(a):

The impact of technological advancement on TV production.

(a):

Explanation of Solution

When the technological advancement in production reduces the world

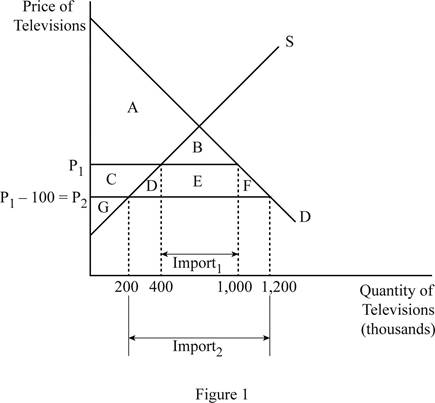

The world price was initially P1, where the consumer surplus was the area of A+B, producer surplus was the area of C+G and the total surplus was the area of A+B+C+G. The quantity of televisions imported is denoted by the Import1 on the graph. When the world price falls to P2 (P1 - 100), the consumer surplus increases to the area of A+B+C+D+E+F, which means that the consumer surplus increases by the area of C+D+E+F. The producer surplus becomes the area of G only which means that the producer surplus declined by the area of C. Thus, the total surplus becomes the area of A+B+C+D+E+F+G which means that the total surplus in the economy increased by the area of D+E+F. As a result of the lower price, the domestic supply falls and the demand increases; this means that the imports increase to Import2, as shown on the graph. The changes can be tabulated as follows:

| P1 | P2 | CHANGE | |

| Consumer Surplus | A + B | A + B + C + D + E + F | C + D + E + F |

| Producer Surplus | C + G | G | –C |

| Total Surplus | A + B + C + G | A + B + C + D + E + F + G | D + E + F |

International trade: It is the trade relation between the countries.

Export: It is the process of selling domestic goods in the international market. Thus, the goods produced in the domestic firms will be sold to other foreign countries. So, it is the outflow of domestic goods and services to the foreign economy.

Import: It is the process of purchasing the foreign-made goods and services by the domestic country. Thus, it is the inflow of foreign goods and services to the domestic economy.

(b):

The impact of technological advancement on TV production due to fall in price.

(b):

Explanation of Solution

The area of C can be calculated as follows:

Area of C is $30 million.

The area of D can be calculated as follows:

Area of D is $10 million.

The area of E can be calculated as follows:

Area of E is $60 million.

The area of F can be calculated as follows:

Area of F is $10 million.

The change in the consumer surplus is by the area of C+D+E+F. Thus, the value of change in consumer surplus can be calculated as follows:

Thus, the value of change in consumer surplus is by $110 million.

The change in the producer surplus is by the area of - C. Thus, the value of change in producer surplus is by $30 million.

The change in the total surplus is by the area of D+E+F. Thus, the value of change in total surplus can be calculated as follows:

Thus, the value of change in total surplus is by $80 million.

International trade: It is the trade relation between the countries.

Export: It is the process of selling domestic goods in the international market. Thus, the goods produced in the domestic firms will be sold to other foreign countries. So, it is the outflow of domestic goods and services to the foreign economy.

Import: It is the process of purchasing the foreign-made goods and services by the domestic country. Thus, it is the inflow of foreign goods and services to the domestic economy.

Comparative advantage: It is the ability of the country to produce the goods and services at lower opportunity costs than the other countries.

(c):

The impact of technological advancement on TV production due to tariff.

(c):

Explanation of Solution

When the government imposes a tax of $100 on the imports, the price of the imports will increase by $100; this means that the price level will revert back to the initial world price. This denotes that the consumer surplus, producer surplus, and the total surplus will revert back to the initial levels. The consumer surplus will fall by the area of C+D+E+F, which is $110 million and the producer surplus will increase by the area of C, which is $30 million.

The government would earn a tax revenue through this and the tax revenue can be calculated as follows:

Thus, the government will earn a tax revenue of $60 million.

There will be

International trade: It is the trade relation between the countries.

Export: It is the process of selling domestic goods in the international market. Thus, the goods produced in the domestic firms will be sold to other foreign countries. So, it is the outflow of domestic goods and services to the foreign economy.

Import: It is the process of purchasing the foreign-made goods and services by the domestic country. Thus, it is the inflow of foreign goods and services to the domestic economy.

Comparative advantage: It is the ability of the country to produce the goods and services at lower opportunity costs than the other countries.

(d):

The impact of technological advancement on TV production due to subsidy.

