ACCOUNTING F/GOV.+NON...(LL)

18th Edition

ISBN: 9781266785580

Author: RECK

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 13C

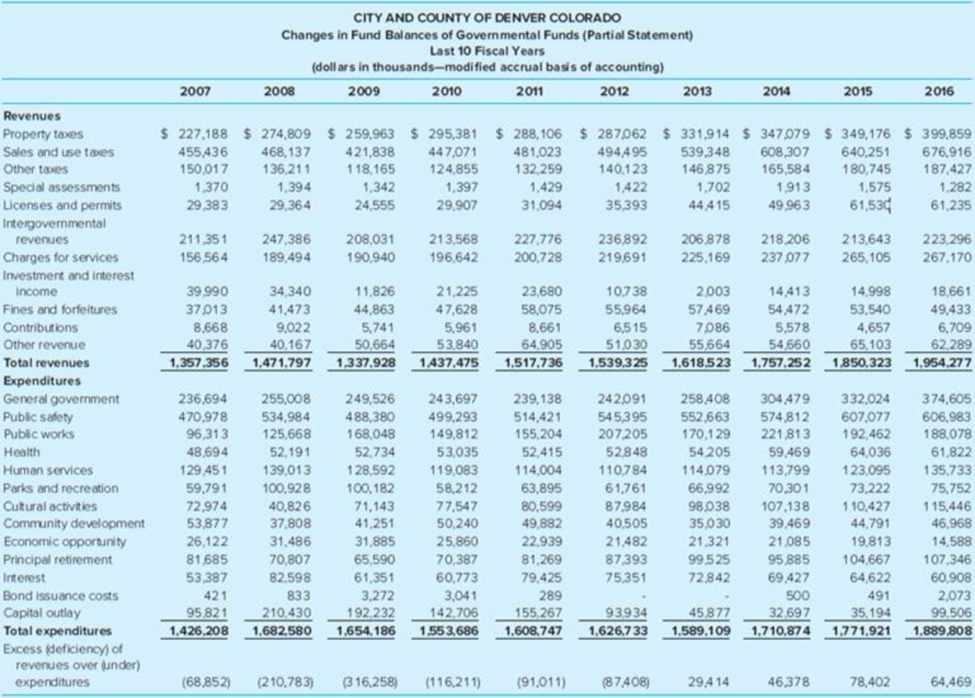

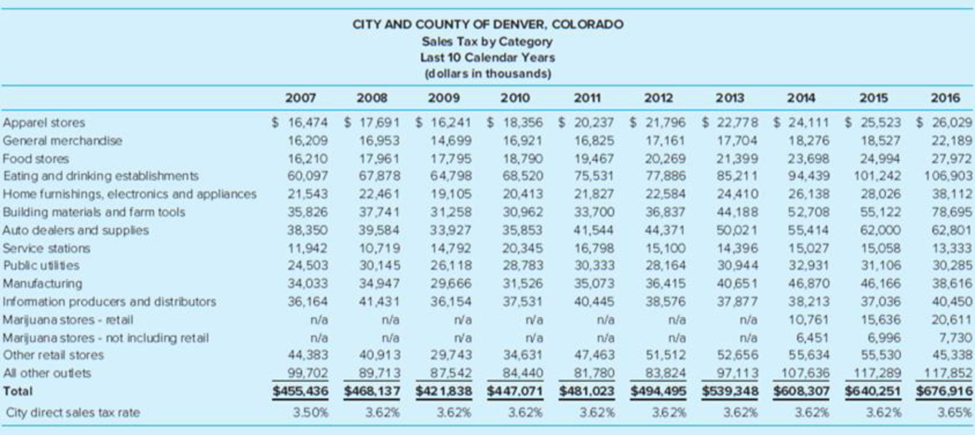

The MD&A for the 2016 City and County of Denver CAFR is included as Appendix B in this chapter. Following are two tables that have been adapted from the statistical section of the CAFR. Use the MD&A and the provided statistical tables to complete this case.

Required

- a. What are the three largest sources of governmental funds revenue? What percentage of the governmental funds revenue is from each of these sources?

- b. Sales tax is a large part of Denver’s tax revenue. Using information from the MD&A and trend information from both statistical tables provided, discuss trends in Denver’s sales tax revenues and your projection for sales tax revenues over the next two to three years.

- c. What are the three largest sources of governmental funds expenditures? What percentage of the governmental funds expenditures does each of the three sources represent and what has been the trend for each over the past few years?

