Gen Combo Looseleaf Principles Of Corporate Finance With Connect Access Card

13th Edition

ISBN: 9781260695991

Author: Richard A Brealey

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 11PS

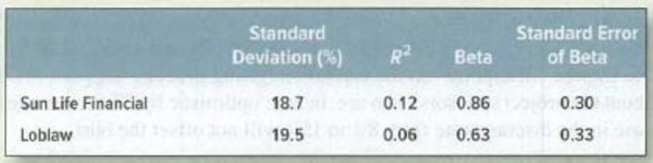

Measuring risk* The following table shows estimates of the risk of two well-known Canadian stocks:

- a. What proportion of each stock’s risk was market risk, and what proportion was specific risk?

- b. What is the variance of the returns for Sun Life Financial stock? What is the specific variance?

- c. What is the confidence interval on Loblaw’s beta? (See page 234 for a definition of “confidence interval.”)

- d. If the

CAPM is correct, what is the expected return on Sun Life? Assume a risk-free interest rate of 5% and an expected market return of 12%. - e. Suppose that next year, the market provides a 20% return. Knowing this, what return would you expect from Sun Life?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

6. If the Net Present Value (NPV) of a project is positive, it means:A. The project will break evenB. The project is not financially viableC. The project is expected to add value to the firmD. The payback period is very short

no ai

A stock’s beta coefficient measures its:A. Total riskB. Diversifiable riskC. Market risk relative to the overall marketD. Interest rate sensitivity

Which of the following ratios is used to measure a company’s profitability?A. Current RatioB. Quick RatioC. Return on Equity (ROE)D. Debt to Equity Ratio

Chapter 9 Solutions

Gen Combo Looseleaf Principles Of Corporate Finance With Connect Access Card

Ch. 9 - (VAR.P and STDEV.P) Choose two well-known stocks...Ch. 9 - (AVERAGE, VAR.P and STDEV.P) Now calculate the...Ch. 9 - (SLOPE) Download the Standard Poors index for the...Ch. 9 - Definitions Define the following terms: a. Cost of...Ch. 9 - True/false True or false? a. The company cost of...Ch. 9 - Company cost of capital Quark Productions (Give...Ch. 9 - Company cost of capital The total market value of...Ch. 9 - Company cost of capital You are given the...Ch. 9 - Company cost of capital Nero Violins has the...Ch. 9 - WACC A company is 40% financed by risk-free debt....

Ch. 9 - WACC Binomial Tree Farms financing includes 5...Ch. 9 - Prob. 10PSCh. 9 - Measuring risk The following table shows estimates...Ch. 9 - Prob. 12PSCh. 9 - Asset betas Which of these projects is likely to...Ch. 9 - Asset betas EZCUBE Corp. is 50% financed with...Ch. 9 - Prob. 15PSCh. 9 - Prob. 16PSCh. 9 - Prob. 17PSCh. 9 - Fudge factors John Barleycorn estimates his firms...Ch. 9 - Prob. 19PSCh. 9 - Prob. 20PSCh. 9 - Certainty equivalents A project has a forecasted...Ch. 9 - Certainty equivalents A project has the following...Ch. 9 - Prob. 23PSCh. 9 - Beta of costs Suppose that you are valuing a...Ch. 9 - Fudge factors An oil company executive is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Diversification is a strategy used to:A. Increase total riskB. Eliminate systematic riskC. Increase expected returnsD. Reduce unsystematic riski need help!!arrow_forwardDiversification is a strategy used to:A. Increase total riskB. Eliminate systematic riskC. Increase expected returnsD. Reduce unsystematic riskarrow_forwardI need answer !! What is the effect of compounding interest?A. It decreases total interest earned over timeB. It keeps the interest constantC. It increases interest earned over time by earning interest on interestD. It applies only to loans, not investmentsarrow_forward

- What is the effect of compounding interest?A. It decreases total interest earned over timeB. It keeps the interest constantC. It increases interest earned over time by earning interest on interestD. It applies only to loans, not investmentsarrow_forwardWhat is the effect of compounding interest?A. It decreases total interest earned over timeB. It keeps the interest constantC. It increases interest earned over time by earning interest on interestD. It applies only to loans, not investments need answer !!arrow_forwardi need help in this question!What is the primary goal of corporate finance?A. Maximize salesB. Minimize costsC. Maximize shareholder wealthD. Maximize employee satisfactionarrow_forward

- What is the primary goal of corporate finance?A. Maximize salesB. Minimize costsC. Maximize shareholder wealthD. Maximize employee satisfactionhelp me please !arrow_forwardWhat is the primary goal of corporate finance?A. Maximize salesB. Minimize costsC. Maximize shareholder wealthD. Maximize employee satisfactionarrow_forwardWhat does the price-to-earnings (P/E) ratio indicate?a) The total debt of a companyb) The market value relative to earningsc) The return on equityd) The efficiency of company operationshelp in thisarrow_forward

- What does the price-to-earnings (P/E) ratio indicate?a) The total debt of a companyb) The market value relative to earningsc) The return on equityd) The efficiency of company operationsarrow_forwardWhich of the following is an example of equity financing?a) Issuing bondsb) Taking out a bank loanc) Selling shares of stockd) Borrowing from a financial institutionplease answer step by step.arrow_forwardNo ai. Which of the following is an example of equity financing?a) Issuing bondsb) Taking out a bank loanc) Selling shares of stockd) Borrowing from a financial institutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Portfolio Management; Author: DevTechFinance;https://www.youtube.com/watch?v=Qmw15cG2Mv4;License: Standard YouTube License, CC-BY