(d):

Explanation of Solution

The fall in the world price benefits the consumers because they are able to get the commodity at lower price than before. Also, the consumer surplus increases by $110 million. The fall in the world price harms the domestic producers because it leads to a fall in the producer surplus by $30 million. Since the consumer is benefited much more than the producer is harmed, the total welfare of the economy increases. Thus, the reason behind the fall in the world price does not matter in the analysis.

International trade: It is the trade relation between the countries.

Export: It is the process of selling domestic goods in the international market. Thus, the goods produced in the domestic firms will be sold to other foreign countries. So, it is the outflow of domestic goods and services to the foreign economy.

Import: It is the process of purchasing the foreign-made goods and services by the domestic country. Thus, it is the inflow of foreign goods and services to the domestic economy.

Comparative advantage: It is the ability of the country to produce the goods and services at lower opportunity costs than the other countries.

Want to see more full solutions like this?

Chapter 9 Solutions

Principles of Macroeconomics (MindTap Course List)

- Suppose the government imposes a fuel levy, identify, and discuss at least two ways in which this increase might have an effect on GDP growth, making use of the assumptions of the Keynesian model of income and expenditure.arrow_forwardCan you please assist Suppose the Government of Botswana has decided to implement a national minimum wage, but they have not yet decided at which rate to set this wage. With the aid of two separate diagrams, discuss the possible implications of setting this rate (i) at and (ii) below the equilibrium wage rate, respectively.arrow_forwardIf interest rate parity holds between two countries, then it must be true that: Question 3 options: The interest rates between the two countries are equal. The current forward rate is an unbiased predictor of the future exchange rate. The interest rate differential between the two countries is equal to the percentage difference between the forward exchange rate and the spot exchange rate. Significant covered interest arbitrage opportunities exist between the two currencies. The exchange rate adjusts to keep purchasing power constant across the two currencies.arrow_forward

- If interest rate parity holds between two countries, then it must be true that: Question 3 options: The interest rates between the two countries are equal. The current forward rate is an unbiased predictor of the future exchange rate. The interest rate differential between the two countries is equal to the percentage difference between the forward exchange rate and the spot exchange rate. Significant covered interest arbitrage opportunities exist between the two currencies. The exchange rate adjusts to keep purchasing power constant across the two currencies.arrow_forwardSuppose the indirect exchange rate for the Canadian dollar is 0.93. Based on this, you know you can buy: Question 2 options: $1 U.S. for $1.93 Canadian. $1 U.S. for $1.08 Canadian. $1 U.S. for $0.93 Canadian. $1.93 U.S. for $1 Canadian. $1.08 U.S. for $1 Canadian.arrow_forwardAccording to the relative purchasing power parity theory, high inflation in country A and low inflation in country B will cause the value of country A's currency to appreciate relative to that of country B. Question 1 options: True Falsearrow_forward

- How might different tax structures influence consumer behavior in luxury versus essential goods?arrow_forwardWhat is a competitive market?arrow_forwardلا. Assignniend abcpain the the three type of state- and explaining of the decannolly you know + 29 Explain Cu Marginal utility Jaw State the lid of diminishing. Explain the Concept of the aid of ha the relations and marginal uitity. Marginal finishing حومarrow_forward

- How does the change in consumer and producer surplus compare with the tax revenue?arrow_forwardConsidering the following supply and demand equations: Qs=3P-1 Qd=-2P+9 dPdt=0.5(Qd-Qs) Find the expressions: P(t), Qs(t) and Qd(t). When P(0)=1, is the system stable or unstable? If the constant for the change of excess of demand changes to 0.6, this is: dPdt=0.6(Qd-Qs) do P(t), Qs(t) and Qd(t) remain the same when P(0)=1?arrow_forwardConsider the following supply and demand schedule of wooden tables.a. Draw the corresponding graphs for supply and demand. b. Using the data, obtain the corresponding supply and demand functions. c. Find the market-clearing price and quantity. Price (Thousands USD) Supply Demand2 96 1104 196 1906 296 270 8 396 35010 496 43012 596 51014 696 59016 796 67018 896 75020 996 830arrow_forward

Principles of Macroeconomics (MindTap Course List)EconomicsISBN:9781285165912Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Macroeconomics (MindTap Course List)EconomicsISBN:9781285165912Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning Principles of MicroeconomicsEconomicsISBN:9781305156050Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of MicroeconomicsEconomicsISBN:9781305156050Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Macroeconomics (MindTap Course List)EconomicsISBN:9781305971509Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Macroeconomics (MindTap Course List)EconomicsISBN:9781305971509Author:N. Gregory MankiwPublisher:Cengage Learning Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning