Concept explainers

Analyzing Allowance for Doubtful

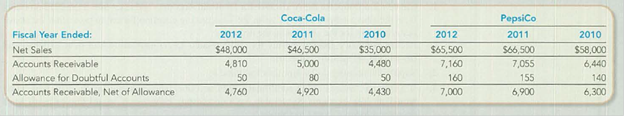

Coca-Cola and PepsiCo are two of the largest and most successful beverage companies in the world in terms of the products that they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the following rounded amounts reported in their annual reports (amounts in millions).

Required:

- 1. Calculate the receivables turnover ratios and days to collect for Coca-Cola and PepsiCo for 2012 and 2011. (Round to one decimal place.)

- 2. Which of the companies is quicker to convert its receivables into cash?

1.

Explanation of Solution

Accounts receivable turnover:

Accounts receivable turnover is a liquidity measure of accounts receivable in times, which is calculated by dividing the net credit sales by the average amount of net accounts receivables. In simple, it indicates the number of times the average amount of net accounts receivables has been collected during a particular period.

Average collection period:

Average collection period indicates the number of days taken by a business to collect its outstanding amount of accounts receivable on an average.

Calculate accounts receivables turnover ratio and days to collect for Company Cfor 2012 as follows:

Thus, the accounts receivables turnover ratio and the number of days to collect the receivables for Company Cfor the year 2012 are 9.9 times and 36.9 days respectively.

Calculate accounts receivables turnover ratio and days to collect for Company Cfor 2011 as follows:

Thus, the accounts receivables turnover ratio and the number of days to collect the receivables for Company Cfor the year 2011 are 9.9 times and 36.9 days respectively.

Calculate accounts receivables turnover ratio and days to collect for Company Pfor 2012 as follows:

Thus, the accounts receivables turnover ratio and the number of days to collect the receivables for Company Pfor the year 2012 are 9.4 times and38.8 days respectively.

Calculate accounts receivables turnover ratio and days to collect for Company Pfor 2011 as follows:

Thus, the accounts receivables turnover ratio and the number of days to collect the receivables for Company Pfor the year 2011 are 10.1 times and 36.1 days respectively.

2.

To identify: The company which was quicker ability to convert its receivables into cash in 2012 and 2011.

Explanation of Solution

Accounts receivables turnover ratio and the number of days to collect the receivables for Company C for the year 2012 are 9.9 times and 36.9 days respectively.

Accounts receivables turnover ratio and the number of days to collect the receivables for Company C for the year 2011 are 9.9 times and 36.9 days respectively.

Accounts receivables turnover ratio and the number of days to collect the receivables for Company P for the year 2012 are 9.4 times and 38.8 days respectively.

Accounts receivables turnover ratio and the number of days to collect the receivables for Company P for the year 2011 are 10.1 times and 36.1 days respectively.

A company which has higher receivables turnover ratio and lower days to collect the receivables is considered as the best company in converting its receivables to cash.

In 2011, Company P’s receivables turnover ratio is higher and days to collect is lower in comparison with Company C.

In 2012, Company C’s receivables turnover ratio is higher and days to collect is lower in comparison with Company P.

Want to see more full solutions like this?

Chapter 8 Solutions

Connect 1 Semester Access Card for Fundamentals of Financial Accounting

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub