Inventory of premiums | $240 | $288 | $1,230 |

| Liabilities | October | November | December |

| Current liabilities: | |||

| Estimated premium liability | $540 | $699 | $1,170 |

Table (16)

Prepare the T-accounts to determine the estimated premium liability and inventory of premiums:

Want to see more full solutions like this?

Chapter 9 Solutions

EBK INTERMEDIATE ACCOUNTING: REPORTING

- Accountarrow_forwardGross profit is: a. profit before deducting operating expenses b. profit after deducting other expenses c. profit after deducting operating expenses d. None of these choices are correct.arrow_forwardA company has a $1,000,000 bond issue outstanding with unamortized premium of $10,000 and unamortized issuance cost of $5,100. What is the book value of its liability? 4 PTSarrow_forward

- Financial Account information is presented below: Operating expenses $ 50000; Sales returns and allowances 3000; Sales discounts 5000; Sales revenue 184000; Cost of goods sold 98000. Given the information, what would be the gross profit?arrow_forwardSub. General Accountarrow_forwardYour hotel served 32,500 guests with a $31,000 labor cost (the highest) in June and 20,000 guests with a $24,000 cost (the lowest) in December. Using the High-Low method, calculate the total variable cost in June.arrow_forward

- Provide answer general accounting questionarrow_forwardHadley, Inc. manufactures a product that uses $25 in direct materials and $10 in direct labor per unit. Under the traditional costing system Hadley uses, manufacturing overhead applied to each unit is $13. However, Hadley is considering switching to an ABC system. Under the ABC system, the total activity cost would be $30. What is the total manufacturing cost per unit for Hadley under the ABC system? Right Answerarrow_forwardAbcarrow_forward

- What amount should the bond issue proceeds increase shareholders equity?arrow_forwardCan you please give me correct answer this general accounting question?arrow_forwardCompute investing and financing amounts for the statement of cash flows: please answer the financial accounting questionarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College