- d. Compare the growth in revenue to the growth in expenditures over the past 10 years. Discuss any changes in the overall expenditure growth patterns you have seen and would expect to see over the next two to three years.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Kindly help me with accounting questions

1. I want to know how to solve these 2 questions and what the answers are 3. Field & Co. expects its EBIT to be $125,000 every year forever. The firm can borrow at 7%. The company currently has no debt, and its cost of equity is 12%. If the tax rate is 24%, what is the value of the firm? What will the value be if the company borrows $205,000 and uses the proceeds to purchase shares?

2. Firms HD and LD each have $30m in invested capital, $8m of EBIT, and a tax rate of 25%. Firm HD has a D/E ratio of 50% with an interest rate of 8% on their debt. Firm LD has a debt-to-capital ratio of 30%, however, pays 9% interest on its debt. Calculate the following:

a. Return on invested capital for firm LDb. Return on equity for each firmc. If HD’s CFO is thinking of lowering the D/E from 50% to 40%, which will lower their interest rate further from 8% to 7%, calculate the new ROE for firm HD.

what is the variable cost per minute?

Chapter 9 Solutions

ACCOUNTING F/GOV.+NON...(LL)

Ch. 9 - Prob. 1QCh. 9 - Prob. 2QCh. 9 - Prob. 3QCh. 9 - What is a component unit?Ch. 9 - Explain the difference between a blended and a...Ch. 9 - Prob. 6QCh. 9 - Prob. 7QCh. 9 - Prob. 8QCh. 9 - Give examples of items (transactions) that would...Ch. 9 - Prob. 10Q

Ch. 9 - Prob. 11QCh. 9 - Prob. 12CCh. 9 - The MDA for the 2016 City and County of Denver...Ch. 9 - Prob. 14CCh. 9 - Prob. 17.1EPCh. 9 - Prob. 17.2EPCh. 9 - Prob. 17.3EPCh. 9 - Interim government financial reports a. Are not...Ch. 9 - The comprehensive annual financial report (CAFR)...Ch. 9 - Prob. 17.6EPCh. 9 - The city council of Lake Jefferson wants to...Ch. 9 - Prob. 17.8EPCh. 9 - Prob. 17.9EPCh. 9 - Prob. 17.10EPCh. 9 - A positive unassigned fund balance can be found in...Ch. 9 - A city established a special revenue fund for gas...Ch. 9 - The county commission passed into law through an...Ch. 9 - Prob. 17.14EPCh. 9 - Prob. 17.15EPCh. 9 - Prob. 18EPCh. 9 - Prob. 19EPCh. 9 - The City of Lynnwood was recently incorporated and...Ch. 9 - Prob. 21EPCh. 9 - Prob. 22EPCh. 9 - Prob. 23EPCh. 9 - Prob. 24EPCh. 9 - You have recently started working as the...Ch. 9 - Prob. 26EPCh. 9 - Prob. 27EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I want to know how to solve these 2 questions and what the answers are 1. Stella Motors has $50m in assets, which is financed with 40% debt and 60% common equity. The company’s beta is currently 1.25 and its tax rate is 30%. Find Stella’s unlevered beta. 2. Sugar Corp. uses no debt. The weighted average cost of capital is 7.9%. If the current market value of the equity is $15.6 million and there are no taxes, what is the company’s EBIT?arrow_forwardI don't need ai answer general accounting questionarrow_forwardCan you help me with accounting questionsarrow_forward

- Cariveh Co sells automotive supplies from 25 different locations in one country. Each branch has up to 30 staff working there, although most of the accounting systems are designed and implemented from the company's head office. All accounting systems, apart from petty cash, are computerised, with the internal audit department frequently advising and implementing controls within those systems. Cariveh has an internal audit department of six staff, all of whom have been employed at Cariveh for a minimum of five years and some for as long as 15 years. In the past, the chief internal auditor appoints staff within the internal audit department, although the chief executive officer (CEO) is responsible for appointing the chief internal auditor. The chief internal auditor reports directly to the finance director. The finance director also assists the chief internal auditor in deciding on the scope of work of the internal audit department. You are an audit manager in the internal audit…arrow_forwardCariveh Co sells automotive supplies from 25 different locations in one country. Each branch has up to 30 staff working there, although most of the accounting systems are designed and implemented from the company's head office. All accounting systems, apart from petty cash, are computerised, with the internal audit department frequently advising and implementing controls within those systems. Cariveh has an internal audit department of six staff, all of whom have been employed at Cariveh for a minimum of five years and some for as long as 15 years. In the past, the chief internal auditor appoints staff within the internal audit department, although the chief executive officer (CEO) is responsible for appointing the chief internal auditor. The chief internal auditor reports directly to the finance director. The finance director also assists the chief internal auditor in deciding on the scope of work of the internal audit department. You are an audit manager in the internal audit…arrow_forwardProvide solution of this all Question please Financial Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License