Decide whether to discontinue a department (Learning Objective 4)

This case is a continuation of the Caesars Entertainment Corporation serial case that began in Chapter 1. Refer to the introductory story in Chapter 1 for additional background. (The components of the Caesars serial case can be completed in any order.)

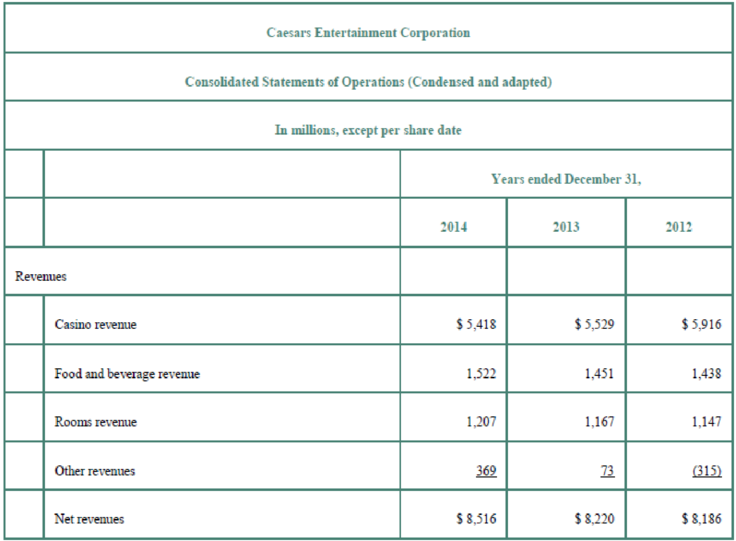

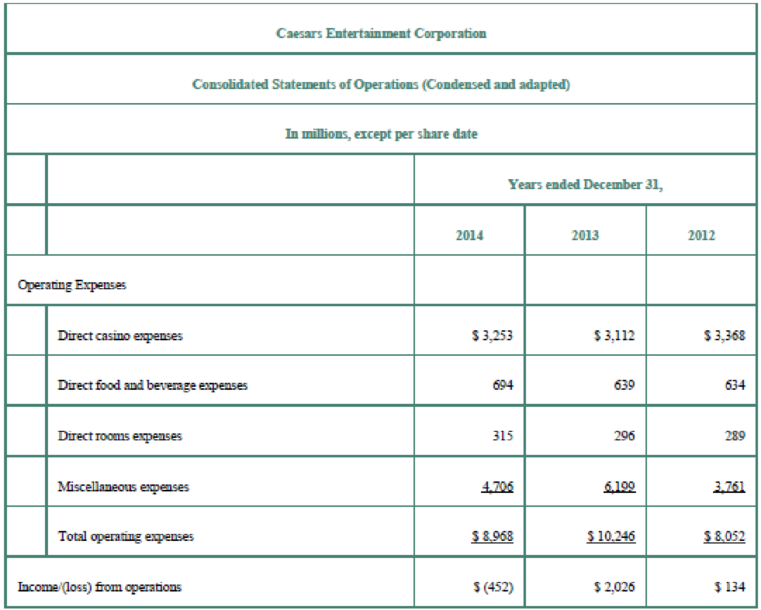

What follows are the income statements for Caesars Entertainment Corporation for the three years ending December 31, 2012 through 2014.

Requirements

Note: To answer these questions, calculate a segment margin for each of the departments. For the purpose of this case only, calculate segment margin as revenues less direct expenses. (We are modifying the concept of segment margin slightly here, given the information that is publicly available. We are essentially assuming that the direct expenses are the variable expenses.)

Using the statements of operations (income statements) given, answer the following questions.

- 1. Calculate the segment margin for the three departments: Casinos, Food and Beverage, and Rooms.

- 2. Given the segment margins that you calculated, should Caesars discontinue any of the three departments? Why or why not?

- 3. What expenses are likely to be included in “Miscellaneous expenses”? Should these expenses be allocated to the three departments if Caesars is evaluating whether it should discontinue any departments? Why or why not?

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Managerial Accounting (5th Edition)

- Give true answer the financial accounting questionarrow_forwardNeed help with this financial accounting questionarrow_forwardGary Watson, a graduating business student at a small college, is currently interviewing for a job. Gary was invited by both Tilly Manufacturing Company and Watson Supply Company to travel to a nearby city for an interview. Both companies have offered to pay Gary's expenses. His total expenses for the trip were $96 for mileage on his car and $45 for meals. As he prepares the letters requesting reimbursement, he is considering asking for the total amount of the expenses from both employers. His rationale is that if he had taken separate trips, each employer would have had to pay that amount. Who are the parties that are directly affected by this ethical dilemma? multiple choice 1 Tilly Manufacturing Company Watson Supply Company Both the employers Are the other students at the college potentially affected by Gary's decision? multiple choice 2 Yes No Are the professors at the college potentially affected by Gary's decision? multiple choice 3 Yes No…arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning