GEN COMBO LL FUNDAMENTALS OF FINANCIAL ACCOUNTING; CONNECT ACCESS CARD

6th Edition

ISBN: 9781260260083

Author: Fred Phillips Associate Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 9E

Recording and Determining the Effects of Write-Off s. Recoveries, and Bad Debt Expense Estimates on the

Fraud Investigators Inc. operates a fraud detection service.

Required:

- 1. Prepare

journal entries for each transaction below.- a. On March 31, 10 customers were billed for detection services totaling $25,000.

- b. On October 31, a customer balance of $1,500 from a prior year was determined to be uncollectible and was written off.

- c. On December 15, a customer paid an old balance of $900, which had been written off in a prior year.

- d. On December 31, $500 of

bad debts were estimated and recorded for the year.

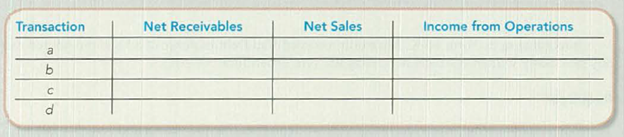

- 2. Complete the following table, indicating the amount and effect (+ for increase, − for decrease, and NE for no effect) of each transaction.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Define in detail the following in relation to Organizational Ethics.

The Ethical Culture of an organization.

Define these Five Signs of Ethical Collapse

a) Pressure to maintain the numbers

b) Fear of reprisals

c) Loyalty to the boss

d) Innovations

e) Goodness in some areas, atones for evil in others

Calculate the stock in the beginning

I need help with this problem and accounting

Chapter 8 Solutions

GEN COMBO LL FUNDAMENTALS OF FINANCIAL ACCOUNTING; CONNECT ACCESS CARD

Ch. 8 - What are the advantages and disadvantages of...Ch. 8 - Prob. 2QCh. 8 - Which basic accounting principles does the...Ch. 8 - Using the allowance method, is Bad Debt Expense...Ch. 8 - What is the effect of the write-off of...Ch. 8 - How does the use of calculated estimates differ...Ch. 8 - A local phone company had a customer who rang up...Ch. 8 - What is the primary difference between accounts...Ch. 8 - What are the three components of the interest...Ch. 8 - As of May 1, 2016, Krispy Kreme Doughnuts had...

Ch. 8 - Does an increase in the receivables turnover ratio...Ch. 8 - What two approaches can managers take to speed up...Ch. 8 - When customers experience economic difficulties,...Ch. 8 - (Supplement 8A) Describe how (and when) the direct...Ch. 8 - (Supplement 8A) Refer to question 7. What amounts...Ch. 8 - 1. When a company using the allowance method...Ch. 8 - 2. When using the allowance method, as Bad Debt...Ch. 8 - 3. For many years, Carefree Company has estimated...Ch. 8 - 4. Which of the following best describes the...Ch. 8 - 5. If the Allowance for Doubtful Accounts opened...Ch. 8 - 6. When an account receivable is recovered a....Ch. 8 - Prob. 7MCCh. 8 - 8. If the receivables turnover ratio decreased...Ch. 8 - Prob. 9MCCh. 8 - Prob. 10MCCh. 8 - Prob. 1MECh. 8 - Evaluating the Decision to Extend Credit Last...Ch. 8 - Reporting Accounts Receivable and Recording...Ch. 8 - Recording Recoveries Using the Allowance Method...Ch. 8 - Recording Write-Offs and Bad Debt Expense Using...Ch. 8 - Determining Financial Statement Effects of...Ch. 8 - Estimating Bad Debts Using the Percentage of...Ch. 8 - Estimating Bad Debts Using the Aging Method Assume...Ch. 8 - Recording Bad Debt Estimates Using the Two...Ch. 8 - Prob. 10MECh. 8 - Prob. 11MECh. 8 - Recording Note Receivable Transactions RecRoom...Ch. 8 - Prob. 13MECh. 8 - Determining the Effects of Credit Policy Changes...Ch. 8 - Prob. 15MECh. 8 - (Supplement 8A) Recording Write-Offs and Reporting...Ch. 8 - Recording Bad Debt Expense Estimates and...Ch. 8 - Determining Financial Statement Effects of Bad...Ch. 8 - Prob. 3ECh. 8 - Recording Write-Offs and Recoveries Prior to...Ch. 8 - Prob. 5ECh. 8 - Computing Bad Debt Expense Using Aging of Accounts...Ch. 8 - Computing Bad Debt Expense Using Aging of Accounts...Ch. 8 - Recording and Reporting Allowance for Doubtful...Ch. 8 - Recording and Determining the Effects of Write-Off...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Using Financial Statement Disclosures to Infer...Ch. 8 - Using Financial Statement Disclosures to Infer Bad...Ch. 8 - Prob. 15ECh. 8 - Analyzing and Interpreting Receivables Turnover...Ch. 8 - (Supplement 8A) Recording Write-Offs and Reporting...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Interpreting Disclosure of Allowance for Doubtful...Ch. 8 - Recording Notes Receivable Transactions Jung ...Ch. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Interpreting Disclosure of Allowance for Doubtful...Ch. 8 - Recording Notes Receivable Transactions CS...Ch. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Prob. 2PBCh. 8 - Prob. 3PBCh. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording and Reporting Credit Sales and Bad Debts...Ch. 8 - Prob. 2COPCh. 8 - Recording Daily and Adjusting Entries Using FIFO...Ch. 8 - Prob. 1SDCCh. 8 - Prob. 2SDCCh. 8 - Ethical Decision Making: A Real-Life Example You...Ch. 8 - Critical Thinking: Analyzing the Impact of Credit...Ch. 8 - Using an Aging Schedule to Estimate Bad Debts and...Ch. 8 - Accounting for Receivables and Uncollectible...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide correct solution and accountingarrow_forwardWhat is its DOL? Accounting questionarrow_forwardThe following data were selected from the records of Fluwars Company for the year ended December 31, current year: Balances at January 1, current year: Accounts receivable (various customers) $ 111,500 Allowance for doubtful accounts 11,200 The company sold merchandise for cash and on open account with credit terms 1/10, n/30, without a right of return. The following transactions occurred during the current year: Sold merchandise for cash, $252,000. Sold merchandise to Abbey Corp; invoice amount, $36,000. Sold merchandise to Brown Company; invoice amount, $47,600. Abbey paid the invoice in (b) within the discount period. Sold merchandise to Cavendish Inc.; invoice amount, $50,000. Collected $113,100 cash from customers for credit sales made during the year, all within the discount periods. Brown paid its account in full within the discount period. Sold merchandise to Decca Corporation; invoice amount, $42,400. Cavendish paid its account in full after the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License