Cengagenowv2, 1 Term Printed Access Card For Wahlen/jones/pagach’s Intermediate Accounting: Reporting And Analysis, 2017 Update, 2nd

2nd Edition

ISBN: 9781337912259

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 8, Problem 8E

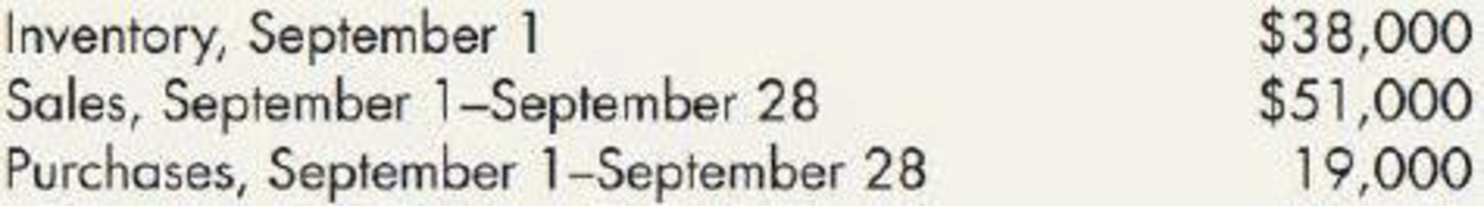

Gross Profit Method: Estimation of Theft Loss You are requested by a client on September 28 to prepare an insurance claim for a theft loss that occurred on that day. You immediately take an inventory and obtain the following data:

The inventory on September 28 indicates that an inventory of $15,000 remains after the theft. During the past year, net sales were made at 50% above the cost of goods sold.

Required:

- 1. Compute the inventory lost during the theft. Round the gross profit percentage to 3 decimal places.

- 2. Next Level What concerns might you have about the inventory estimation under the gross profit method?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

financial accounting

General accounting

Need help with this question solution general accounting

Chapter 8 Solutions

Cengagenowv2, 1 Term Printed Access Card For Wahlen/jones/pagach’s Intermediate Accounting: Reporting And Analysis, 2017 Update, 2nd

Ch. 8 - Prob. 1GICh. 8 - Define the upper and lower constraints used in the...Ch. 8 - How may a company apply the lower of cost or a...Ch. 8 - What is the major criticism of the lower of cost...Ch. 8 - Prob. 5GICh. 8 - Prob. 6GICh. 8 - Prob. 7GICh. 8 - Prob. 8GICh. 8 - What is the basic assumption underlying the gross...Ch. 8 - Prob. 10GI

Ch. 8 - Explain the meaning of the following terms:...Ch. 8 - Prob. 12GICh. 8 - Prob. 13GICh. 8 - The retail inventory method indicated an inventory...Ch. 8 - Prob. 15GICh. 8 - Indicate the effect of each of the following...Ch. 8 - Sienna Company uses the FIFO cost flow assumption....Ch. 8 - Prob. 2MCCh. 8 - Prob. 3MCCh. 8 - Prob. 4MCCh. 8 - Prob. 5MCCh. 8 - Under the retail inventory method, freight-in...Ch. 8 - The retail inventory method would include which of...Ch. 8 - Prob. 8MCCh. 8 - Estimates of price-level changes for specific...Ch. 8 - A company forgets to record a purchase on credit...Ch. 8 - The following information is available regarding...Ch. 8 - Each unit of Black Corporations inventory has a...Ch. 8 - Prob. 3RECh. 8 - Prob. 4RECh. 8 - Prob. 5RECh. 8 - Kays Beauty Supply uses the gross profit method to...Ch. 8 - Uncle Butchs Hunting Supply Shop reports the...Ch. 8 - Use the information in RE8-7. Calculate Uncle...Ch. 8 - Use the information in RE8-7. Calculate Uncle...Ch. 8 - Use the information in RE8-7. Calculate Uncle...Ch. 8 - Johnson Corporation had beginning inventory of...Ch. 8 - Prob. 12RECh. 8 - Prob. 13RECh. 8 - Prob. 14RECh. 8 - Lower of Cost or Market Stiles Corporation uses...Ch. 8 - Prob. 2ECh. 8 - Prob. 3ECh. 8 - Prob. 4ECh. 8 - Prob. 5ECh. 8 - Prob. 6ECh. 8 - Prob. 7ECh. 8 - Gross Profit Method: Estimation of Theft Loss You...Ch. 8 - Retail Inventory Method Harmes Company is a...Ch. 8 - Prob. 10ECh. 8 - Retail Inventory Method The following information...Ch. 8 - Prob. 12ECh. 8 - Prob. 13ECh. 8 - Prob. 14ECh. 8 - Errors A company that uses the periodic inventory...Ch. 8 - Prob. 16ECh. 8 - Prob. 17ECh. 8 - Lower of Cost or Market Palmquist Company has five...Ch. 8 - Prob. 2PCh. 8 - Prob. 3PCh. 8 - Prob. 4PCh. 8 - Prob. 5PCh. 8 - Prob. 6PCh. 8 - Prob. 7PCh. 8 - Prob. 8PCh. 8 - Retail Inventory Method Weber Corporation uses the...Ch. 8 - Prob. 10PCh. 8 - Prob. 11PCh. 8 - Prob. 12PCh. 8 - Errors As controller of Lerner Company, which uses...Ch. 8 - Prob. 14PCh. 8 - (Appendix 8.1) Lower of Cost or Market The...Ch. 8 - Prob. 16PCh. 8 - Prob. 1CCh. 8 - Sandberg Paint Company, your client, manufactures...Ch. 8 - Prob. 3CCh. 8 - Prob. 4CCh. 8 - Prob. 5CCh. 8 - Prob. 6CCh. 8 - Prob. 7CCh. 8 - Various Inventory Issues Hudson Company, which is...Ch. 8 - Prob. 10CCh. 8 - Prob. 11C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License