ACCOUNTING F/GOV.+..(LL)-W/CODE>CUSTOM<

18th Edition

ISBN: 9781264107919

Author: RECK

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 13C

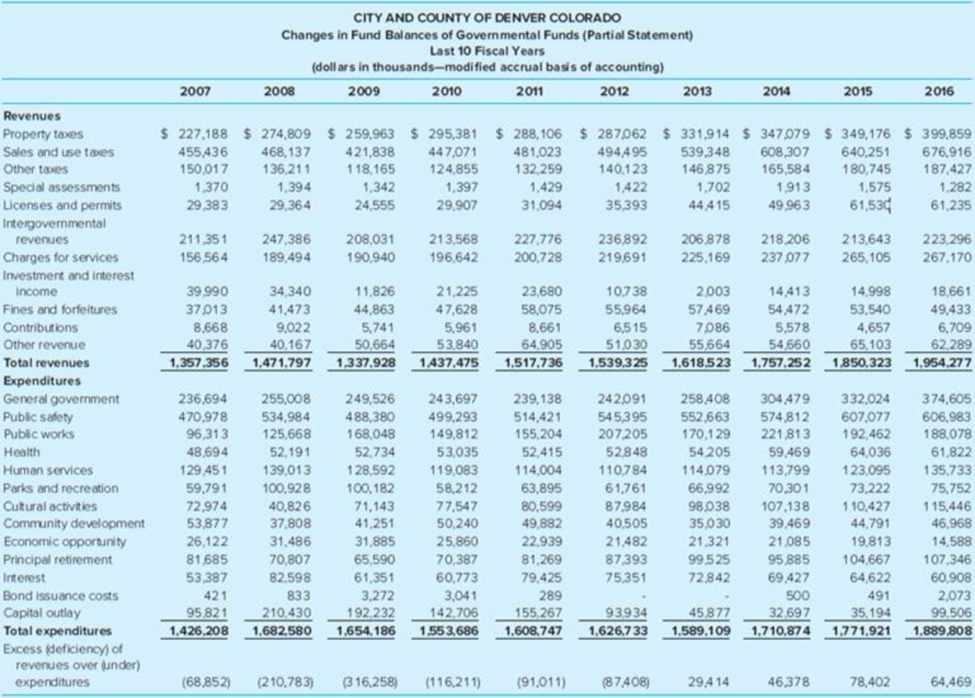

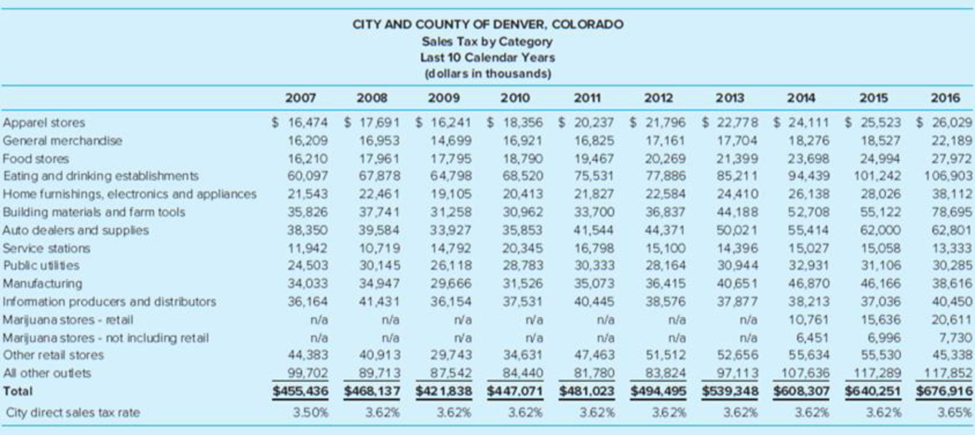

The MD&A for the 2016 City and County of Denver CAFR is included as Appendix B in this chapter. Following are two tables that have been adapted from the statistical section of the CAFR. Use the MD&A and the provided statistical tables to complete this case.

Required

- a. What are the three largest sources of governmental funds revenue? What percentage of the governmental funds revenue is from each of these sources?

- b. Sales tax is a large part of Denver’s tax revenue. Using information from the MD&A and trend information from both statistical tables provided, discuss trends in Denver’s sales tax revenues and your projection for sales tax revenues over the next two to three years.

- c. What are the three largest sources of governmental funds expenditures? What percentage of the governmental funds expenditures does each of the three sources represent and what has been the trend for each over the past few years?

- d. Compare the growth in revenue to the growth in expenditures over the past 10 years. Discuss any changes in the overall expenditure growth patterns you have seen and would expect to see over the next two to three years.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

abc general accounting

Calculate a b c d?

Labor quantity variance was

Chapter 9 Solutions

ACCOUNTING F/GOV.+..(LL)-W/CODE>CUSTOM<

Ch. 9 - Prob. 1QCh. 9 - Prob. 2QCh. 9 - Prob. 3QCh. 9 - What is a component unit?Ch. 9 - Explain the difference between a blended and a...Ch. 9 - Prob. 6QCh. 9 - Prob. 7QCh. 9 - Prob. 8QCh. 9 - Give examples of items (transactions) that would...Ch. 9 - Prob. 10Q

Ch. 9 - Prob. 11QCh. 9 - Prob. 12CCh. 9 - The MDA for the 2016 City and County of Denver...Ch. 9 - Prob. 14CCh. 9 - Prob. 17.1EPCh. 9 - Prob. 17.2EPCh. 9 - Prob. 17.3EPCh. 9 - Interim government financial reports a. Are not...Ch. 9 - The comprehensive annual financial report (CAFR)...Ch. 9 - Prob. 17.6EPCh. 9 - The city council of Lake Jefferson wants to...Ch. 9 - Prob. 17.8EPCh. 9 - Prob. 17.9EPCh. 9 - Prob. 17.10EPCh. 9 - A positive unassigned fund balance can be found in...Ch. 9 - A city established a special revenue fund for gas...Ch. 9 - The county commission passed into law through an...Ch. 9 - Prob. 17.14EPCh. 9 - Prob. 17.15EPCh. 9 - Prob. 18EPCh. 9 - Prob. 19EPCh. 9 - The City of Lynnwood was recently incorporated and...Ch. 9 - Prob. 21EPCh. 9 - Prob. 22EPCh. 9 - Prob. 23EPCh. 9 - Prob. 24EPCh. 9 - You have recently started working as the...Ch. 9 - Prob. 26EPCh. 9 - Prob. 27EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License